Smaller financial institutions could face big costs as the government proposes to raise bank assessment rates for the Deposit Insurance Fund.

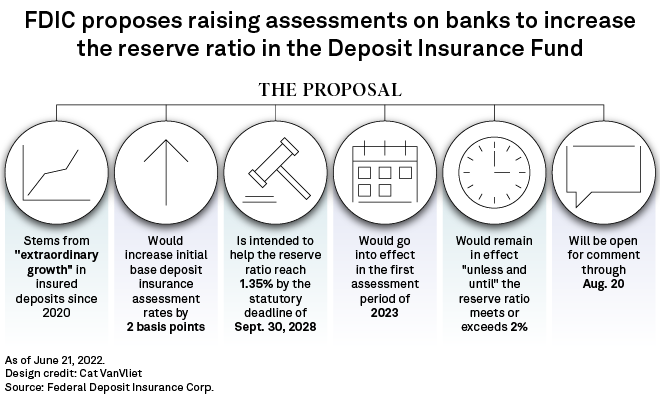

The concern comes as banks across the board face a 2-basis point increase to their deposit insurance assessment rates, proposed June 21 by the Federal Deposit Insurance Corp. The change is intended to help the fund's reserve ratio, which is the fund balance as a percent of insured deposits, reach a minimum of 1.35% by the statutory deadline of September 2028.

The FDIC said the pandemic led to "extraordinary growth" in insured deposits during the first and second quarters of 2020, causing the reserve ratio to drop to 1.30% by June 30, 2020. Even as the pandemic subsided, deposits continued to increase, with the ratio falling to 1.23% as of March 31, 2022. The newly announced rate increase would take effect during the first assessment period of 2023 and will remain in effect "unless and until" the reserve ratio reaches 2%, the FDIC said. Comments are due Aug. 20.

As uncertainty builds around the outlook for the U.S. economy, FDIC acting Chairman Martin Gruenberg said he believes it is a good idea to take action now.

"Better to take prudent but modest action earlier in the statutory 8-year period to reach the minimum reserve ratio … than to delay and potentially have to consider a larger increase in assessments at a later time when banking and economic conditions may be less favorable," Gruenberg said in a statement.

The imminent change could negatively impact smaller banks that may not have enough resources to immediately absorb the increase, Brad Bolton, president and CEO of Community Spirit Bank in Red Bay, Ala., told S&P Global Market Intelligence.

Given the current economic situation, with the Fed tightening monetary policy to combat rising inflation, "I just don't think it's time to put additional expense pressure on community banks nationwide," said Bolton, who is also chairman of the Independent Community Bankers of America.

Change too soon?

The new increase is the first of this scale in over a decade, said Chris Cole, senior regulatory counsel at the ICBA. With six years to reach the goal, Cole said it is too soon for the increase.

"We think that some of the reserve ratio will correct itself without this increase," he said. "Even if that's incorrect, you still have a lot of time, say two years. This is premature and a tough time to do it.

"Some economists are predicting a downturn in the economy. This is going to hit community banks at a time when they could be suffering," Cole told S&P Global Market Intelligence.

Attorneys representing some of the bigger banks said regardless of size, all financial institutions would see an impact to their bottom lines.

"It's not going to be modest for everyone," Paul Aguggia, a partner in the financial services practice at law firm Holland & Knight, said in an interview. "It's going to affect profitability."

But the cost would be greater for smaller banks, according to James Stevens, who leads the financial services practice at law firm Troutman Pepper. Large financial institutions have more scale and can spread their assets across a broader range of financial activity, such as mergers and acquisitions, Stevens said in an interview.

"This change would have a bigger impact on a bank that has less scale," he said.

At the same time, the FDIC's action comes at a positive time for banks, even if the future is uncertain, Stevens said.

"You have this increase in interest rates," he said. "For most banks, their net interest earnings should be going up. They're going to make more money on loans. They're not competing for deposits, and that's a great thing for banks."

CFPB director proposes flexibility

Consumer Financial Protection Bureau Director Rohit Chopra, who is a member of the FDIC Board of Directors, said in a June 21 statement that he voted for the increase to shore up the fund while banking industry profits are robust.

However, he said the FDIC should look to a future that could bring more balance to assessments.

Over the long term, the board should consider a new mechanism that would automatically adjust premiums up and down based on economic conditions. For example, assessment rates should be calibrated based on banking sector profitability, or a combination of metrics, Chopra said.

The FDIC should also look at the burden of assessments on banks of varying sizes, he said. That includes "whether the largest firms, especially global systemically important banks, should be paying a higher share of the assessments than they do today."

Chopra's statement "is consistent with a lot of his priorities," said Joann Needleman, an attorney at law firm Clark Hill and former member of the CFPB's Consumer Advisory Board.

"He is about leveling the playing field, creating better competition," Needleman said. "That's his philosophy."