Europe's non-life insurers are likely to be pressured in 2022 after posting better-than-expected performances during the height of the COVID-19 pandemic.

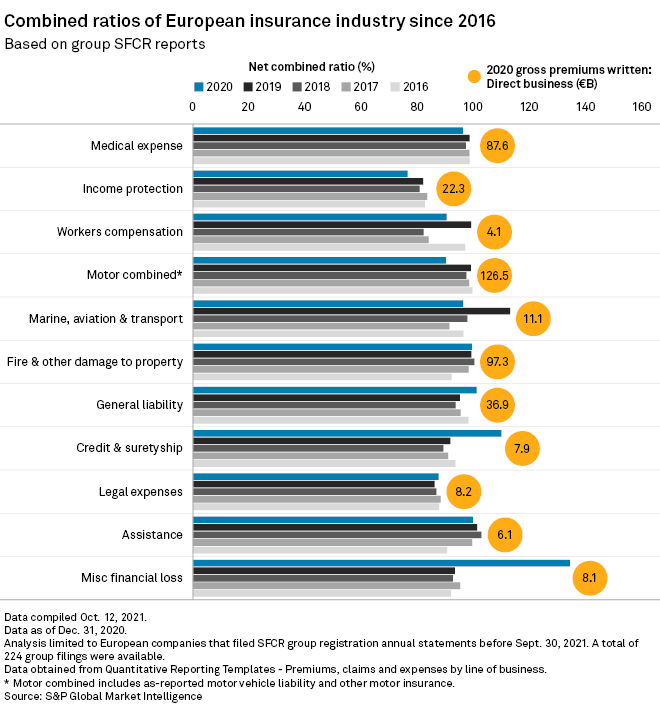

Despite facing an economic slowdown and pandemic-related claims, European insurers' 2020 underwriting results beat those seen in 2019. The industry's combined ratio, which measures non-life underwriting profitability, was 96.1% in 2020, an S&P Global Market Intelligence analysis of 224 insurers shows. That marked an improvement of 1.2 percentage points from the 97.3% reported in 2019. In addition, 16 of the top 20 insurers reported lower combined ratios in 2020 than the previous year.

Cordoned-off café seating in Milan during the COVID-19 lockdown in 2020

Cordoned-off café seating in Milan during the COVID-19 lockdown in 2020

"The industry had a better year than it was expecting and ... certainly a better year than anyone would have predicted on the way in," said Simon Burtwell, Ernst & Young's Europe, Middle East, India and Africa and U.K. financial services consulting insurance leader.

Pandemic benefits

COVID-19-related non-life claims stemmed mainly from event cancellation and non-damage business interruption covers. While overall results were better, certain lines of business performed far worse in 2020 than they had a year earlier.

