Europe's investment banks have been fighting an uphill battle to remain competitive against U.S. peers on global markets, and it is unlikely any will become a dominant global player, according to analysts and industry experts.

The European companies have been gradually losing market share, while the U.S. banks boast scale and diversification.

"We have to acknowledge the fact that the battle for global investment banking has been lost and I don't think there is any point in hoping there will be some sort of European champion," Andrea Vismara, CEO of Italian investment bank Equita Group SpA, said in an interview.

American supremacy

U.S. banks have the benefit of deep and well-developed capital markets at home, where none of the European players have ever been able to really "make it," according to Vismara. Deutsche Bank AG has tried unsuccessfully, and currently only U.K.-based Barclays PLC is doing well in the U.S., he said.

In contrast, large U.S. groups have been gradually taking away domestic market share from European investment banks and have come to dominate significant parts of the investment banking industry in Europe, according to a report published by Equita and Italy-based Bocconi University earlier this year.

Since 2016, the largest global U.S. investment banks, including JPMorgan Chase & Co., Goldman Sachs Group Inc., Morgan Stanley, Citigroup Inc. and Bank of America Corp., have accounted for more than half of total investment banking revenues in the EMEA region, according to a Sept. 28 report from S&P Global Ratings, which cited data from Coalition, an S&P Global research company.

In 2019, the U.S. banks held 53% of the revenue pool, while the leading European groups, including Barclays, BNP Paribas SA, Credit Suisse Group AG, Deutsche Bank, HSBC Holdings PLC, Société Générale SA and UBS Group AG, held 47%, according to the data. Furthermore in the first half of 2020, despite the boom in trading volumes triggered by COVID-19, European banks' revenues accounted for only 42% of the pool versus 58% for the U.S. banks.

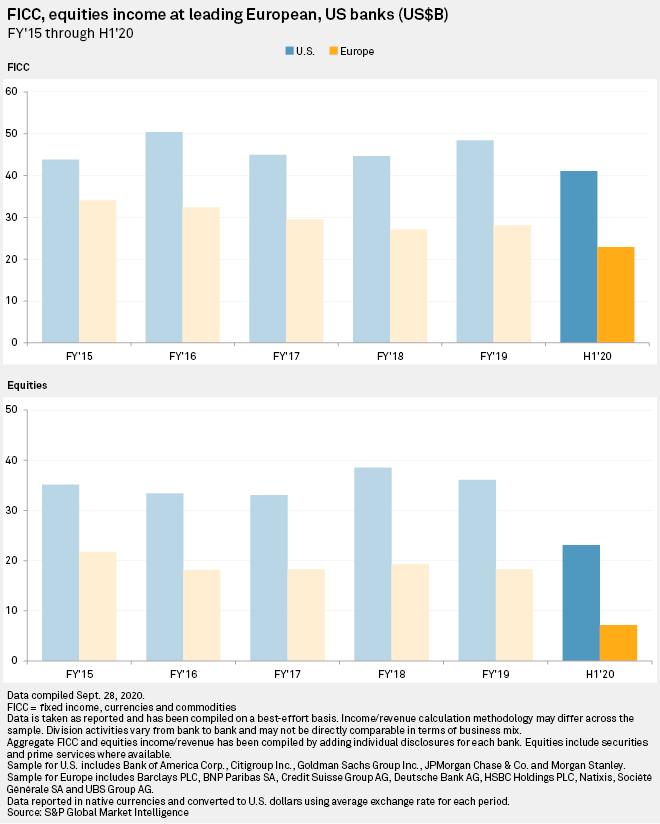

In the past 5.5 years, European investment banks have consistently generated a lower level of trading revenues and profits than U.S. peers, with many also booking higher costs, S&P Global Market Intelligence data shows.

"Given economies of scale in investment banking, S&P Global Ratings believes that the U.S. 'bulge bracket' firms are well placed to gain further market share," Ratings said. If the big European banks "struggle to meet earnings targets in the next two to three years, they may downsize further or possibly consider structural changes such as partnerships and mergers."

At this juncture, the question for European banks is more about how to keep their investment banking units profitable and remain relevant at home. Seeking to regain global dominance is a lost cause because any European champion would not have a big enough presence in the U.S. and Asia "to be a real global champion," Vismara said.

Very few European banks will have the scale to compete globally in the future, Stéphane Le Priol, head of public fixed income at Axa SA, told S&P Global's Banking Horizons Europe 2020 conference on Oct. 1.

"Most of [them] will have to focus their strategy on a specific set of products, specific client base and specific region," he said.

I-banking fit for Europe

But specialization in profitable segments or more consolidation among large European investment banks will not address a key issue — the underserving of small European businesses in need of equity and debt financing, Vismara and Bocconi University associate professor Stefano Gatti said. In recent years, big European banks have gradually downsized their investment banking units as they struggled to boost profits while many smaller investment banking services providers have disappeared from the market.

European regulators have recently made steps to ease cross-border consolidation, Gatti, an associate professor of the finance department at Bocconi and one of the authors of the report, said in an interview.

If some big European banks do merge, they will be able to compete with large American banks and serve international clients — in other words, get more big-ticket deals, he said. But this would still leave the problem of providing capital markets services to small and medium-sized enterprises unresolved.

Either large European banks ensure the provision of capital market services for SMEs, or a new breed of specialized financial institutions — independent boutiques or small commercial banks — will emerge to pick up that SME business, Gatti said.

Policymakers must help

SMEs are the backbone of the European economy but in a more concentrated market where all profitable business is in the hands of large U.S. banks, these companies may not get full access to market funding, Vismara said.

Large U.S. investment banks may not have a big incentive to run research on European SMEs or back IPOs or bond originations of €50 million for them, because this is mostly unprofitable, he said.

Their growing market share in Europe could be a potential vulnerability of the region's real economy if they "[prioritize] their home markets in a stress scenario and [reduce] their commitment to Europe, with insufficient time for local firms to fill the gap," S&P Global Ratings said.

During the worst weeks of the pandemic in early 2020, the only area where European banks continued to dominate was lending, with statistics showing most of the loans went to European companies, Vismara said.

However, lending is the least profitable of the investment banking activities and carries the most risks, and European banks cannot lead in only that segment if they want to remain competitive, he said. European investment banking has to be treated as critical infrastructure by regulators and policymakers, according to Vismara.

There is a need for rules and policies that make investment banking for small investors and SMEs worthwhile, not only for big banks but also for the whole ecosystem of lenders, brokers and smaller boutique players in Europe, Vismara said.