Hopes for a forthcoming policy pivot from the Federal Reserve and a modest U.S. stock market rally in October following months of losses have sparked optimism that equities' bear market days may be numbered.

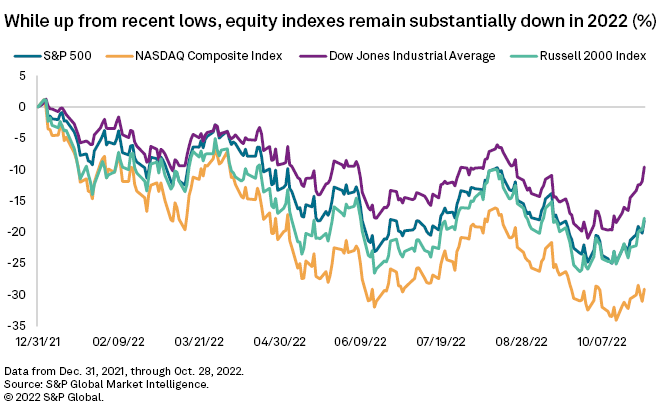

On Oct. 12, the S&P 500 settled at 3577.03, down nearly 25% on the year and the lowest close for the large-cap index since November 2020. The S&P 500 then rallied more than 9% through Oct. 28, as other equity indexes have jumped from their recent lows as well.

Whether this rally signals the beginning of the end for the ongoing bear market depends on a number of factors, particularly the Fed's path forward, whether inflation has peaked and whether the U.S. economy falls into a recession, equity analysts said.

"It sure feels like we've hit the bottom, but it's so hard to tell," said Callie Cox, a U.S. investment analyst at eToro. "From here, the market's next move could depend on what happens with profits. If earnings stay strong and the U.S. economy avoids a recession, we could be past the worst of this storm."

The market is likely to hit bottom before inflation eases and the Fed stops hiking rates, but it will be extremely difficult to tell just when that will occur, said Paul Schatz, president of Heritage Capital.

"We rarely know if this is the bottom or a bottom until weeks or months later," Schatz said.

Signs of surrender

In one sign of a bottom, fund managers are now showing "full capitulation" as investors have moved 6.3% of their portfolios into cash, the highest level since April 2001, and nearly half are underweight equities, according to an Oct. 18 survey from equity strategists at Bank of America. Stocks are likely to bottom in the first half of 2023 once the Fed starts to pivot away from interest rate hikes, the strategists wrote.

Despite some signs the bear market could be nearing an end, the bottom will likely be triggered by a shock to the market, said Vincent Deluard, the global macro strategist with StoneX Group.

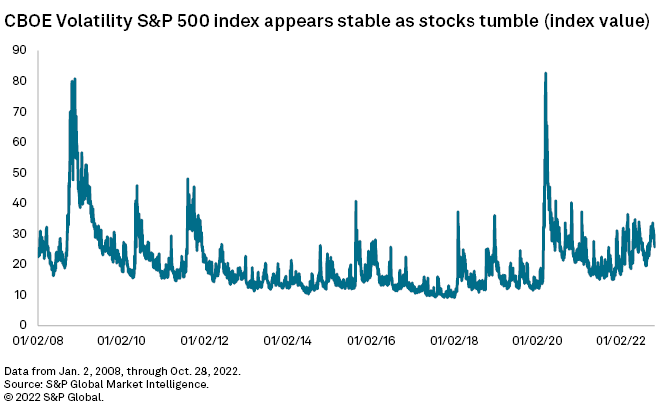

"This has been a fairly orderly sell-off," Deluard said. "This is not how a bear market ends. Bear markets do not end when everybody's calm."

The CBOE Volatility Index has remained below 30 since Oct. 20, settling below 26 on Oct. 28. The index measures volatility in equities through moves in the options market and is widely viewed as the market's fear gauge. Also known as the VIX, the index peaked at nearly 83 in the early days of the pandemic in March 2020 and rose to almost 81 in November 2008.

"You don't bottom when the VIX is at 30," said Deluard. "You need to see something big break."

No "Lehman-esque moment of capitulation" in the stock market has happened yet, but such a moment is not necessary before the market can bottom, said Matthew Weller, global head of research at FOREX.com and City Index.

"If the Fed pivots to slower rate hikes and an outright pause on tightening in Q1, the U.S. economy could still skirt a formal recession, making the current market valuations compelling enough to support a sustained rally," Weller said.