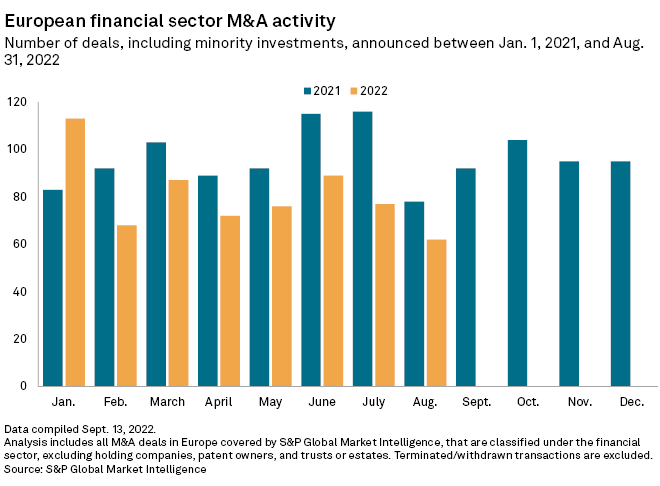

The number of mergers and acquisitions involving European financial institutions hit a year-to-date low in August, underscoring a global slump in dealmaking in 2022.

In a year characterized by an economic slowdown, an energy crisis and rising rates amid runaway inflation, just 62 deals were reached in the sector in August. This is the lowest figure since the beginning of 2022, according to S&P Global Market Intelligence data.

August also marked the second consecutive monthly volume decline, after 89 and 77 deals in June and July, respectively.

The volume of monthly deals peaked in January, when 113 deals were signed.

The cost of financing has risen as central banks tighten monetary policies in the face of record-high inflation across much of Europe, making it more expensive to fund deals. Many companies, particularly those in the tech space, have suffered from severe declines in valuation.

Notable deals in August include troubled Italian lender Banca Monte dei Paschi di Siena SpA's disposal of problem loans through three transactions, U.K. insurer Phoenix Group Holdings PLC's £248 million acquisition of Sun Life Assurance Co. of Canada (U.K.) Ltd. from Sun Life Financial Inc. and Kenyan bank Fidelity Bank PLC's purchase of the U.K. unit of domestic peer Union Bank of Nigeria PLC.

Sanctions-hit Sberbank of Russia also disposed of its Kazakhstan-based SB JSC Sberbank during the month.

UK slump

As in previous months, U.K.-headquartered companies were involved the most in financials M&A in August, at 32. This was far ahead of Germany and Denmark, which had four deals each.

While higher than the 25 deals in July, U.K. M&A activity more broadly has been slumping. Including other sectors, the volume of deals by companies in the country declined to 333 in the second quarter from 449 in the same period in 2021, according to the U.K's statistics authority.

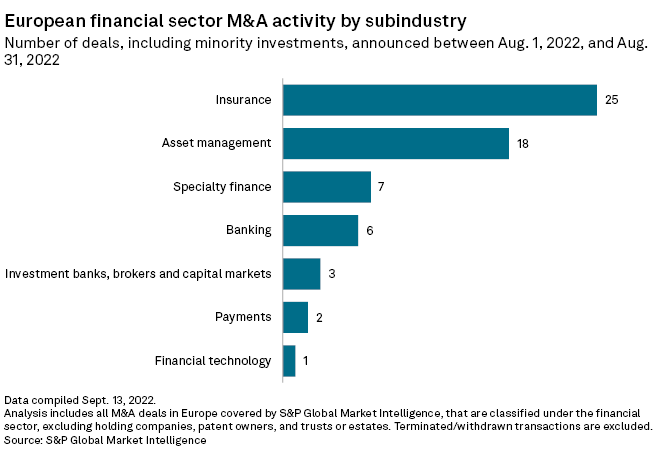

Insurance deals, meanwhile, declined to 25 in August from 27 in July. Yet that subindustry still had the highest number of deals, with the asset management sector in second place with 18.