Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Dec, 2024

US Federal Reserve officials expect higher interest rates for longer will be necessary to tame stubbornly elevated inflation, but exactly where long-term rates need to land to accomplish that goal is still uncertain.

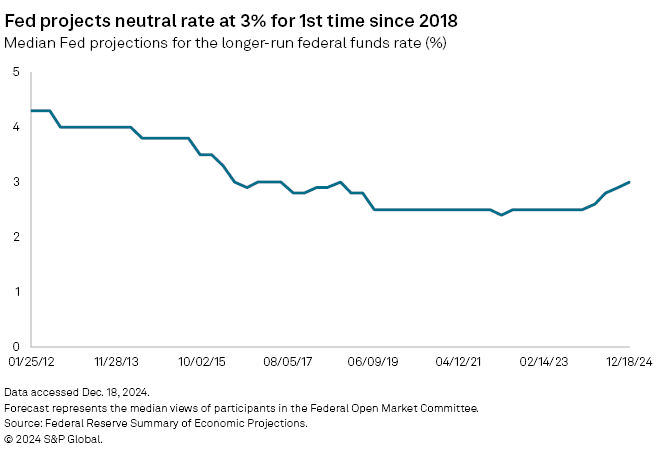

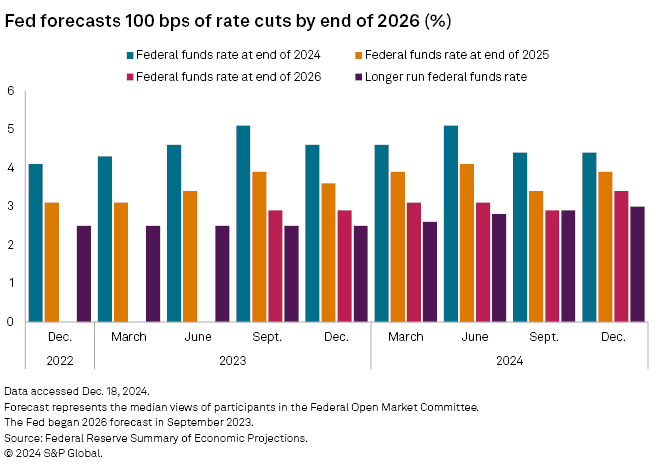

The median view among Fed officials is a longer-run federal funds rate of 3%, up from 2.5% a year earlier and at its highest since 2018, according to their latest quarterly summary of economic projections. The rate-setting Federal Open Market Committee cut benchmark federal funds by 25 basis points on Dec. 18 to a target range of 4.25% to 4.5%.

The so-called neutral rate of interest, where monetary policy achieves a state of equilibrium as it neither contracts nor expands the economy, has long proven elusive to Fed officials. Now, as the central bank shifts from tightening policy to fight soaring inflation to easing to prevent deterioration in the surprisingly resilient labor market, the neutral rate target has proven increasingly tenuous. In announcing the rate-cut decision, Fed Chair Jerome Powell cautioned that as rates move toward neutral, it is unclear how long it will take to get there and exactly where that figure is.

"There is no real certainty," Powell said during a press conference.

The Fed is aiming for a short-term interest rate that will reign over a stable domestic economy. But after cutting by 100 basis points since September, all central bank officials know is that they are likely closer to an ever-moving target. This view of a higher long-run equilibrium interest rate reflects that the Fed has entered a new phase of the rate-cutting cycle, said Oren Klachkin, a financial market economist with Nationwide.

"There's a growing recognition within the Fed that the long-term neutral rate is higher than they've been thinking," Klachkin said. "It's also in line with their new view that they need to proceed more cautiously with rate cuts."

Fed officials have boosted their expectations for the longer-run rate as inflation has proven persistent. The core personal consumption expenditures (PCE) price index jumped 2.8% from October 2023 to October 2024, the largest annual increase since April. The Fed is targeting 2% annual growth for this measure of inflation, which strips out volatile food and energy prices. In their quarterly projections, Fed officials now see core PCE year-over-year growth at 2.5% at the end of 2025, up from the 2.2% they forecast only three months ago.

"The terminal rate has been trending higher due to the growing lack of confidence that tightening, to this point, is enough to bring inflation lower," said Jack McIntyre, portfolio manager for Brandywine Global. "This increase reflects greater uncertainty by the Fed that the inflation we've faced in the past few years might not be conquered, and maybe it will run north of 2% on a structural basis."

Unrelenting inflation compelled Fed officials to lower their rate cut forecasts to only two 25-basis-point cuts in 2025, compared to their September forecast, which had four cuts penciled in for next year.

Powell acknowledged this week that moving inflation to that 2% target was proving harder than expected, and it might be "another year or two" before they get there.

Economic impacts

So far, the US economy appears able to cope with a higher baseline for interest rates, said James Knightley, chief international economist with ING.

"With fiscal policy running so loose and likely to remain loose under Trump, [Fed officials] presumably take the view that monetary policy needs to be kept tighter to ensure inflation hits the 2% target over time and stays there," he said.

As the forecasts for the neutral rate drift higher, it will likely impact the viability of US businesses as costs of capital start to reflect a higher risk-free rate, said Derek Tang, an economist with LH Meyer/Monetary Policy Analytics.

"That will mean some businesses come under M&A and consolidation pressure if they were counting on borrowing costs to come down to tide them over," Tang said. "But that also means the survivors will be more productive on average and lead on sustainable earnings growth going forward."

The implications of higher rate expectations will reverberate throughout the economy, Klachkin with Nationwide said.

"Interest rate-sensitive sectors like housing face challenges right now, and permanently higher interest rates will diffuse more broadly into the economy if they persist," Klachkin said. "It's a difficult trade off because, on the one hand, a higher neutral rate is emblematic of stronger underlying growth potential, but on the other hand it will have adverse effects for businesses, consumers and investors since we're coming out of an era of ultra-low interest rates."

The higher long-term rate expectation will also set a "higher floor" under all borrowing costs, said David Russell, global head of market strategy at TradeStation.

"This pushes long-term yields higher, including mortgage and credit card rates," Russell said. "It will squeeze Main Street and frustrate would-be homebuyers."