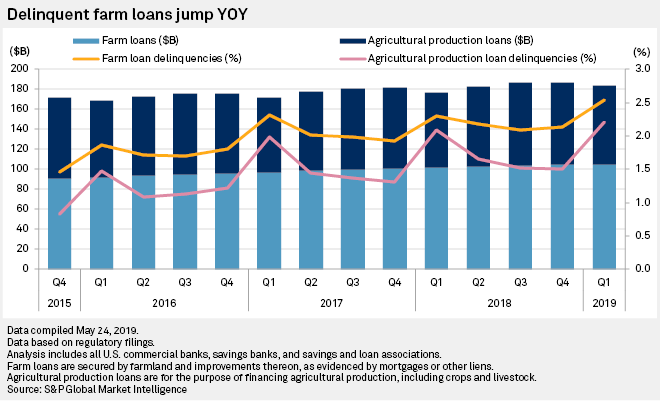

Delinquent farm loans at U.S. banks and thrifts grew 23 basis points year over year to 2.54% in the first quarter, the highest delinquency rate since the second quarter of 2013.

Total agricultural loans climbed 3.9% year over year to $183.77 billion as of March 31, split between $105.24 billion in farm loans and $78.53 billion in agricultural production loans.

Agricultural production loans saw delinquencies rise 11 basis points year over year to 2.20%.

Farm loans are secured by farmland and improvements, while agricultural production loans are used to finance agricultural production, including crops and livestock.

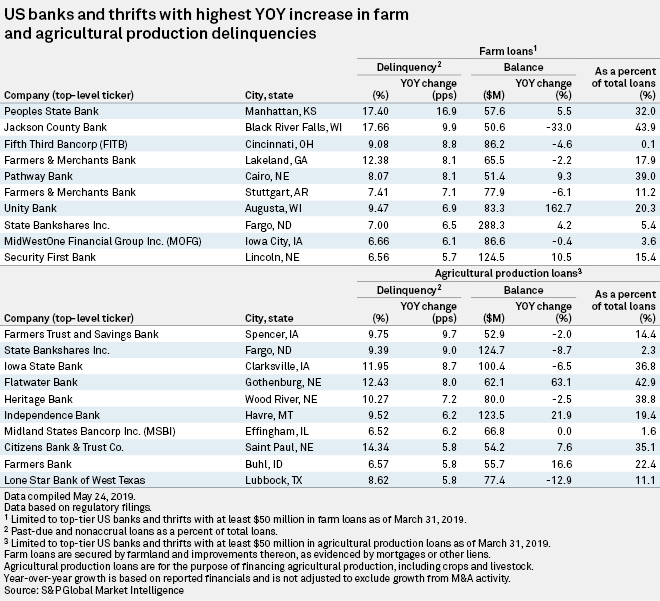

Five of the 20 banks with the largest year-over-year increases in either farm or agricultural production loan delinquencies were headquartered in Nebraska, the most of any state. During the first quarter, Nebraska and other Midwestern states were hit by floods and blizzards, which analysts expect will lead to higher delinquencies in the short term.

Earlier in May, U.S. President Donald Trump announced increased aid for farmers to help ease the continuing burden of tariffs stemming from the ongoing trade impasse with China.

Among the 20 largest banks by total agriculture loans, eight posted a year-over-year decline in ag loans for the first quarter.

Click here to set up real-time alerts for data-driven articles on the U.S. financial sector. Click here for a one-page regulatory tear sheet, with key performance metrics and other financial information for banks and credit unions. Banks report loan information on call report schedule RC-C and Form Y9-C schedule HC-C. |