Investors are jumping from tech-heavy growth stocks into companies offering better, more immediate value in anticipation of interest rate hikes by the Federal Reserve this year.

Higher interest rates would reduce the value of a company's future cash flows and its overall value today. That is likely bad news for growth stocks — defined by measures such as sales growth — that promise greater returns in the future. Meanwhile, a high-rate environment tends to have less of an impact on value stocks such as financials and energy, since those companies are typically defined by their ability to generate profits today.

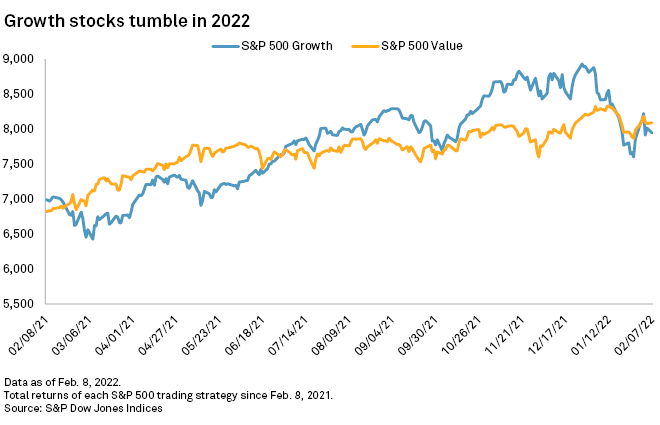

The S&P 500 Growth index is down 7.3% so far in 2022. It counts Apple Inc., Microsoft Corp., Amazon.com Inc., Alphabet Inc., and Tesla Inc. as its five largest constituents. Before 2022 these were good bets, building trillion-dollar market capitalizations as investors flocked to skyrocketing share prices.

Inflation has changed the game, with consumer prices rising 7.5% year over year in January. Market analysts are forecasting between five and seven increases in the benchmark federal funds rate this year as the Fed looks to clamp down on soaring prices.

"Estimates for rate hikes are all over the place, but they've been trending a lot higher in the past couple of weeks and we've seen stocks and other risk assets fall in response," Kristina Hooper, chief global market strategist at Invesco, said in an email.

Tech malfunction

The share prices of Apple, Microsoft and Meta Platforms Inc. have all fallen this year, with the last of those down by nearly a third after a difficult earnings season showed active user growth had stalled and investments in the metaverse had sent costs soaring.

"Investors had been worrying about the Federal Reserve and stubborn inflation, but a strong earnings season would counter those worries," Geir Lode, head of global equities at Federated Hermes, said in an email. "Weak numbers from technology companies have made investors reallocate to value stocks less sensitive to higher interest rates."

The traditional value-focused method of stock picking rather than following trends — an example of which is Warren Buffett's widely reported refusal to buy stock in Tesla — has underperformed for more than a decade. That trend has reversed somewhat and the S&P 500 Value index — characterized by healthy price-to-book values and having high sales relative to share price — is up 0.2% in 2022.

"The divergence in styles is noteworthy with growth falling out of favor versus value," Sean Darby, global equity strategist at Jefferies, said in an email.

Buying value

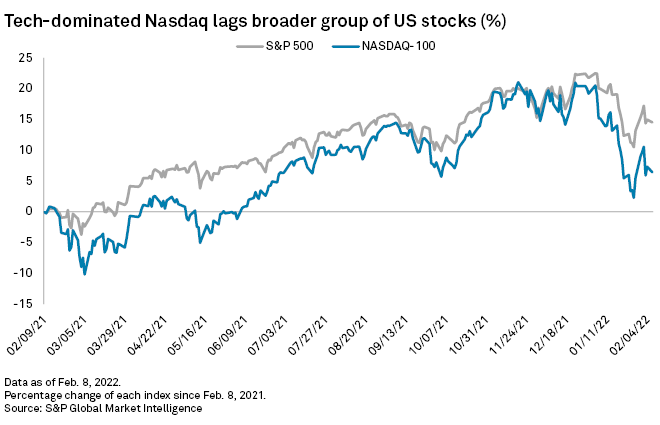

The performance of the tech-dominated Nasdaq 100, which was down 7.7% in 2022 as of the close of Feb. 9, also reflects the move away from growth trading. By contrast, the broader S&P 500 was down 3.8% as traditional value stocks such as energy and financials are benefitting from the shift in fundamentals.

"At elevated valuation levels, disappointing earnings growth, higher inflation and interest rates we believe stocks with low valuations, strong balance sheet and safe dividends look more attractive," Lode said.

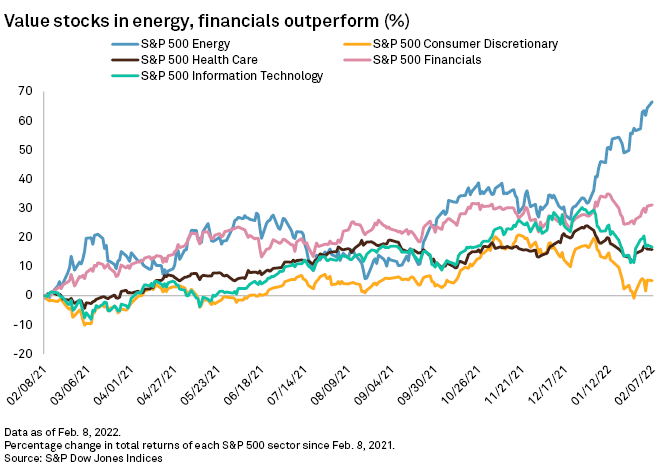

The economy is still growing strongly and is a key driver of value stocks such as financials, which grease the wheels of economic activity, and energy stocks, which enjoy higher demand. The U.S. economy grew by an estimated 5.7% in 2021, according to government data, while the International Monetary Fund predicts GDP will grow a further 4% in 2022.

Oil and gas majors have started earnings season with big profits. Exxon Mobil Corp. — the fourth-largest stock in the Value index — smashed market expectations by posting its largest profit since 2014. Its share price is up 29.1% in 2022, while fellow energy giant Chevron Corp. — the sixth-largest stock in the index — is up 17.4% this year.

The share price of Berkshire Hathaway Inc., the largest value stock by market capitalization, is up 7.4% in 2022. The second- and third-largest, Johnson & Johnson and The Procter & Gamble Co., are up 0.3% and down 2.4%, respectively.

"Value will outperform growth in the medium to long term, not only on a relative basis, but also, and much more importantly, by producing a positive absolute return," Jonathan Boyar, president of Boyar Research, said in an email.