Investor expectations for the second-quarter earnings in the pure-play shale gas sector are muted, with analysts looking for signs of spending discipline and free cash flow generation rather than production growth.

"We now believe flat is the new up," Stifel Nicolaus & Co.'s E&P, or exploration and production, team told clients July 19. "Regarding capital discipline and Q2 2020 sector messaging, we expect management teams to pivot further away from growth and towards returns as the sector prepares for a lower-for-longer environment."

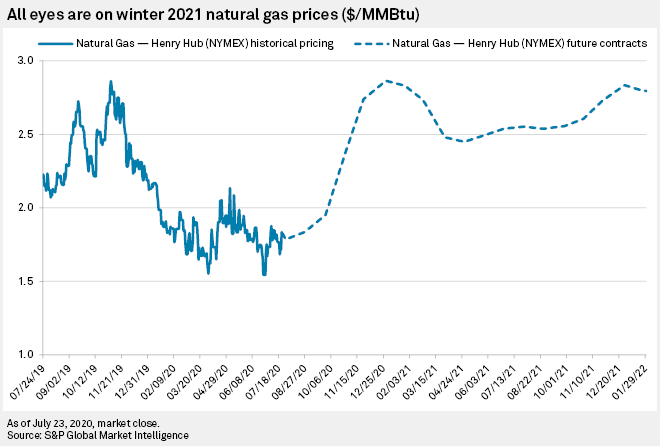

Some of the biggest shale gas producers, including the U.S. top natural gas producer EQT Corp., have already signaled production volumes will be lower for the second quarter which, combined with low gas prices, implies lowered revenues and income. EQT shut in 1.4 Bcf/d for most of the quarter, saying it would save that gas for the coming winter when the futures curve calls for higher prices, a move that was copied by others in Appalachia.

Although EQT and others have begun returning the shut-in production to the market, analysts do not expect second-quarter earnings calls to feature aggressive drilling plans to add even more volume to the market.

"We are watching if operators stick to original plans of ramping production in the back half of 2020 to keep year-over-year production flat or continue with reduced activity and guide to lower production as prices have remained low," energy data firm Enverus analyst Shawn Stuart said July 24. "We anticipate some operators deferring Q2 activity until later in 2020 when prices are expected to be higher."

Stuart is also looking to hear more details on 2021 hedging portfolios to protect realized prices and for company progress on spending cuts.

U.S. Capital Advisors upstream analyst Cameron Horwitz has mixed feelings about how much of the higher winter price expectations will be captured, an expectation that pushed stock prices higher as oil cratered. "The specter of significant shut-in volumes and a plummeting oil-directed rig count got a lot of folks excited about natural gas stocks in late April," U.S. Capitol told clients July 19. "However, that has been tempered by a big drop off in LNG exports and elevated natural gas storage levels."

"We're in the camp that producers are not going to add meaningful gas-directed activity at the current strip, which should flip storage into a deficit next year even after considering robust stocks heading into the heating season," Horwitz said. His top pick in the sector is EQT, followed by Haynesville Shale producer Comstock Resources Inc.

Stuart said a key question for producers on second-quarter earnings calls will be: "What price would promote operators to add back rigs past maintenance levels?" Enverus is forecasting $3/MMBtu-plus pricing for 2021 but a renewed drilling effort in Appalachia could sink those prices, Stuart said.

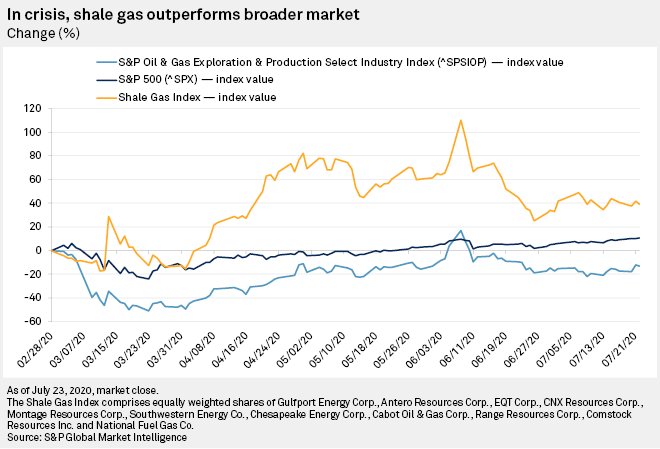

Forecasts for higher prices as early as the fourth quarter have pushed shale gas stock prices higher with an index of eleven gas drillers gaining just over 48% in value since the oil crisis began in March. The equally weighted index of shale gas stocks has outperformed both the broader S&P 500 and S&P Oil and Gas Exploration & Production indexes and held those gains even as oil drilling and its "free" associated gas production began to return.