Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Feb, 2022

Buy-and-build deal volume in Europe will remain at the heightened level seen in 2021 if macro conditions continue as are, as private equity firms chase returns in a competitive market, industry sources told S&P Global Market Intelligence.

An active buy-and-build strategy was a key growth lever by prior private equity owners for approximately half of Baird's private equity transactions in 2021, more than double five years ago, according to data analyzed by the investment bank, said Vinay Ghai, managing director in Baird's financial sponsor group.

Firms have been growing their existing portfolio or "platform" companies by buying smaller businesses to add onto them as valuations have increased, a trend spurred by the growing number of buyout funds in the market raising larger vehicles with more buying power.

|

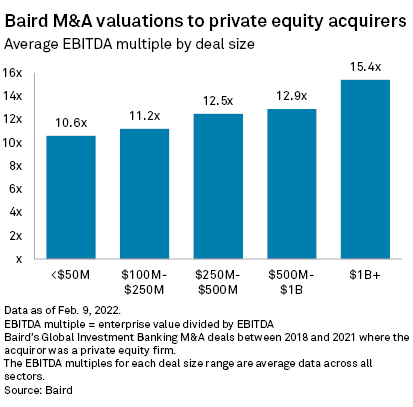

Valuation growth is particularly pertinent at the top of the market; average EBITDA multiples for companies with deal sizes over $1 billion where the acquirer was a private equity firm sit at 15.4x compared with an average of 10.6x for companies with a deal size of under $50 million, according to data from 2018 through to 2021 from investment bank Baird.

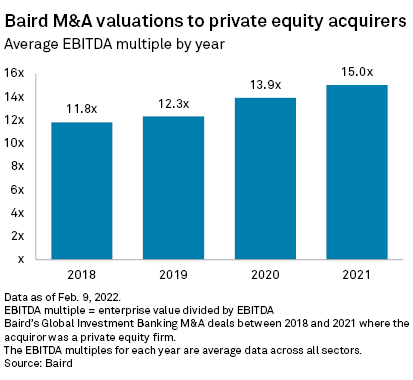

In 2021, the average EBITDA multiple for all Baird deals bought by private equity acquirers was 15.0x, up from an average 11.8x in 2018.

|

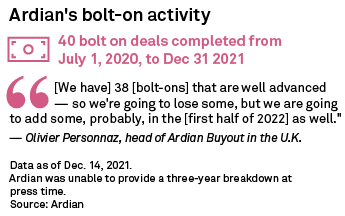

Private equity firms use bolt-on acquisitions to grow companies in many ways — they can give access to new geographies or an adjacent product or service. They can secure critical raw materials, strengthen distribution of core products, or introduce environmentally friendly practices, Olivier Personnaz, Head of Ardian Buyout in the U.K. said. Bolt-ons can also address consumer demand for a one-stop-shop, Ghai said.

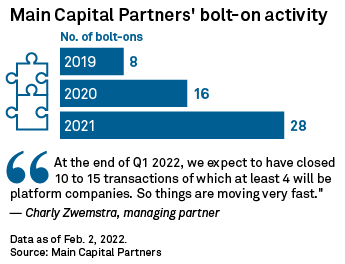

Software-focused Main Capital Partners BV, which has an active buy-and-build strategy, has reaped the benefit of swelling valuations. Its platform companies have attracted interest from publicly listed large strategic buyers alongside the portfolio companies of large name private equity houses, Managing Partner Charly Zwemstra said.

Sofon BV was sold to TA Associates Management LP's Revalize Inc. in 2021, The Patient Safety Company to was acquired by symplr backed by Clearlake Capital Group LP and SkyKnight Capital LP in 2020, and it sold Roxit Holding B.V. to HgCapital LLP's Visma AS in 2019.

Bolt-on deal volume has also been stoked by the growing pool of targets, managers said. Initially spurred on by COVID-19 lockdowns, rising interest rates and supply chain issues are now among the attractions of joining a larger platform for businesses considering selling. Elevated valuations are also at play here — management teams that were not planning to sell see now as a good time to do so, Personnaz said.

Most deals have an M&A story for the new private equity acquirer, Ghai said.

Building out

|

The approach to these deals has evolved. Private equity firms, which previously sought more mature platforms to scale, are increasingly attracted to smaller businesses, particularly for businesses in technology or technology-enabled services, Ghai said.

The strategy has also become "much more institutionalized," Ghai added. In the past it was ad-hoc, but there is now an industry around private equity M&A and integration. Private equity firms and their portfolio companies are able to tap specialized consultants in technology, pricing and data to enhance the business through data mining. Larger platforms are increasingly building M&A functions within their portfolio companies and there are also boutiques focused on finding bolt-on deals, he added.

|

European buyout house Ardian works to build internal M&A teams in its portfolio companies. Around half of the portfolio companies Ardian acquires already have an internal M&A team. In these cases, it helps source deals through its own global network where the private equity firm may have "more density," and will also help with the "heavy lifting" when it comes to execution where there may be need for additional equity or debt, Personnaz said.

For those without, Ardian will take on this role before staffing an internal M&A team so the company becomes independent when the private equity firm eventually sells the business.

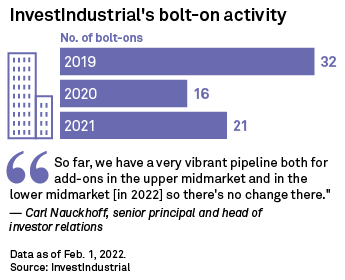

Buy-and-build is central to Investindustrial's lower mid-market value creation strategy. Its investment team works alongside its portfolio companies' management teams to source bolt-on opportunities, Roberto Ardagna, managing principle and head of InvestIndustrial's lower mid-market program, said.

It invests in lower mid-market businesses with the goal of helping them to become larger, more international, more diversified businesses.

|

It typically targets businesses where management teams are split — founders may want to move on while others want to enlarge the business. These businesses "do not have the opportunity to grow … because their shareholder structure is not fit for the challenges and the opportunities that this global world offers," without investment from a private equity firm.

For Main Capital Partners, data analysis is at the forefront of its bolt-on strategy. Ahead of any deal to secure a portfolio company, the firm analyzes the target's peers and the product market across borders in its due diligence. The firm gets to know these competitors, so it can demonstrate to the management team of the original target which combinations it could pursue in the future, and in which order, Zwemstra said.

"That's, of course, an excellent way to win a deal," Zwemstra added. For the firm, it already has "a very clear picture on what would be the natural targets for bolt-ons" before it makes an investment.