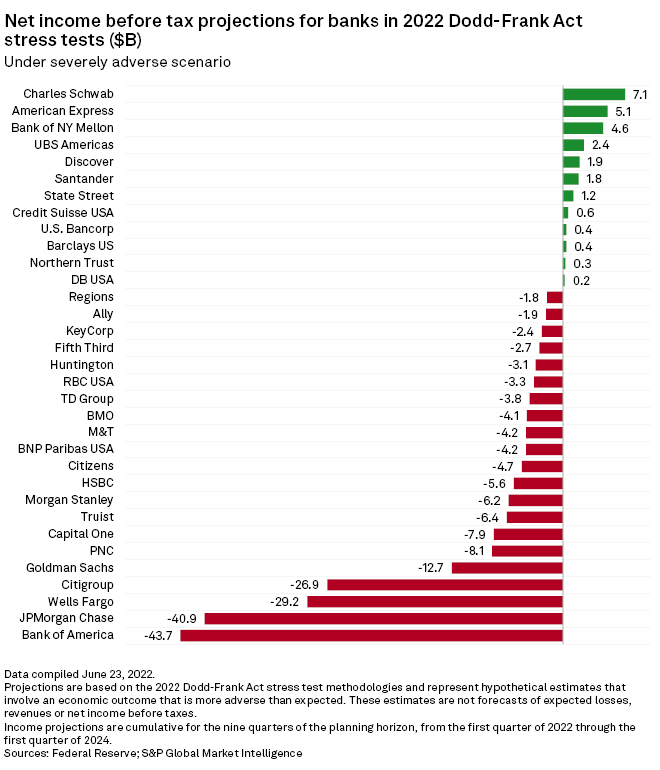

Bank of America Corp., Citigroup Inc. and JPMorgan Chase & Co. face higher-than-anticipated increases in their stress capital buffers under the Federal Reserve's stress tests, likely constraining stock buybacks.

The three banks' stress capital buffers, or SCBs, are headed up 90 to 100 basis points, Wolfe Research analyst Steven Chubak estimated. That means the trio will have greater capital deficit positions to internal targets and will be restrained in buybacks unless there is a more significant reduction in risk-weighted assets, which would likely reduce revenues, he said in a June 23 note.

The magnitude of increases in stress capital buffers at those three banks was a "surprise (not a good one)," wrote Susan Katzke at Credit Suisse. Higher capital requirements "will not be welcomed," Katzke added.

The trio might need to hold back on stock buybacks to build their common equity Tier 1 ratios, wrote Ken Usdin at Jefferies.

