The Parler app faces an uphill battle in generating ad revenue and boosting its engagement metrics amid rising competition and recent usage declines. |

As the artist formerly known as Kanye West gears up to buy Parler Inc., industry experts said the alternative social media platform is facing a number of headwinds that celebrity attention alone might not fix.

As part of the deal, West, who legally changed his name to Ye, will acquire Parlement Technologies Inc.'s social media division, composed of Parler. Parlement Technologies will retain its cloud services division and continue to provide infrastructure services and support to the Parler social media platform.

Ye agreed to buy Parler after the artist was dropped from more mainstream social media platforms including Twitter Inc. and Instagram LLC after posting anti-Semitic comments. In the deal announcement, Ye expressed a desire to support a platform that promoted free speech. But in a crowded field of self-styled free speech champions, Ye faces competition. And social media experts are not sure Ye's star is bright enough to reverse Parler's recent engagement declines.

"I see this being a tough sell," said Eric Dahan, CEO and co-founder of Open Influence, an influencer marketing company that works with content creators. "It's not like Kanye West is seen as a leader in free speech thought circles ... I just don't see the mashup."

Growth challenges

Parler rose to some prominence after the 2020 U.S. presidential election, when conservative politicians and media stars began championing Parler as an alternative to Facebook and Twitter and those platforms' respective content moderation policies. On Nov. 9, 2020, Parler counted more than 5 million active users, an eight-fold increase from the prior week, according to a statement at the time from John Matze, its then-CEO.

But some of those accounts have since gone dormant. After Parler's recent sale announcement, the company sent emails to hundreds of VIPs, some of which later told media outlets that they had little association with the site.

|

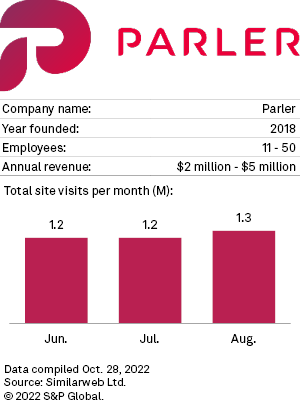

Parler counted about 1.3 million site visits in the month of August, according to website analytics tracker Similarweb. That compares to Twitter's 6.8 billion site visits in August, and Facebook's 18.2 billion.

Even other alternative apps like Gettr Usa Inc.'s Gettr and Trump Media & Technology Group Corp.'s Truth Social — founded by former president Donald Trump — have outdrawn Parler by significant margins in terms of site visits. In August, Truth Social recorded 9 million site visits and Gettr saw 7.2 million, according to Similarweb.

Platforms that are more niche tend to be harder to grow, Dahan said. "I don't really see it having mass adoption, but I do see it having a niche, very active audience," he said. "It's really hard to get a social platform off the ground. And it's even harder to sustain a new one, because these existing platforms just have so much staying power. So there needs to be something inherently unique in [Parler's] feature set."

In addition to content, monetized social media platforms generally depend on advertising. Parler's ad base would likely look similar to that of the advertisers who populate the airwaves of right-wing talk radio or television programming, said Will Duffield, a speech and internet governance analyst at the Cato Institute, a libertarian think tank in Washington, D.C.

"Plenty of businesses serve the right wing that might feel as though they're discriminated against on Twitter," Duffield said. And so you don't need a whole lot more than that — supplements and gun ads ... I think there's plenty of room for niche ad-funded platforms."

Website analytics tracker Similarweb estimates that Parler generates between $2 million and $5 million a year from its advertising, merchandise sales and its nonfungible token marketplace.

An

Parlement Technologies, meanwhile, is shifting its focus to the cloud, a sector that has seen slower growth recently but is expected to rebound as enterprises increasingly require cloud-based internet infrastructure. Parlement Technologies in September bought Dynascale Inc. and launched itself into the cloud business. The move comes after Parler was dropped from major cloud services providers including Amazon Web Services Inc. over concerns about content promoting violence on its platform. Parler also was dropped from the app stores of both Apple Inc. and Google LLC, though it has since been reinstated. In launching its internet infrastructure division, Parlement Technologies stressed its desire to support free speech.

Growing users is a constant challenge, even for established social media players with large user bases, said Valerie Wirtschafter, a senior data analyst in the Artificial Intelligence and Emerging Technologies Initiative at the Brookings Institution.

While Ye brings visibility to the Parler platform given his celebrity, attention alone is not a monetization vehicle, Wirtschafter said in an interview.

"[Ye] certainly adds cachet to the question of how long the power of an individual can drive the profit incentive," the analyst said. "The company needs to have a revenue model that needs to be able to differentiate itself in some way."

Political

The transaction comes as Republican members in Congress plan to focus their tech policy agenda on preventing platform censorship. Republicans generally argue that major social media platforms censor or silence conservative viewpoints, while Democrats say more content moderation is needed to prevent misinformation and hate speech from spreading online.

But even with GOP leaders focused on free speech, that likely would not translate into growth for Parler or related apps that eschew content moderation policies seen on Big Tech platforms, said Jesse Lehrich, who heads Accountable Tech, a group advocating for technology company regulation.

"I think [Republicans] are more interested in having this political battle with Big Tech than they are with actually creating or fueling the growth of alternative, moderation-free platforms," Lehrich said in an interview.

Ye has not made public comments about how he would change or enhance Parler's user experience or content moderation practices. The lack of commentary is leading some to view the purchase as just a way to enable Ye and others who agree with him to say what they want online without consequences.

"It could just simply be that if he owns it, there's no way he can be banned," said Cato's Duffield. He added that Ye buying Parler "is a pretty marginal event in social media space."

Parler did not respond to a request for comment. Representatives for Ye could not be reached for comment.