Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Sep, 2022

By Camellia Moors and Taylor Kuykendall

|

A prototype Honda electric vehicle. Honda is one of several EV manufacturers expecting to ramp up domestic investments in the wake of the Inflation Reduction Act. |

Electric vehicle makers and their suppliers are rushing to invest in the North American supply chain after passage of the Inflation Reduction Act, and more announcements are likely in the works.

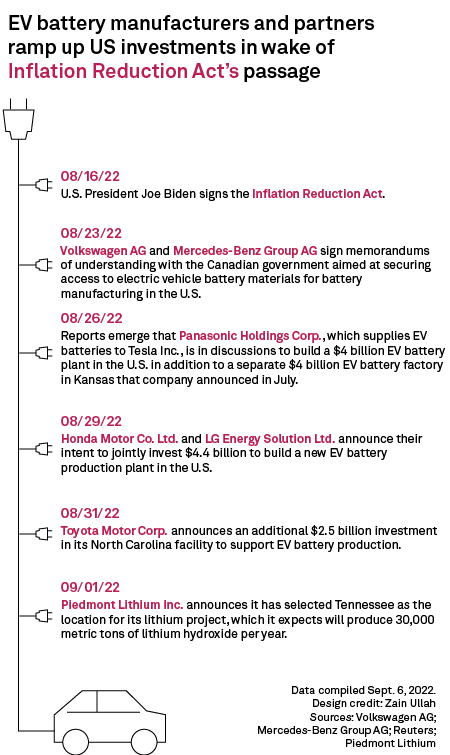

Since U.S. President Joe Biden signed the bill into law Aug. 16, at least five major EV manufacturers and battery minerals suppliers, including Toyota Motor Corp., LG Energy Solution Ltd. and Piedmont Lithium Inc., have announced billions of dollars worth of investments in the domestic production capacity encouraged by the legislation. The bill expands tax credits for EVs and includes domestic sourcing requirements to promote the development of a local EV supply chain to form the backbone of Biden's clean energy policy.

|

The bill checked off several wish-list items for the EV industry, according to Brian Willis, communications director with the Zero Emission Transportation Association, an advocacy group supported by a coalition of EV and battery makers.

"I think we're going to be inundated over the next couple of years, in a good way," Willis said. "I'm not saying every day, or every month, will be your birthday, but there will be no dearth of opportunities out there."

'Ginormous market signal'

The new law will spur an already hot EV market. Passenger plug-in EV sales across top markets including the U.S., Europe and China skyrocketed 92.5% year over year in the first seven months of 2022, S&P Global Commodity Insights analyst Alice Yu wrote in an August report. Sales grew despite

The Inflation Reduction Act seeks to move the far-flung battery supply chain into the U.S. and allied nations such as Canada and Australia. The legislation created a tax credit equivalent to 10% of the cost of production for certain critical minerals used to manufacture EVs, including aluminum, lithium and graphite. The bill also contains measures to implement the Defense Production Act, which may boost domestic critical minerals processing.

Panasonic Holdings Corp., which supplies batteries for electric automaker Tesla Inc., is planning to build a $4 billion EV battery plant in the U.S., according to the Wall Street Journal, in addition to a Kansas facility announced in July. Tesla filed on Aug. 22 with a Texas regulator for permission to build a lithium refining facility. Volkswagen AG and Mercedes-Benz Group AG announced a few days after the bill signing that they are working with the Canadian government to secure battery materials for U.S. manufacturing, and other companies in the EV supply chain, including battery metal miners such as Piedmont Lithium, joined in the chorus of major investment announcements.

"What we're seeing is this unprecedented policy driver or policy signal layered on top of what was quickly becoming a ginormous market signal," said Aaron Brickman, a senior principal with the Rocky Mountain Institute, a research organization promoting sustainability.

With the Inflation Reduction Act passed, the EV supply chain has gained more regulatory and political certainty. That means less risk, cheaper financing, and easier employee recruitment, Willis said.

"The real additionality is not going to be coming in the next one month, two months or three months, but in the next two to three years as new sites are scoped out and expanded," Nathan Iyer, a senior associate at the Rocky Mountain Institute, told Commodity Insights.

Challenges remain

For some mining and automotive industry members, there remains more to be done.

"The whole permitting process probably needs to be looked at more closely if the United States is going to achieve the aims [of the Inflation Reduction Act]," said Lindsay Dudfield, executive director of Australia-based Jindalee Resources Ltd., which owns the McDermitt lithium project in Oregon.

Austin Devaney, senior vice president and chief commercial officer for Piedmont Lithium, said the act is a "fast and fabulous first step" to building an independent supply chain for EVs in the U.S., but "it will take time to get projects up and running to the point that they can deliver. That's kind of my biggest concern, the fact that the industry has a long development cycle."

A permitting reform deal struck by Democratic Senate leadership in early August may help alleviate some of the concerns, but details are scant and the bill has not been introduced.

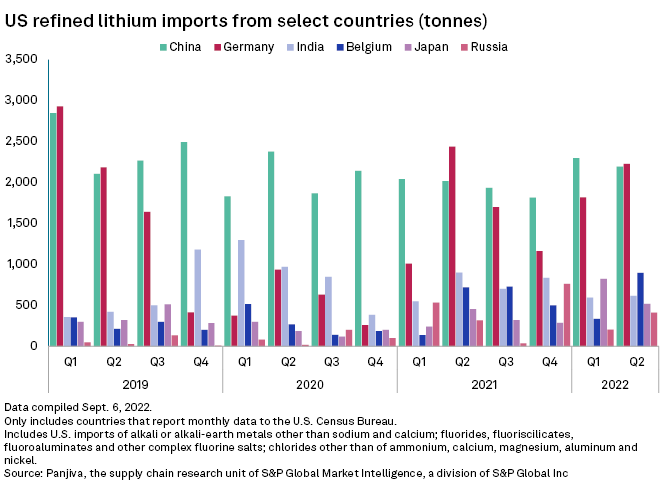

Foreign automakers are irate that they will be locked out of credits due to the domestic sourcing rules. The anemic U.S. battery supply chain will force companies without existing sources of materials to rely on imports for years.

South Korea-based Hyundai Motor Co. announced plans in May to open a $5.5 billion EV plant in Georgia in 2025, but the company will struggle to source materials from inside the U.S., and many of its EVs may be frozen out of subsidies.

"We are disappointed that the current legislation severely limits EV access and options for Americans and may dramatically slow the transition to sustainable mobility in this market," a Hyundai spokesperson told Commodity Insights.

Even with those worries, the Inflation Reduction Act has cheered EV makers, giving a boost to the Biden administration's target of 50% EV sales by 2030.

"I think the 50% target remains ambitious," said Jane Nakano, a senior fellow at the Center for Strategic and International Studies. "But I think it's much more reachable thanks to the [Inflation Reduction Act]."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.