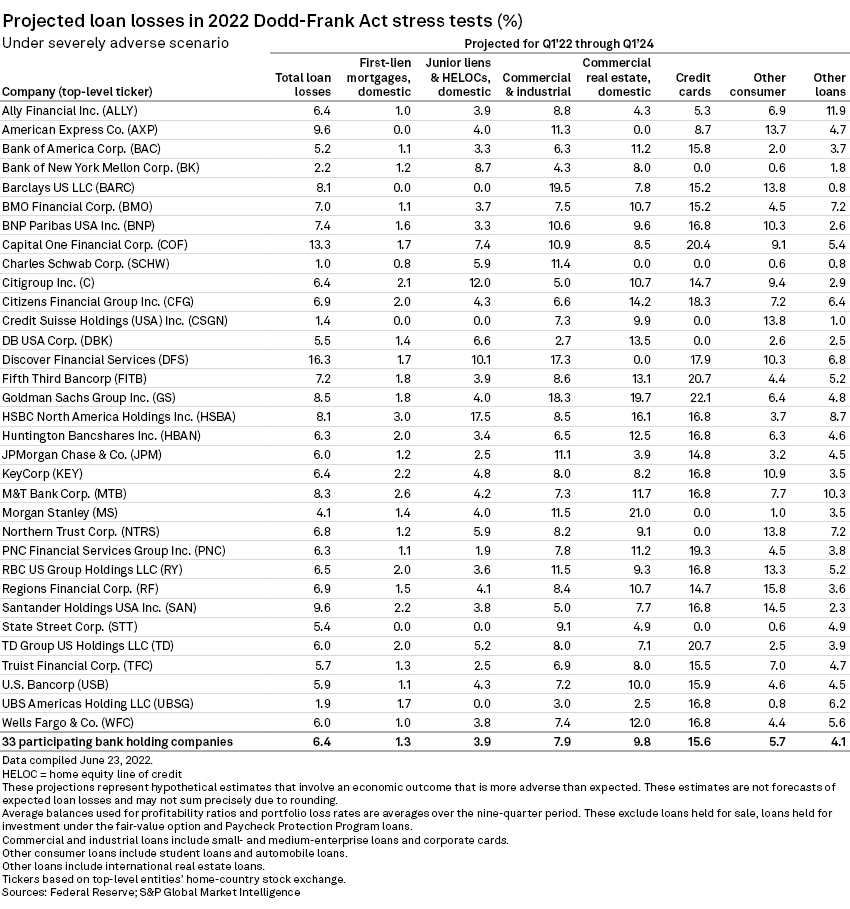

M&T Bank Corp. was the main exception among regional banks in terms of relatively poor performance on the tests, Usdin added. Commercial real estate loans accounted for $4.1 billion of its total projected loan losses of $7.6 billion under the stress test, which included particularly tough parameters for CRE.

SCBs are a component of large banks' capital requirements and are based on the differential between each stress test bank's starting CET1 ratio and its minimum under the simulation, along with four quarters of dividends. The differential for M&T in the most recent test was 4.1 percentage points. Its current SCB is 2.5%.

Despite M&T's poor performance, Peter Winter at Wedbush Securities anticipates it will stay active with buybacks as its CET1 ratio is above its estimated minimum. Winter expects overall stock buyback activity to be "modest," however.

Results were also tough for Capital One Financial Corp., Huntington Bancshares Inc. and The PNC Financial Services Group Inc., Usdin added. On the other hand, Ally Financial Inc. and Discover Financial Services were the "all-around winners" in their asset size range.

