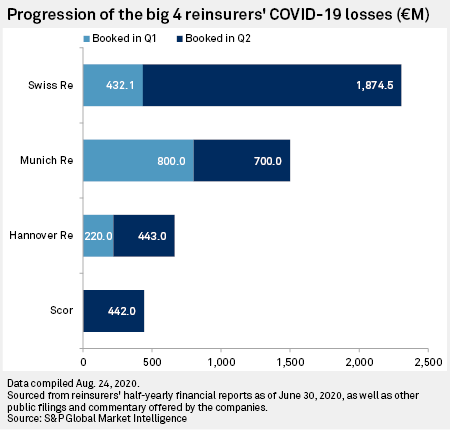

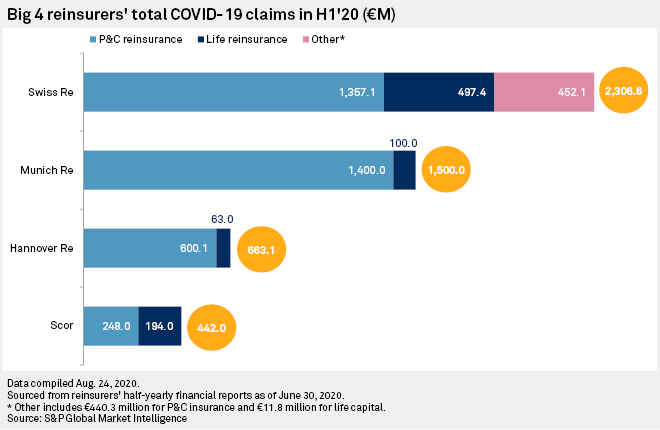

Europe's four biggest reinsurers racked up an additional €3.46 billion of coronavirus claims and reserves between them in the second quarter, taking the total for the first half of the year to €4.91 billion. And more claims are likely amid the continued uncertainty about business interruption, credit and surety and life in particular.

The bulk of the €1.45 billion of coronavirus claims and reserves Münchener Rückversicherungs-Gesellschaft AG, Swiss Re AG and Hannover Rück SE reported in the first quarter came from event cancellation. SCOR SE, which has little exposure to event cancellation, did not book any coronavirus claims in the first quarter. But in the second quarter the reinsurers, including Scor, started to add reserves for other business lines.

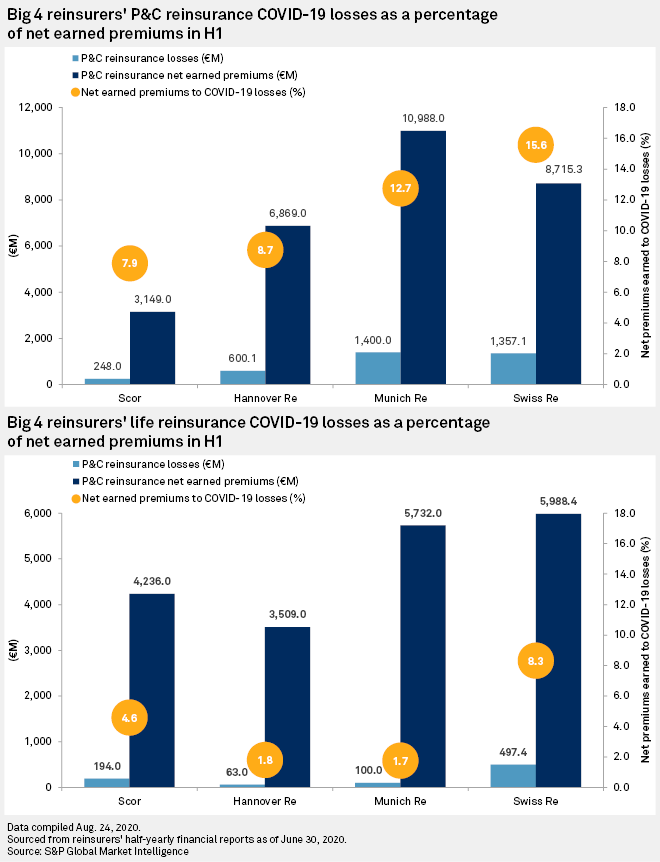

Event cancellation continued to be the biggest source of expected claims for Munich Re, but the largest single portion of Swiss Re's $2.54 billion first-half claims charge was business interruption, which totaled $973 million across its property and casualty reinsurance and Corporate Solutions primary insurance units. Hannover Re said 40% of its €600 million nonlife reinsurance coronavirus claims hit was for business interruption, with 25% for credit and surety, 20% for event cancellation and 15% for other classes. Scor's €248 million nonlife reinsurance bill came mainly from credit, surety and political risk and business interruption.

Having booked no life reinsurance claims in the first quarter, the four companies registered combined life claims and reserves of €850 million in the second quarter.

Further claims

The majority of the coronavirus claims hit booked to date comprises reserves for incurred but not reported, or IBNR, claims, rather than paid claims or case reserves. Swiss Re's earnings presentation showed that 72% of its $2.54 billion total was IBNR, for example.

Robert Mazzuoli, director of EMEA insurance at Fitch Ratings, said in an interview that there was "still a huge amount of uncertainty" about how much the big four reinsurers will have to pay out for the pandemic, noting that Swiss Re's expectation that its first-half provisions will cover the majority of its ultimate bill could indicate anything from 51% to almost everything.

Christian Badorff, senior analyst at Moody's, said in an interview that while those of the big four that Moody's rates "are following a conservative reserving approach," it is "very difficult to say whether what has been put aside in the first half of the year is going to be enough or not."

The trajectory of the virus will be a critical factor, Badorff said, adding that if there was another lockdown on the scale of those seen between March and June, "then we would of course possibly see additional claims from the lines of business that have already been hit."

Mazzuoli expects credit and surety claims, which are generally triggered by company insolvencies, "to trickle in later, quarter after quarter," because of governments' spending on keeping economies afloat during the crisis.

Business interruption remains a big source of uncertainty because of the various court battles about coverage. Swiss Re CFO John Dacey said on an earnings call July 31 that while the company's first-half business interruption provision could absorb unfavorable court decisions "up to a point", it may have to reevaluate reserves if judgments are "radically adverse to the industry."

Similarly, Hannover Re's nonlife reinsurance head, Sven Althoff, told analysts that if all the cases go against the insurance industry, the €240 million it has set aside for business interruption "would not be sufficient." He also noted that the provision assumes no retroactive changes to business interruption coverage in the U.S.

Mazzuoli said that although it is "hard to say" whether the industry has now accounted for the bulk of its coronavirus claims, "I would guess that substantial amounts ... of additional claims will have to be booked in the next two or three quarters at least," depending on what happens in winter.

Life's uncertainties

Many of the life reinsurance claims seen so far have related to U.S. mortality business — for example, between 80% and 90% of Munich Re's life claims were from the U.S. This is because coronavirus-related deaths have mainly fallen on older age groups, and, unlike many European countries, mortality cover is typically taken out on a whole-life basis in the U.S., rather than just up to retirement age.

A further issue is that there is typically a delay before reinsurers are notified about deaths and their causes, which could mean reinsurers have more coronavirus-related mortality claims than they think. Hannover Re's life reinsurance head, Klaus Miller, told analysts that as a result the company expected that claims "will be slightly higher in the second half of the year" than in the first half, and that the outcome depended on whether the U.S. "starts managing the pandemic or not."

Badorff said the Moody's view of the life business was that "there is also a significant area of uncertainty and that claims are likely to go up."