Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

2 May, 2022

By Peter Brennan and Brian Scheid

The Federal Reserve's hawkish turn is exposing structural cracks in the bond market as the central bank pulls a historic level of accommodation from the marketplace.

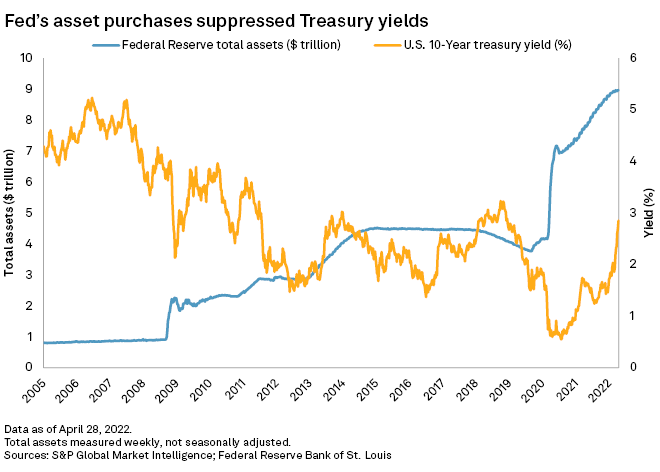

Rocketing inflation has pushed the Fed to tighten financial conditions, raising interest rates and signaling that it will reduce its $9 trillion balance sheet. The Fed provided critical support to the Treasury market during the COVID-19 pandemic, facilitating an explosion in the size of the market from $17.2 trillion to $23.8 trillion.

Following the rate-setting Federal Open Market Committee's meeting this week, Fed Chairman Jerome Powell is expected to announce that the central bank will begin to reduce its balance sheet by more than $1.1 trillion per year and hike rates by as much as 50 basis points.

With the Fed no longer buying bonds and now reducing its holdings in the Treasury market, it is up to traditional buyers, particularly big banks, to fill the void. The early signs suggest that they will struggle to do so.

"As the Fed pulls that liquidity away, we should not be surprised to see the return of volatility as other market makers have to now absorb that supply and absorb all that market-making activity," said Patrick Leary, a senior trader with Loop Capital Markets.

Liquidity dries up

The spread between bids and offers in Treasurys, one measure of depth in the market, has widened significantly compared to 2021, a sign that these securities are more difficult to buy and sell without significantly impacting prices.

"Treasury market liquidity is currently rather low compared to the amount of supply coming to market in the coming years," said Lyn Alden, who runs an investment research service. "It's not facing any sort of acute liquidity crisis like it did in March 2020, but the conditions for a problem are there."

The yield on the U.S. 10-year Treasury jumped 121 basis points from 1.72% on March 1 to its most recent high of 2.93% on April 19 as prices fell.

The closely-watched ICE BofAML Move Index — a bond market equivalent of the VIX "fear gauge" for equities — has climbed near highs not seen since March 2020, while the S&P US Treasury Bond Index fell to its lowest point since 2010.

"The now stale metaphor is that the pipes are just too small," Greg Staples, head of fixed income in North America at asset manager DWS Group, said in an email. "With the move in rates, the potential for the infrastructure to become overwhelmed, precipitating some new variant of a 'flash crash,' is concerning."

Fed backstop

The U.S. Treasury market is the world's largest bond market, worth $22.666 trillion. The ability of financial markets to absorb that many U.S. government IOUs is a testament to the global demand for a stable, liquid asset. The onus of demand has traditionally been on big banks, pension funds, foreign governments and other investors that like the security and liquidity of holding U.S. government debt. But the market has been increasingly reliant on Fed support as a backstop.

Traditionally, large banks acted as market makers in the primary Treasury market, providing liquidity by both buying and selling. But as borrowing by the U.S. Treasury grew, banks' balance sheets have not kept pace. The total outstanding debt held by the public has exceeded the balance sheets of the major U.S. banks since 2011, with the scale growing each year. In 2021, the combined size of the balance sheets of the banking giants was $13.8 trillion, as opposed to the $22.666 trillion Treasury market.

Other actors have stepped in to provide liquidity, notably high-frequency and algorithmic traders. But while banks typically take long positions, these actors are more likely to follow big market sell-offs, exacerbating liquidity crises. The Fed has been forced to step in on three occasions since 2014 when liquidity has evaporated, buying trillions of dollars of bonds to stabilize the market and prevent a spike in borrowing costs.

As COVID-19 sent shockwaves through financial markets in February 2020, liquidity dried up as investors sold off. The Fed stepped in with massive bond-buying operations, providing liquidity and holding yields low to stabilize markets and facilitate economic recovery. Over the course of the pandemic, the total assets on its balance sheet rose from $4.2 trillion to almost $9 trillion today.

Flash crash threat

The fact that the Fed is looking to sell off Treasurys and raise rates makes insufficient demand more likely.

"Investors have to be persuaded to give up their cash to buy billions to trillions in new Treasury and MBS debt at the same time the known return on that cash is increasing significantly," Staples said. "This will be a challenge."

The jump in Treasury yields has already exacerbated the roughly $100 billion in bond outflows since the start of the year, said Craig Brothers, senior portfolio manager and co-head of fixed income at Bel Air Investment Advisors.

"The market is very leery that a Fed with a $9+ billion balance sheet can simultaneously hike rates and [balance sheet reduction]," Brothers said in an email.

Fed concern

Declining liquidity and soaring volatility have yet to cause Fed officials to rethink their path to tighten monetary policy through higher rates and balance sheet reduction.

"The lack of liquidity is not at acute levels but it's clearly on their radar," said Alden, pointing out that a lack of liquidity and market depth in Treasurys was mentioned in the minutes of the FOMC's March meeting.

Alden believes the Fed is "completely focused" on efforts to combat inflation and will only change course if liquidity becomes a more severe problem.

"The Fed is historically a reactive organization rather than a proactive one, so they would likely need to be told by the market when to pivot rather than anticipate in advance where the pivot point may be," Alden said.

A lack of liquidity in the market was the reason the Fed started buying bonds in March 2020 and another spike in volatility and decline in liquidity could force Fed officials to delay their plans to reduce the balance sheet, said Antoine Bouvet, a senior rates strategist with ING.

"I am convinced that such a drying up in liquidity could convince them to stop [balance sheet reduction] and focus instead on hiking the fed funds rate to combat inflation," Bouvet said.

A "small army" of Fed officials will be watching liquidity conditions as the central bank begins reducing its balance sheet, said John Luke Tyner, a fixed-income analyst at Aptus Capital Advisors. If conditions worsen, the Fed may not get rid of some assets from its balance sheet as quickly as expected.

"They are on the case," Tyner said. "If there are clear market strains along the way, they will make adjustments."