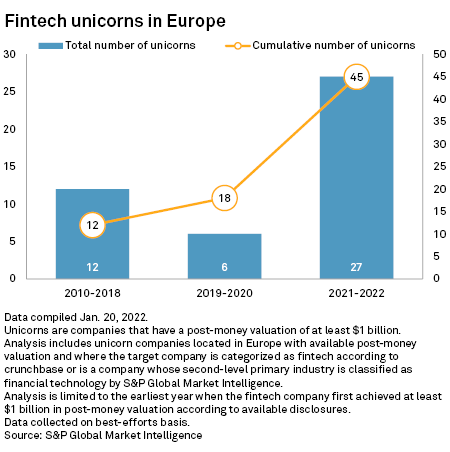

The number of European financial technology unicorns more than doubled in 2021, S&P Global Market Intelligence data shows.

A total of 26 European fintech unicorns — companies that have a post-money valuation of $1 billion or more — were created in 2021. Europe was home to 45 fintech unicorns as of Jan. 20 after French business banking startup Qonto joined the ranks earlier in the month.

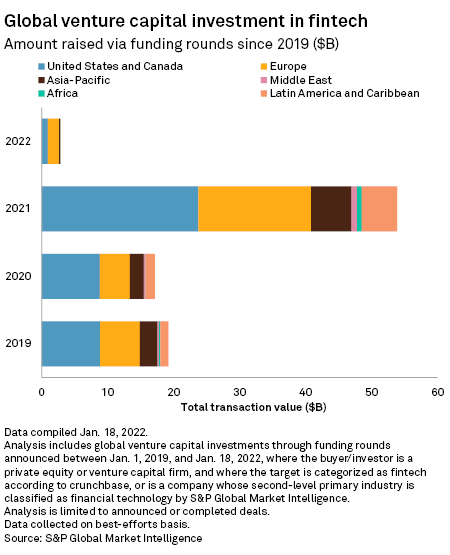

Venture capitalists pumped $17.1 billion into the continent's fintech sector in 2021 as digitalization reached unprecedented levels amid the pandemic. More money was invested in the European fintech sector by venture capital firms in 2021 than in the previous two years combined.

Global venture capital investment in the fintech sector more than tripled year over year to $53.9 billion in 2021 from $17.2 billion, the data shows.

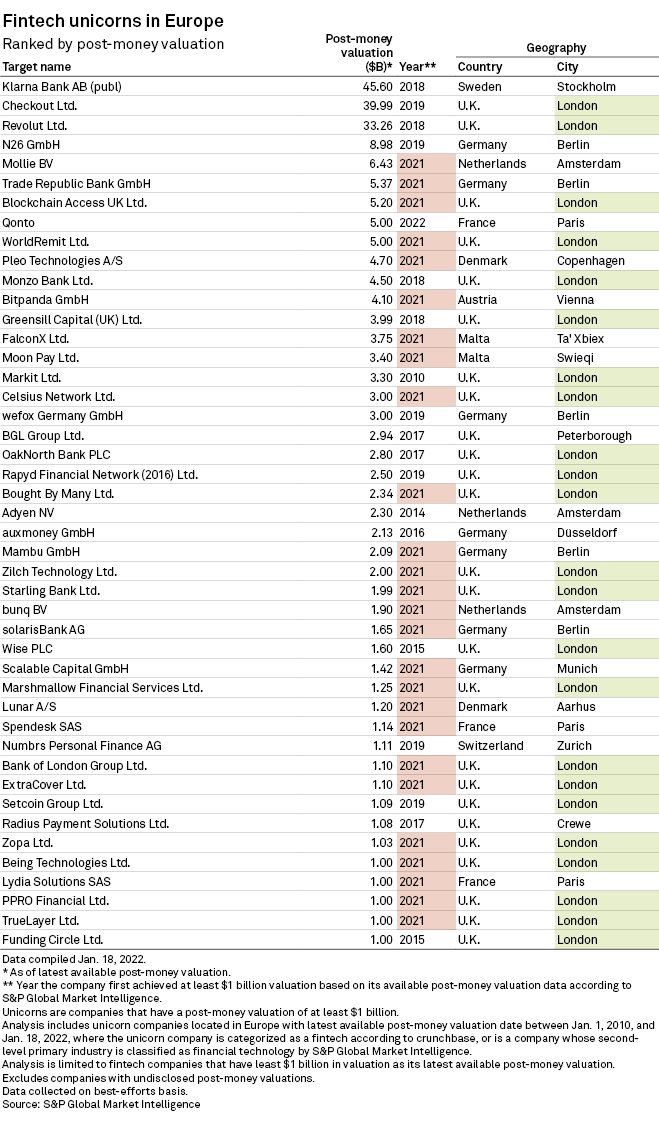

Swedish buy-now, pay-later firm Klarna Bank AB (publ) is the most valuable fintech unicorn on the continent with a post-money valuation of $45.60 billion, which it achieved in 2018. U.K.-based Checkout Ltd. and Revolut Ltd. are the next most valuable at $39.99 billion and $33.26 billion, respectively.

The U.K. is home to more than half of Europe's fintech unicorns, with 23 such businesses based in London and two elsewhere in the country. Germany has seven fintech unicorns, the second most in Europe.