The total number of U.S. financial institution initial public offerings dropped in 2018, and the stock-price performance of the class makes the prospects for a quick rebound challenging.

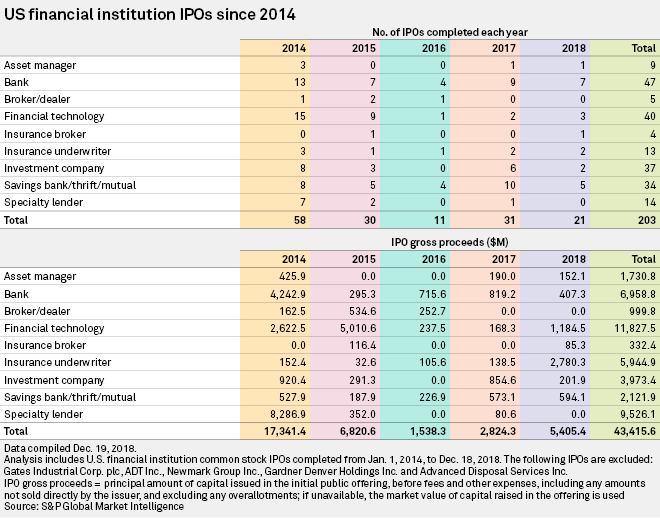

The number of U.S. financial company IPOs fell to 21 in 2018 from 31 in 2017. But the total value raised, excluding overallotments, from the 2018 IPOs nearly doubled year over year to $5.41 billion thanks to a couple of large deals: AXA Equitable Holdings Inc.'s $2.75 billion IPO and GreenSky Inc.'s $874.0 million IPO.

But after going public, the stock prices of those companies faced considerable headwinds. Through Dec. 26, AXA Equitable was down more than 25% from its IPO price of $20 per share and GreenSky was down more than 60% from its IPO price of $23 per share.

Investors in other financial IPOs also saw lackluster returns. Among all 2018 U.S. IPOs, the financial sector produced a return of 2.0%, and that was the sixth-best-performing sector, according to a Dec. 17 report from the IPO research firm Renaissance Capital LLC.

"Financial IPOs haven't been the best of breed," said Josef Schuster, founder of IPOX Schuster LLC, which offers index products that track IPOs and spinoffs.

Financial stocks in general have been out of favor. Through Dec. 26, the total return of the S&P 500 Financials Index was down 16.38% while the total return of the entire S&P 500 Index was down 8.4%.

Shares of traditional asset managers struggling with growth and profitability in the wake of outflows from their active equity strategies have been hit particularly hard. The total return of the S&P 500 Asset Management and Custody Banks Index was down 27.07% through Dec. 26.

"Given where asset managers are trading, anyone who had ambitions to go public has those on hold right now," Sandler O'Neill & Partners LP Principal Aaron Dorr said in an interview.

If the market does turn, the outlook for financial institution IPOs could change, as several companies are on the brink of an IPO.

The financial sector is trailing only the technology and healthcare sectors in the number of private companies on Renaissance's IPO watch list. Some of the financial companies on that list include the startup trading app company Robinhood Markets Inc. and the investment bank Perella Weinberg Partners LP.

But for the time being, the IPO pipeline in the financial space is pretty barren. "There's little demand for financial IPOs right now," Schuster said in an interview.

Did you enjoy this analysis? Click here to set real-time alerts for data-driven articles on the U.S. financial sector. |