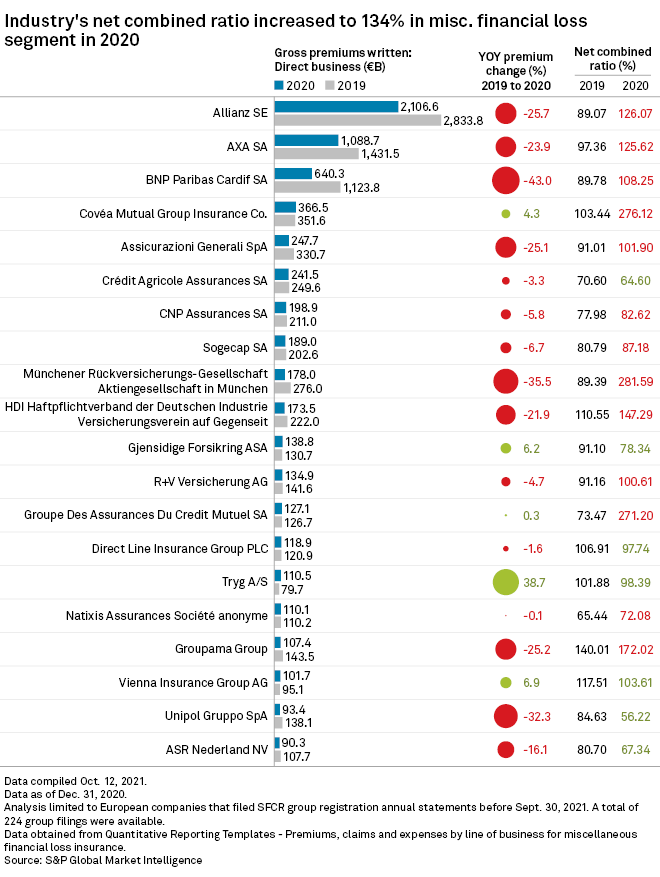

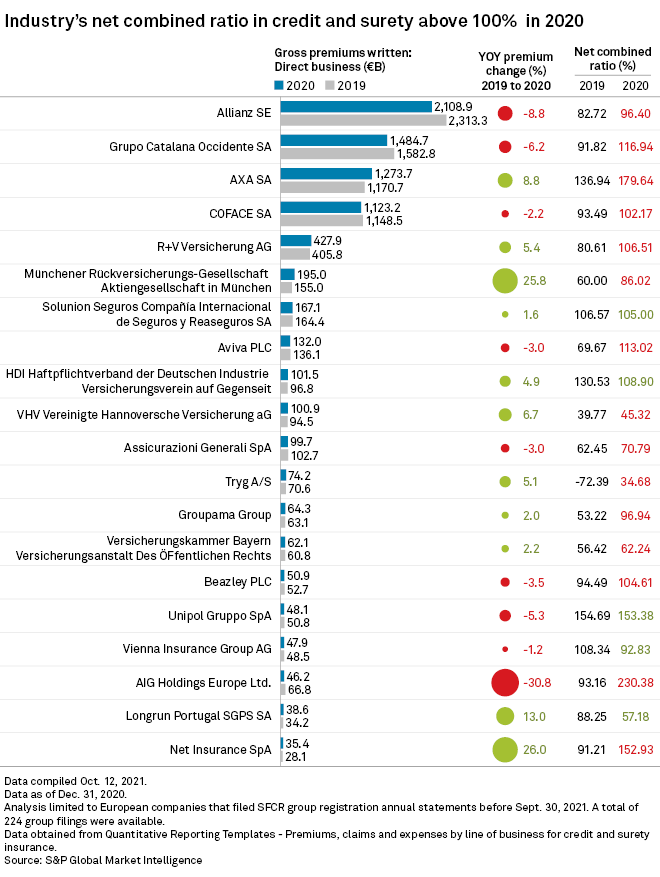

Miscellaneous financial loss fared worst, slipping to an unprofitable 133.9% combined ratio in 2021 from a profitable 93% in 2019. The credit and surety business saw its combined ratio deteriorate year over year to 109.5% from 91.5%. The ratios for both lines were far higher than in the previous four years.

But those lines are relatively small, each accounting for less than 2% of the €416 billion gross written premiums in this analysis. Also, while COVID-19-related non-damage business interruption claims figured heavily in the U.K., German and French markets, they failed to show up others.

Business interruption was "no topic at all" in Italy, for example, said Robert Mazzuoli, director of EMEA insurance at Fitch Ratings. Further, a significant chunk of primary insurers' business interruption claims bills were ceded to reinsurers, according to Benjamin Serra, a senior vice president at Moody's.

Improved performance in larger lines appears to have offset negative results elsewhere. Motor, which accounts for 30% of the premiums studied, saw an 8.9-point improvement in its combined ratio. Insurers enjoyed a COVID-19-induced reduction in motor claims frequency as people drove far less under restrictions aimed at curbing the spread of the virus.

Non-life insurers may see more positive results for full year 2021. Analysts originally expected 2021 to be tougher as lower prices for coverage in personal lines, triggered by reduced frequency in 2020, coincided with a return to more normal claims trends this year.

However, as lockdowns were reinstated in the early part of 2021 in many European countries, "sub-normal" frequency levels continued, Serra said in an interview, making this year likely to be a good one for property and casualty companies.

Natural catastrophes in some countries, most notably severe flooding in mid-July in Germany and neighboring countries, could dampen results for insurers exposed to those markets. But for insurers focused on other regions, such as the relatively unaffected France, there should be positive results, according to Serra.

Delayed reaction

The challenging conditions analysts expected in 2021 look more likely to emerge in 2022. Along with a return of claims frequencies to more normal levels, the cost of claims is rising for several reasons, including pandemic-induced difficulties in sourcing materials and labor for repairs and a more general rise in inflation.

"We can see inflationary pressures coming almost from everywhere," Mohammad Khan, general insurance leader at PwC in the U.K., said in an interview. As a result, 2022 and 2023 "will be a lot more challenging for the industry, whether it is commercial, personal or specialty."

Personal lines could bear the brunt of the claims trends. While prices in commercial and specialty lines are expected to continue rising ahead of claims inflation, personal lines rates are lagging. Heavy competition and government and regulatory scrutiny of personal lines insurance rates are limiting insurers' ability to raise prices, Serra said, meaning that "pricing adequacy is going to be the main challenge of 2022."

With the Jan. 1, 2022, reinsurance renewals approaching, insurers and reinsurers are still wrangling over whether, and to what extent, reinsurance will cover COVID-19-related business interruption claims. And as the support governments provided to economies during the pandemic unwinds, there could be "recessionary-type impacts" that were predicted but never came to pass in 2020, said David Staunton, partner, financial services consulting at Ernst & Young.

If such a "delayed recession" starts to bite, Burtwell said, "then we could be in for a few dark years."