Property and casualty underwriters made up the bulk of U.S. insurers placed into receivership in 2022 for the sixth straight year, according to an S&P Global Market Intelligence analysis

Regulators placed eight insurers into liquidation in 2022, the data shows, compared with 15 companies put into liquidation or rehabilitation in 2021.

Florida's turbulent market takes toll

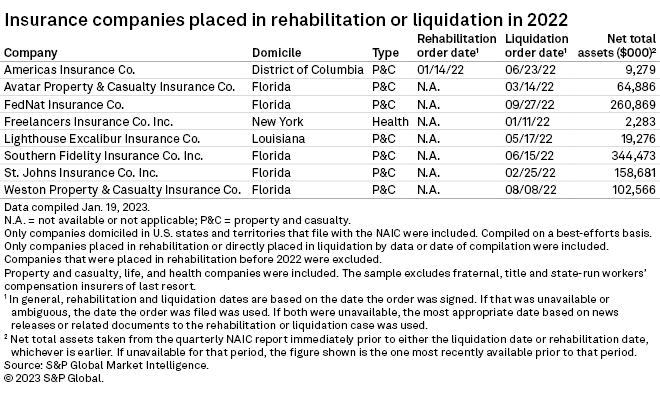

Seven of the eight companies that were liquidated in 2022 were P&C carriers. Net total assets of companies placed under receivership in 2022 totaled $962.3 million, an increase from $716.8 million in 2021.

Five of the P&C insurers that were liquidated in 2022 were casualties of Florida's chaotic homeowners insurance market, which has been bedeviled by excessive litigation and slammed by major tropical storm systems in recent years. The Sunshine State's troubles have led to a spate of homeowners companies failing, announcing plans to wind down or implementing significant new underwriting restrictions over the last year.

The 2022 failures began in February and March when regulators placed St. Johns Insurance Co. Inc. and Avatar Property & Casualty Insurance Co., respectively, into liquidation. Southern Fidelity Insurance Co. Inc. and Weston Property & Casualty Insurance Co. followed in June and August, respectively, and FedNat Insurance Co. came next in September.

Southern Fidelity had the most assets of any of the liquidated companies. It was deemed to be in a "hazardous" financial situation due to its deteriorating operational results and lack of adequate reinsurance, according to a June 3, 2022, consent order signed by the Florida Office of Insurance Regulation. As of the end of May 2022, Southern Fidelity had about 78,000 policies in Florida and another approximately 69,000 policies spread across Louisiana, South Carolina and Mississippi.

The Louisiana Department of Insurance placed Americas Insurance Co. into receivership in January after it incurred significant losses from Hurricane Ida. At the time, Americas had approximately 24,000 policies and 13,000 Ida-related claims, covering 1.31% of the Louisiana homeowners insurance market as of Dec. 31, 2020, according to the regulator.

The regulator several months later took similar action against Lighthouse Property Insurance Corp., a Tampa, Fla.-headquartered company that generated $45.5 million of its $123.4 million in direct premiums written during the first nine months of 2021 from the Sunshine State.

Managed care insurer Freelancers Insurance Co. Inc. was the only non-P&C carrier placed into receivership in 2022. Incorporated in 2008, the New York-based company was placed into liquidation in January 2022 by an order of the Supreme Court of the State of New York.

A continuing trend

In 2017, seven out of the nine companies placed in receivership were P&C carriers. That figure climbed to nine in 2018 and then soared to 14 out of the 22 total insurers put into receivership in 2019. In 2020, eight of the 12 total companies placed into receivership were P&C insurers. In 2021, that figure was 11 out of 15.

Of the 78 insurers placed into receivership since 2017, 56 have been P&C underwriters, 14 have been managed care insurers and eight have been life insurers.