The Federal Reserve's long-awaited tapering announcement has eliminated the probability of a near-term interest rate hike, according to a key measure of investors' expectations.

As expected, the Federal Open Market Committee this week approved a plan to taper its $120 billion in securities purchases by $15 billion per month, likely concluding in June. Following that decision, Fed Chairman Jerome Powell said Nov. 3 that the tapering plan "does not imply any direct signal regarding our interest rate policy," and gave no indication that a move away from keeping the benchmark federal funds rate near 0% was even being considered.

"We think that we can be patient," Powell said.

Those comments were enough to purge the already slim chances of a near-term rate hike from the market.

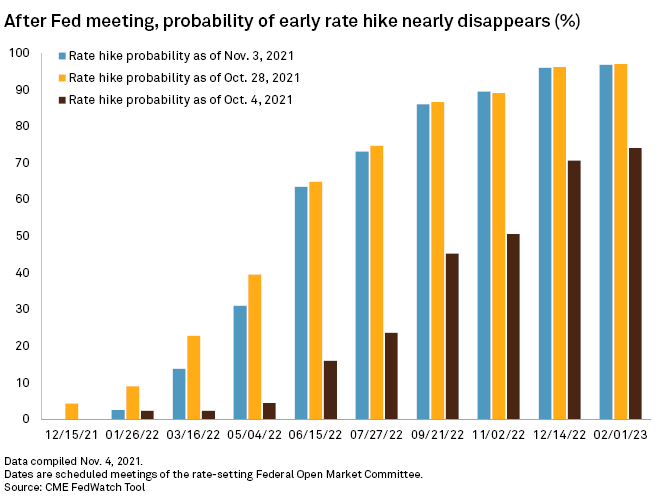

Market odds for a rate hike as early as December have disappeared, falling from a 4% chance just a week ago, according to the CME FedWatch Tool, which measures investor sentiment in the Fed funds futures market. The chance of a January rate hike fell to less than 3%, from 9% a week earlier, and the probability of a rate hike following the May FOMC meeting fell to 31%, from 40% a week ago.

The majority of the market now expects the first rate hike in June, with the odds of a hike at about 64%, down slightly from a week earlier, but well above the 16% odds the market was giving for a June hike a month ago, according to the FedWatch Tool.

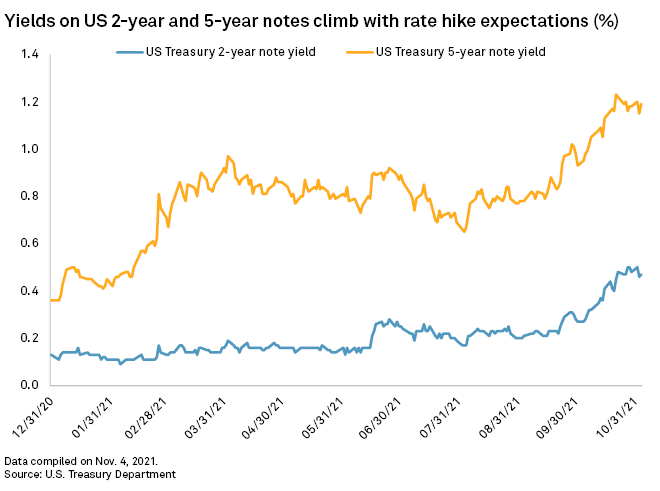

The two- and five-year U.S. Treasury notes, proxies for interest rate expectations, closed at 0.47% and 1.19%, respectively, on Nov. 3, up 20 and 24 basis points over the past month.

The probability of a summer 2022 rate hike has soared over the past month with inflation expectations. The FedWatch Tool shows a 73% likelihood on Nov. 3 of at least one hike by July, up from 24% one month earlier.

"We expect that by July 2022, inflation will be high enough for liftoff and the unemployment rate will be low enough," David Mericle, a senior economist at Goldman Sachs, wrote in a Nov. 3 note, on the likelihood of a July hike.

Still, a summer hike remains unlikely as rapid economic growth will slow in 2022 and inflation will ease, said Kathy Jones, managing director and chief fixed-income strategist for the Schwab Center for Financial Research.

"That could mean that by mid-2022 the case for a rate hike isn't that strong," Jones said in an interview.

Accelerated plans

If inflation continues to surge and the U.S. labor market rebounds to pre-pandemic levels quicker than expected, the Fed may be forced to act sooner.

"If inflation expectations continue to rise in the first two, three months of 2022, the chance of an accelerated tapering and sooner than expected hike will get very real," said Tom Essaye, a trader and founder of The Sevens Report, a research firm.

In its statement following the Nov. 3 meeting, the FOMC said it would adjust the pace of its tapering program "if warranted by changes in the economic outlook," meaning if inflation continues to climb and unemployment falls.

"Clearly the FOMC has left the door open to this and the risk is growing of a faster taper and earlier hikes as inflation fails to decline as quickly as the Fed projected," said Antoine Bouvet, a senior rates strategist with ING.

Bouvet said in an interview that he expects the first rate hike in September 2022 followed by another at the FOMC's December meeting.