Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

3 Feb, 2021

By Anna Akins

Facebook Inc. and others that rely on ads to drive profits have good reason to fear Apple Inc.'s impending privacy-focused operating system update, analysts said.

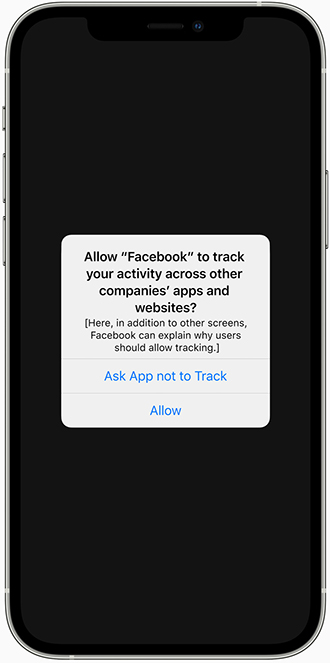

The iOS 14 update, which is set to roll out broadly early this spring, requires apps to seek users' permission to collect and share data. The planned change is likely to impact targeted mobile advertising, and it has sparked a fresh war of words between Apple and Facebook, which for years have tussled over how much access companies should have to users' data. Facebook said the planned iOS change will not only prove a headwind to its ad business, which accounts for the bulk of Facebook's total revenue, but could also impact millions of small businesses that rely on targeted ads. Apple noted that Facebook and others can continue to track and target users after the update; they will simply be required to seek users' permission to do so.

Apple's iOS 14 privacy update rolls out broadly early this spring Source: Apple Inc. |

Among large ad-based internet companies, MKM analyst Rohit Kulkarni said Facebook and Snapchat-parent Snap Inc. have the "highest potential headwind" from Apple's privacy changes, followed by Twitter and Pinterest. Google and Amazon have the lowest exposure, he said. Kulkarni reviewed each company's risk exposure against a variety of factors, including scale, first-party data access, exposure to iOS devices, and relative revenue contribution from a mix of ad types. Overall, he expects large internet platforms to fare better than smaller ones given their size and access to user data.

Facebook on Feb. 1 rolled out an in-app prompt on its core Facebook platform and on photo-sharing app Instagram, asking users for permission to use data collected from third-party sites and apps while also providing more context on how certain data is used. Its CFO on a January earnings call warned that the company would likely see an impact from Apple's privacy update late in the first quarter that could continue through the rest of the year.

Facebook CEO Mark Zuckerberg said during the company's earnings call that he does not think his company's outlook has changed in any significant way due to the iOS 14 change, but Facebook does expect high opt-out rates from people who do not want to receive personalized ads.

Eric Seufert, an independent analyst and marketing strategy consultant who runs mobile advertising trade blog Mobile Dev Memo, forecast that Facebook could take a 7% revenue hit in the second quarter that will likely continue due to marketers spending less on ads as more iOS users opt out of allowing Facebook to collect their data.

"Subsequent quarters will also face revenue losses," Seufert wrote in a report.

In the fourth quarter of 2020, Facebook's advertising revenue grew to $27.19 billion, up from $20.74 billion in the year-ago period, and advertising accounted for about 97% of the company's consolidated revenue. Facebook's total revenue was $28.07 billion for the quarter, up 33% from $21.08 billion a year earlier.

Paige Bartley, a senior research analyst at S&P Global Market Intelligence's 451 Research unit who has expertise in data management, said in an interview that Apple's latest privacy moves are indicative of consumers' growing unease with how big tech companies handle their data, and it could spark similar actions at other companies. Bartley said 81% of respondents in a recent 451 survey expressed some level of concern about the privacy of their personal data online, and roughly half said they believe it is the responsibility of businesses collecting and using their data to keep it private and secure.

"Consumers are becoming more aware of privacy issues — that's a sea change that's unstoppable at this point," Bartley said.

Location

Segment