Exxon Mobil Corp.'s first-time disclosure of greenhouse gas emissions data from its largest source is a good start but still far short of what the supermajor needs to do to convince shareholders of its commitment to the energy transition, analysts said.

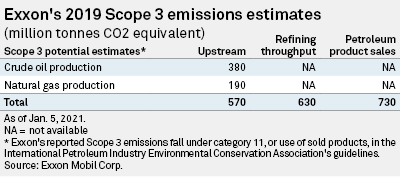

In its "2021 Energy and Carbon Summary" released Jan. 5, Exxon reported Scope 3 greenhouse gas emissions from its upstream sector likely totaled 570 million tonnes of CO2 equivalent in 2019. In addition, Scope 3 emissions, which include those across its supply chain right down to end-user emissions, totaled 630 million tonnes of CO2 equivalent from its refining throughput and 730 million tonnes of CO2 equivalent from the petroleum products it sells.

By comparison, Exxon's 2019 Scope 1 and 2 emissions were pegged at around 120 million tonnes of CO2 equivalent.

"The Scope 3 emissions just tell you how big the company is," RBC Capital Markets analyst Biraj Borkhataria said in a Jan. 7 email.

As the world's largest refiner and one of the top five chemical companies, "By definition, [Exxon] sells massive amounts of oil and gas products to end-users," Raymond James analyst Pavel Molchanov said in a Jan. 7 email. "The 2019 figure of 730 million tonnes equates to 2% of global CO2 emissions."

|

Investors and environmental groups have expressed a growing interest in major oil and gas companies' Scope 3 emissions. These types of emissions can account for 85% or more of integrated companies' total emissions.

In the last year, U.S. energy companies have tried to be more transparent about their climate change efforts to avoid losing billions of dollars in investor capital.

Borkhataria and AJ Bell Investment Director Russ Mould said Exxon must outline not just its yearly emissions figures but also the specific steps the company is taking to reduce them and prepare for a carbon-neutral world by 2050.

"The onus is now on the company to outline its vision for the future — how its operations and its business mix are to change, how it will fund this change and how long it will take," Mould said in a Jan. 6 email.

|

Morningstar analyst Allen Good doubts Exxon is willing or able to align its business strategy with the goals of the Paris Agreement on climate change.

"Ultimately, this [report] is unlikely to affect their investment strategies," Good said in a Jan. 8 email. "Outside of producing less oil/gas there's not much these companies can do about Scope 3 [emissions]."

In its report, Texas-based Exxon reiterated what the oil industry as a whole has claimed for some time: since Scope 3 emissions come from the consumption and use of a company's products outside of its control, the figures could be "misleading" and run the risk of being double-counted.

"The Scope 3 estimates represent three approaches for accounting and are not meant to be aggregated as this would lead to duplicative accounting," Exxon said. "For completeness, the Scope 3 estimates associated with the combustion of the crude processed, produced, or sold from Exxon's refineries are provided. However, to avoid duplicative accounting, these Scope 3 estimates are not included in Exxon's Scope 3 total since the associated Scope 3 emissions would have been reported by the producer of those crudes."

Molchanov, however, questioned the methodology Exxon used in its calculations. "Disclosure of this [Scope 3] information by Exxon is indeed new, but the carbon footprint could have been calculated independently. In other words, it is well-known what the carbon footprint of each gallon of gasoline or diesel is."

"Exxon's report is unlikely to hugely appeal to those who view investment as a means of protecting, or augmenting wealth, regardless of what a firm does, or to those who see it merely as a 'greenwashing' exercise," Mould said. "Greenwashing" implies a company's assets and/or actions are more environmentally friendly than they actually are.

"Nevertheless, they say that sunlight is the best disinfectant. Any document produced by an oil major on carbon emissions has to be seen as better than no document at all, so this is a step forward," Mould added.

Exxon was already criticized for its December 2020 announcement that it would reduce the intensity of its Scope 1 emissions by 15% to 20% by 2025, compared to 2016 levels. Analysts said the targets were too soft since they did not account for Scope 3 emissions.

Intensity-based targets measure the amount of emissions released into the atmosphere relative to a company's energy production. Therefore, a company could maintain or even increase upstream production and still hit carbon intensity targets by adding low-carbon alternatives such as solar and wind to its portfolio, critics have said.