Natural gas buyers will pay a "fear premium" in the U.S. at the start of winter, industry experts said.

Concerns that Europe will run short of gas in 2023 as Russia cuts off supply will likely drive the U.S. benchmark Henry Hub gas price higher as Europe and Asia compete for a limited number of spot liquefied natural gas cargoes from America, the experts said.

"The increasing reliance on LNG means that Europe's gas problems are the world's gas problems," RBN Energy analyst Lindsay Schneider told clients Sept. 21. "The U.S., which is facing a tight domestic market of its own, will likely face some continued upward pressure."

Europe has been buying U.S. LNG cargoes and using that gas to fill its storage for winter. While most members of the European community reported achieving a goal of having 80% of their anticipated winter gas needs in storage by Oct. 1, traders worry that a colder-than-expected winter could exhaust Europe's supplies early and renew upward pressure on gas prices around the world.

The question of Europe's LNG requirements has joined the usual list of winter worries, Rystad Energy Vice President Emily McClain said in a note. "The risk of extraordinary events, including a hurricane or winter freeze, [is] not off the table, increasing market nervousness as we head into the winter."

European prices ease as storage fills

The early storage fills in Europe have eased the pressure on the Henry Hub futures contract for the moment, Robert Yawger, Mizuho Securities USA managing director and energy futures strategist, said in an email. "NYMEX traded lower on expectations that the EU would not need to pull U.S. LNG as actively as expected."

"The natural gas curve started to come under pressure when France, Germany and Italy all publicly announced that they had reached their storage objectives sooner than anticipated," Yawger said. "The crisis seems to have passed — for the moment."

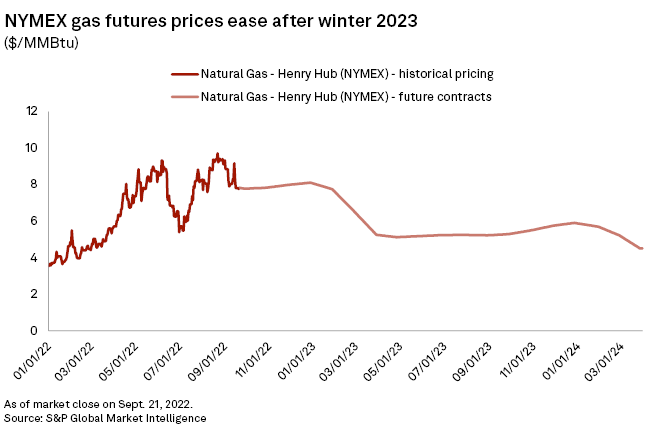

Gas futures values drop by one-third at winter's end

Futures traders said any crisis should end by spring 2023, as the NYMEX contract loses more than a third of its value between winter's peak in January 2023 and the start of the spring injection season in April 2023.

"Honestly, we've been scratching our heads about the shape of the NYMEX curve as well because it is a massive dip," David Meats, director of research for energy and utilities at Morningstar Research Services, said in an email. While some observers forecast that U.S. gas production will increase to more than 100 Bcf in 2023 — a record amount — Meats was skeptical that new U.S. gas could fill the gap.

"Inventories are still at the low end of the range seasonally, and there are still infrastructure constraints limiting a supply response in the key basins (Marcellus, etc.)," Meats wrote.

Meats said the price curve was typical for winter, just at much higher prices than over the past decade.

US production could ease winter imbalance

High U.S. gas production and reduced U.S. gas demand will close the gap between supply and demand this winter and reduce the pressure on prices, American Gas Association Vice President of Energy Markets, Analysis and Standards Richard Meyer said.

Presenting AGA's winter outlook Sept. 22, the gas utility trade group's senior director for energy analysis, Juan Alvarado, said LNG demand will not be the whole story for U.S. prices this winter. "I think a lot of people have talked about LNG as a source of pressure on prices, and I don't think that they're entirely wrong," Alvarado said. But "weather and the economy have a lot more to do with it than LNG."

"Natural gas demand increased 4.3 Bcf/d this year," Alvarado said. Production is catching up, but "it is not as high up as natural gas demand. There is a lag in production compared to the increasing demand. And obviously, for those of you who took Econ 101 ... that's going to have an effect on prices."

The AGA outlook relied on U.S. Energy Information Administration forecasts, which showed a 1-Bcf/d gap between supply and demand in 2022, shifting to a 900,000-MMcf/d surplus of gas in 2023 as demand declines.

"U.S. natural gas demand is higher [in 2022], and it is higher principally because of economic growth and factors relating to weather," Meyer said. "It was a very cold kind of end of the winter into April, and then it flipped very quickly to be a very hot summer. Natural gas exports are quite high, but they are not the principal factor here."

Goldman Sachs oil and gas analyst Samantha Dart pointed to U.S. production bringing price relief. "U.S. natural gas production growth, which started to pick up more significantly since late July, is likely to continue into 2023, while at the same time, the U.S. is not adding any significant LNG export capacity," Dart said in an email. "This sets the stage for a much better-supplied balance in 2023 versus this year, which is why you see the significant price spread between the front of the curve (into peak winter) and next year."

Nearly all of the U.S. big oil and gas producers have pledged to restrain spending and stick to low-growth drilling plans, so privately backed drillers not facing investor pressure to keep costs down are expected to provide the increased volumes of natural gas in 2023.

Pricing still connected with Europe

Jonathan Snyder, vice president of intelligence for energy consulting firm Enverus, said futures traders will still be keeping an eye on LNG and the spread between European pricing points, such as the Dutch TTF, and the Henry Hub. The Europeans have demonstrated in 2022 that they are willing to pay high prices to replace Russian pipeline gas.

"I think traders or gas buyers are thinking that there is the risk that the LNG [arbitrage] (TTF minus Henry Hub) will need to be closed in the event of a very cold start to winter," Snyder wrote in an email. "You have more people willing to lock in higher prices to prevent the catastrophic loss" if European prices spike higher, particularly since how much Europe will pay for gas is still a mystery. "Nobody really knows what this level is as global gas markets will certainly respond with higher prices."

"The way this will shake out is probably in the cash market with domestic gas buyers being willing to pay a hefty price to keep gas supplies at home," Snyder wrote.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.