Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Nov, 2021

By Mary Christine Joy and Cheska Lozano

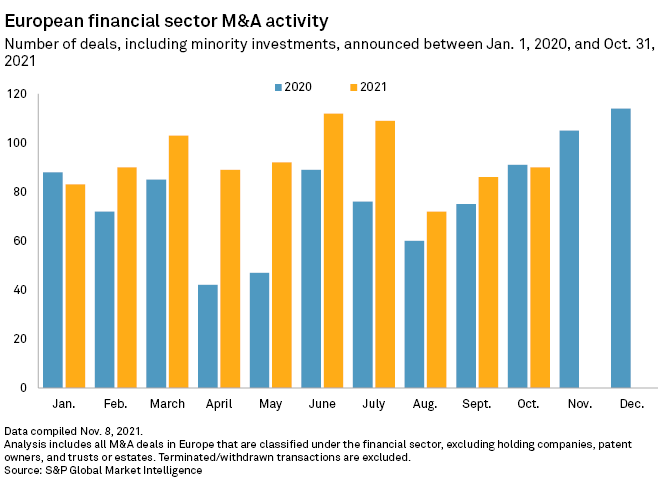

European M&A activity in the financial services sector edged downward in October, the first year-over-year decline since January, according to data from S&P Global Market Intelligence.

There were 89 deals announced in October, compared to 91 a year ago. The 2.25% decline follows a 10.7% year-over-year rise in deal-making activity in September.

British insurance broker A-Plan Group Ltd.'s proposed acquisition of Aston Lark Ltd. from The Goldman Sachs Group Inc. for €1.30 billion was the largest deal of the month, followed by U.S. private equity firm Silver Lake Management LLC's €709 million purchase of Intercontinental Exchange Inc.'s 9.85% stake in Belgium-based Euroclear Holding SA/NV.

AIB Group PLC's sale of a portfolio of nonperforming loans in long-term default to Mars Capital Finance Ireland DAC for a consideration of about €400 million was also among the largest deals in October. The Irish bank's pro forma nonperforming exposure ratio will fall to less than 6% from 6.5% following completion of the transaction.

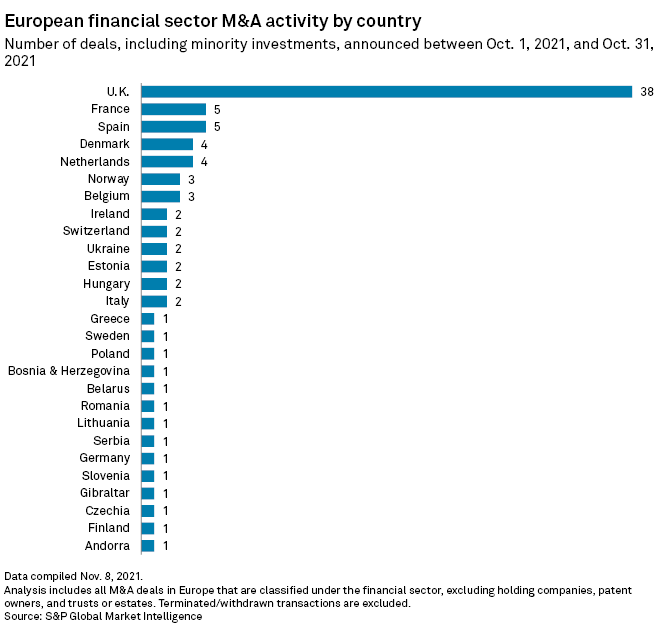

The U.K. remained the most active geography, having reported 38 deals during the month. France and Spain followed with five and four deals, respectively.

The U.K. was also notable for the collapse of two potential transactions. The Co-operative Bank PLC's approach to buy TSB Banking Group PLC was rejected by Banco de Sabadell SA as the Spanish lender's management team ruled out a sale in the near term. Retailer J Sainsbury PLC opted to end talks to sell its Sainsbury's Bank PLC unit, stating that the interest it had received would not offer better value for shareholders than retaining the bank.

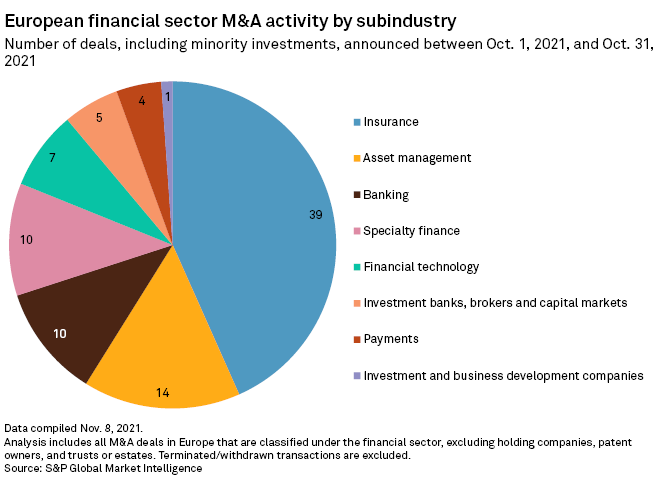

The insurance segment reported the highest number of deals among the subsectors in the industry.