| Christine Lagarde, president of the European Central Bank, gives a speech in March signaling a shift in eurozone monetary policy. Source: Ronald Wittek-Pool/Getty Images News via Getty Images Europe |

A potential European Central Bank move to prevent its ultra-cheap funding program from unduly boosting eurozone lenders' profits would have a limited impact on the sector's income outlook, according to several of the bloc's largest banks.

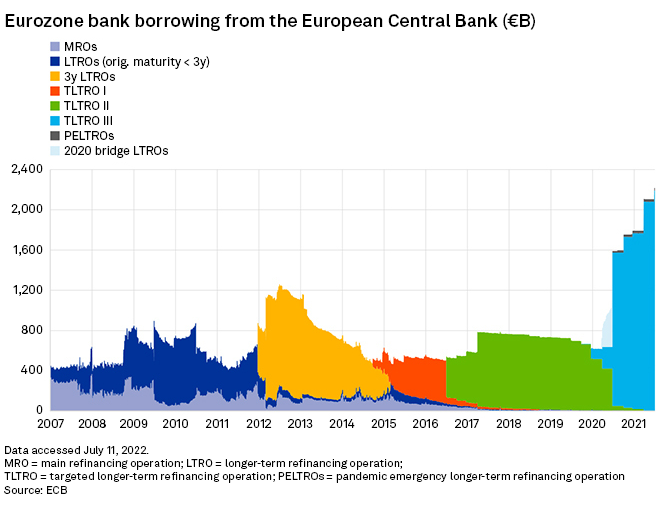

The ECB is discussing ways to stop lenders from profiting from the program — known as the targeted long-term refinancing operation III, or TLTRO III — by keeping the funding on deposit at the central bank while interest rates rise into positive territory in the coming months, a July 3 report in the Financial Times (London) said. The €2.2 trillion of taxpayer-backed funds, which were loaned to banks at negative rates, effectively paying lenders to borrow, were intended to stimulate lending to businesses and households.

Any action by the ECB could deprive eurozone banks of extra earnings of between €4 billion and €24 billion from June until the end of the cheap loans program in December 2024, according to a Morgan Stanley report. But several of the eurozone's largest listed banks told S&P Global Market Intelligence they had not included any potential benefit from depositing the funding at the ECB in a higher interest rate environment in their most recently published earnings estimates; this means any income from doing so would only boost their outlook as rates rise.

"If the ECB keeps the TLTRO III conditions, we will earn even more," said a spokesperson for Banco de Sabadell SA, the eurozone's 16th-largest listed lender. "In any case, the expected rate hikes would more than offset the possible negative effect of any new conditions." Sabadell is Spain's fourth-largest lender.

Added bonus

Of the 20 largest listed eurozone banks by total assets, 10 told Market Intelligence they are not including any benefit from depositing TLTRO III funding at higher interest rates with the ECB in their net interest income estimates. Five of the lenders declined to comment, and five did not respond to a request for comment. Net interest income is the difference between the revenue generated from a bank's assets and the expenses associated with paying on its interest-bearing liabilities.

TLTRO III is the latest in a series of cheap liquidity injections into the euro banking system by the ECB, the first of which began in 2014. The operations are designed to encourage banks to lend to the real economy, with the aim of stimulating growth and helping the ECB reach its 2% inflation target.

Eurozone banks could still profit from depositing TLTRO funds at the ECB once the central bank's deposit rate turns positive, with the extent of any benefit from doing so depending heavily on the pace at which rates rise.

An ECB spokesperson said that any action on the issue is still some way off and is currently only "likely to be discussed, signaling the absence of a concrete proposal or possible workaround as of yet, let alone any details."

Doubts exist about the wisdom of the ECB limiting banks' use of the funds, as well as the legality of such a move. Any action by the ECB could prompt banks to repay the TLTRO III funding much sooner than the December 2024 deadline, significantly reducing liquidity in the eurozone banking system at a time of economic and financial uncertainty.

"I wouldn't have thought the ECB would necessarily want to see up to €2 trillion of additional liquidity coming out of the system at the same time as they are halting quantitative easing and trying to hike rates," said Benjie Creelan-Sandford, bank equity analyst at Jefferies.

Any income from the use of undeployed TLTRO funds as deposits at the ECB is unlikely to make a mark on lenders' NII in the coming quarters, according to Pablo Manzano, vice president of global financial institutions at credit rating agency DBRS Morningstar.

Morgan Stanley's €4 billion to €24 billion estimate of any potential benefit represents between 0.5% and 3% of eurozone banks' 2021 NII on an annualized basis, based on a calculation by Market Intelligence using ECB data.

"If we are in the low range, it's not significant at all," said Manzano. "If we are in the upper range, it's a bit more material, but the net impact of rising rates should still be very positive [in the event of any ECB action]."

Rates in focus

A 200-bps increase in interest rates would boost European banks' annual NII by an average of 18% compared with 2021, excluding Swiss lenders, a June 8 report by S&P Global Ratings said. U.K. and Italian banks stand to benefit the most from rising rates, followed by Spanish, German, Danish and Austrian banks, with French and Dutch lenders experiencing smaller effects, it said.

Still, some analysts expect the deepening slump in the global economy to outweigh any benefit banks may enjoy from rising rates. "In the past, the economic outlook has been the key driver of banks' share prices, more so than interest rates," Anke Reingen, bank analyst at RBC Europe, said in a July 1 note. "We expect this to be the case going forward."

Whatever the balance, eurozone banks are welcoming the prospect of a boost to NII after a decade of record low interest rates squeezed earnings, profitability and share prices.

"We have not included any possible interest rate hikes by the ECB in our current revenue expectations," said a spokesperson for Commerzbank AG, the eurozone's 12th-largest and Germany's second-largest bank by total assets. "[That] means we see upside potential in the case of higher interest rates."