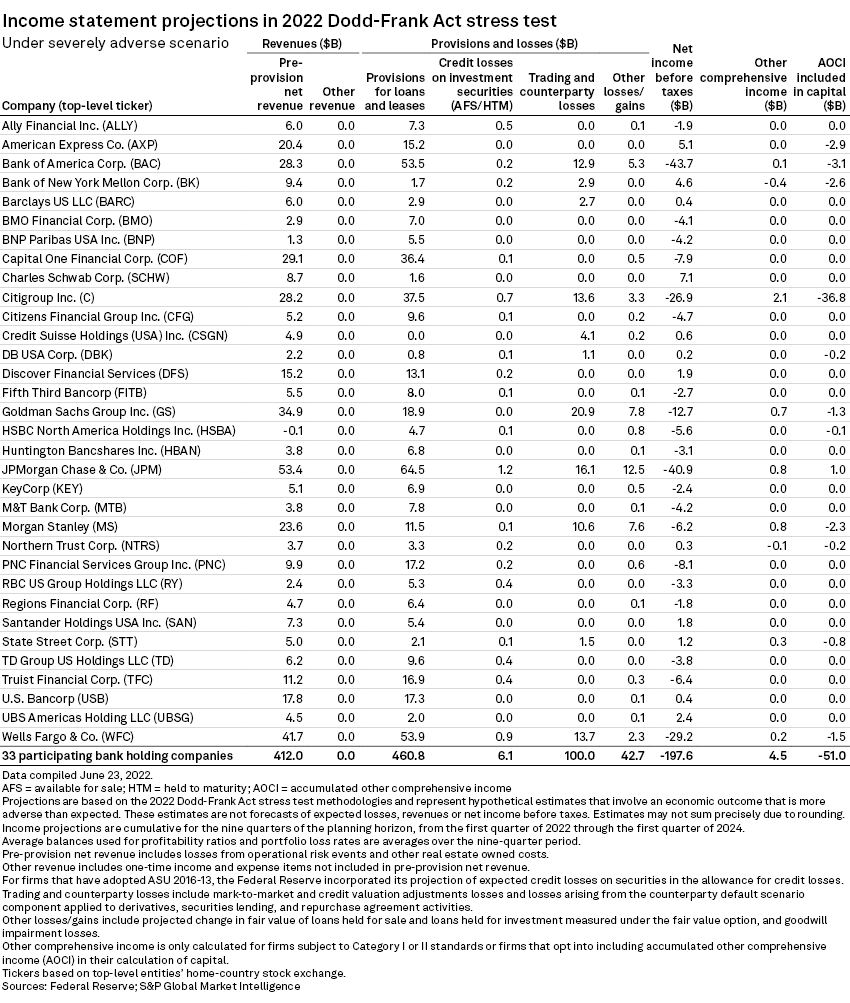

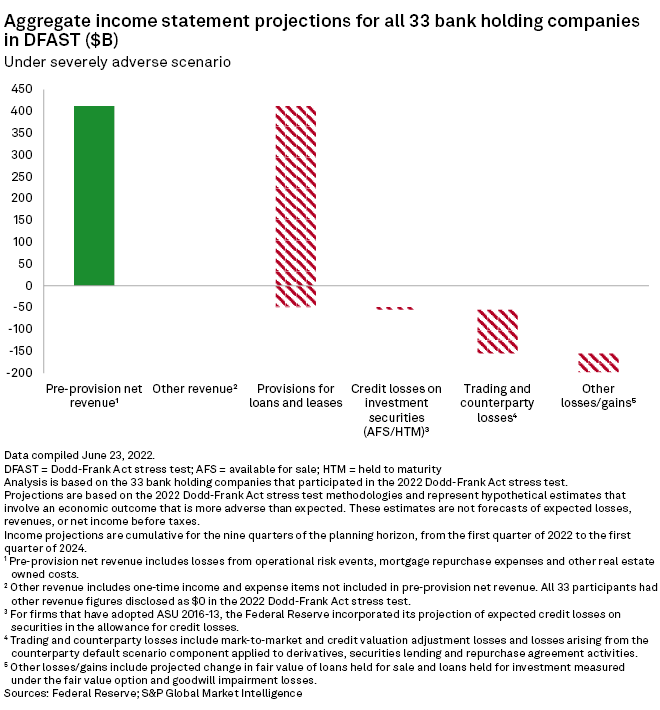

Aggregate losses projected under this year's Federal Reserve stress tests increased compared with last year, creating broad upward pressure on capital requirements and creating another headwind for shareholder payouts.

The Fed conducts the stress tests annually to help ensure that big banks have the capacity to keep lending during a severe recession, and published the most recent results late June 23. All the banks stayed above minimum capital requirements and are expected to start detailing capital plans and new SCBs after markets close June 27. The new SCBs will go into effect Oct. 1.

Policy implications

* Download a tear sheet to run a stress test on banks and thrifts.

* Download a template to view exhibits from the 2022 stress test results.

The stress tests underwent significant changes in recent years under Randal Quarles, the former Fed vice chair for supervision, including the introduction of the SCB framework and the elimination of so-called qualitative objections to banks' capital planning processes. Overall, banks once again received a clean bill of health this year.

"Some progressive Democrats are likely to make the case that the results show that the tests are too easy and that the Fed has made them too predictable," Ian Katz, managing director at Capital Alpha Partners, wrote in a note. "The school metaphor of giving the students the answers before the test is frequently recited among Democrats who follow these things."

But the banks' performance could also be used to push back against efforts to tighten regulation under Michael Barr, U.S. President Joe Biden's nominee to succeed Quarles. "Some Republicans and bankers will argue that the capital levels coming out of the tests show that banks are already over-regulated and that rules should, if anything, be loosened rather than tightened," Katz added.

Raymond James analyst Michael Rose predicted no "significant adjustments" to stress testing under Barr but said he will be on the lookout for potentially more aggressive scenarios next year because of recession fears.

He added that regulators' attention is turning toward a push for higher quality capital and loss-absorbing capacity at large regionals.

"We expect these conversations to accelerate once Barr's confirmation effectively fully staffs the Biden administration's financial regulatory team," he said.