Florida Farm Bureau is being forced to take significant underwriting actions after reporting net losses in seven consecutive quarters.

To help stem the tide, the insurer announced it may nonrenew some policies driving the losses in Florida and stop issuing new homeowners and dwelling-fire policies in the state.

Surplus falls as losses mount

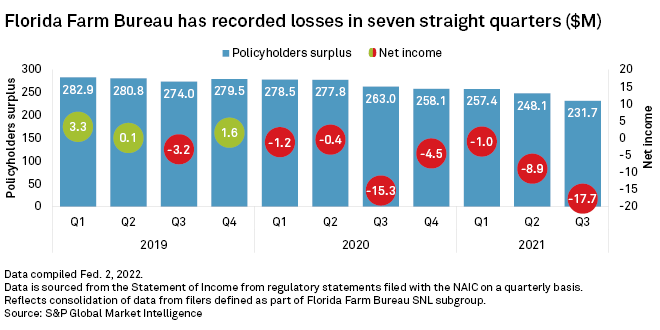

Through the first nine months of 2021, Florida Farm Bureau had not recorded a quarterly profit since the last quarter of 2019. Since then, its aggregate losses have totaled $49 million, including a $17.7 million net loss in the third quarter of 2021, according to an analysis by S&P Global Market Intelligence.

Those losses are pushing the group's policyholders surplus lower in a catastrophe-prone state. Florida Farm Bureau ended the third quarter of 2021 with a $231.7 million policyholder surplus, down about 17% from Dec. 31, 2019.

'Aggressive rate action'

To return to profitability in the business line, Florida Farm Bureau is seeking an "aggressive rate action" plan, according to a rate filing submitted to Florida regulators. The company is pursuing a 40% rate increase within its homeowners coverage.

The insurer said most of its rate need is bring driven by wind peril, having seen "significant" increases in claims frequency and severity in the last several years that show no signs of leveling off.

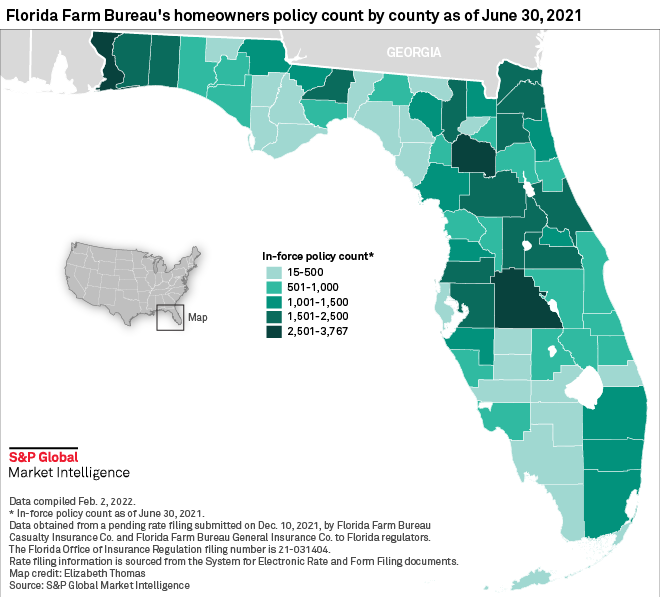

Florida Farm Bureau had almost 68,000 in-force policies within its homeowners program as of June 30, 2021. The insurer's policies are spread across the Sunshine State, though the bulk is located in central and northeastern counties. Three counties had more than 2,500 in-force homeowners policies, led by Alachua with 3,767 policies and followed by Escambia at 2,543 and Polk with 2,524 policies.

Record high for annual homeowners premiums within reach

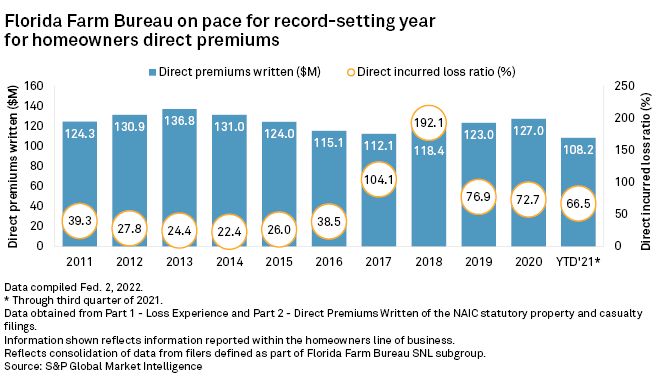

Through the first nine months of 2021, Florida Farm Bureau had $108.2 million in direct premiums written within its homeowners line of business, an increase of 10.5% over the same period during the prior year.

The insurer is only $28.6 million shy of surpassing its record for annual homeowners premiums of $136.8 million. It set that mark in 2013. The company recorded homeowners premiums of $29.0 million in the fourth quarter of 2020. Fourth-quarter and full-year 2021 statutory results are expected to be available in March.

Florida Farm Bureau's actions to sharply raise rates and stop writing new homeowners policies in Florida is yet another indication that the state's property insurance market is in distress.