Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Dec, 2022

By Vanya Damyanova and Rehan Ahmad

European banks' importance within the global financial system has waned over recent years following a period of widespread retrenchment and restructuring in the wake of the 2008 crisis, the latest regulatory data shows.

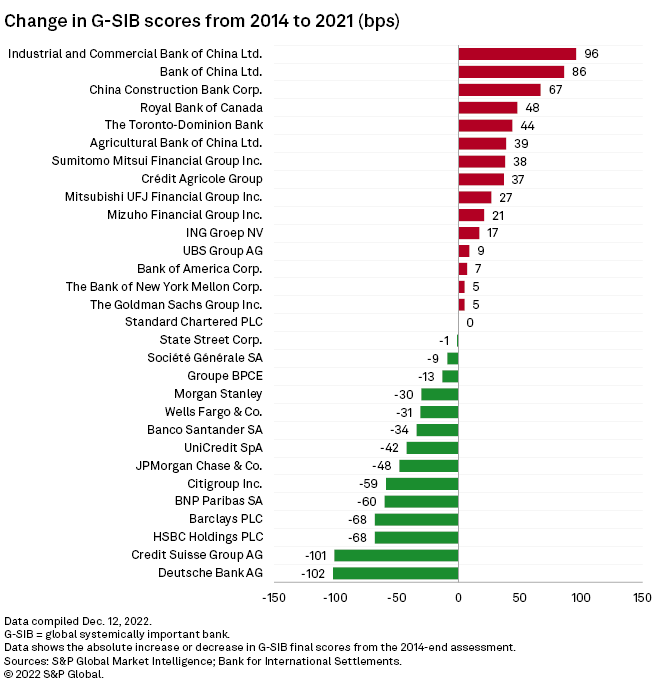

Of the 14 global systemically important banks, or G-SIBs, whose systemic scores fell between 2014 and 2021, nine were headquartered in Europe. The scores, provided by the Basel Committee on Banking Supervision, or BCBS, were introduced to track the risks posed by so-called "too-big-to-fail" banks to the wider financial system.

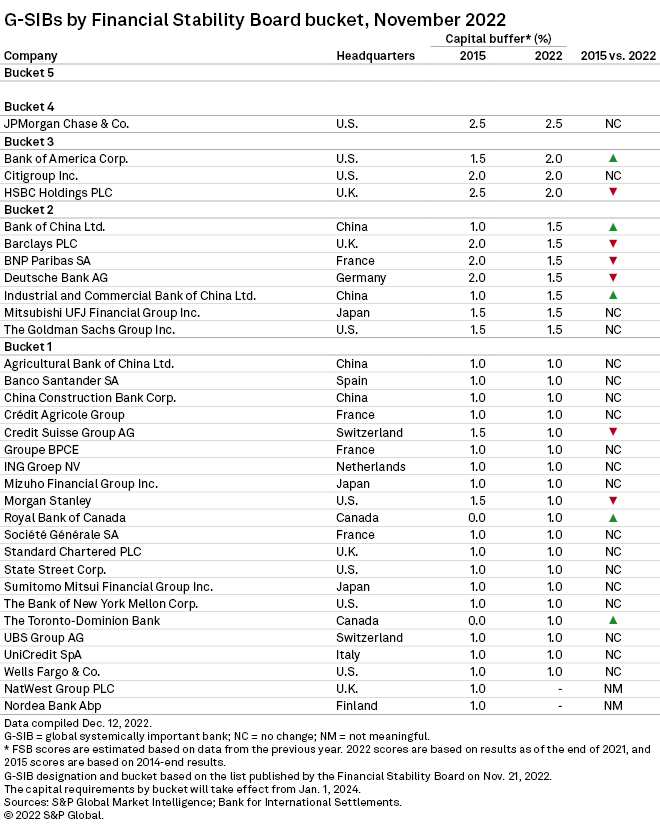

G-SIB scores are determined by assessing large globally active banks in five equally weighted categories: size, interconnectedness, substitutability, complexity and cross-border activity. Final scores, measured in basis points, put banks in buckets that determine their G-SIB surcharge — the additional capital they must hold because of their systemic importance.

Deutsche Bank AG, Credit Suisse Group AG, HSBC Holdings PLC, BNP Paribas SA, UniCredit SpA, Banco Santander SA, Groupe BPCE and Société Générale SA all have reduced systemic scores, with Credit Suisse and Deutsche Bank booking a decline of over 100 basis points.

U.K.-based Standard Chartered PLC was the only bank whose score remained stable, while the scores of Swiss bank UBS Group AG, Netherlands-based ING Groep NV and French bank Crédit Agricole Group increased over the period.

The drop in the G-SIB scores for most European banks means that some now fall into lower buckets than they did in 2014 and their G-SIB surcharge is lower than before.

Five out of the six G-SIBs that dropped to a lower capital requirement bucket between 2014 and 2021 are Europe-based, the BCBS data shows.

HSBC Holdings and Barclays moved to a lower bucket in 2016 after cutting billions in risk-weighted assets and off-loading parts of their global operations.

Deutsche Bank dropped down in 2019 as the group reduced its capital market exposure through a large-scale restructuring that is still ongoing.

Credit Suisse and BNP Paribas fell to a lower bucket in 2017 amid efforts to de-risk and reduce complexity across their franchises. BNP Paribas climbed back to bucket 3 in 2021 as it took on more international business during the pandemic, but fell back in 2022 due to BCBS methodology adjustments to account for market integration in the European Union.

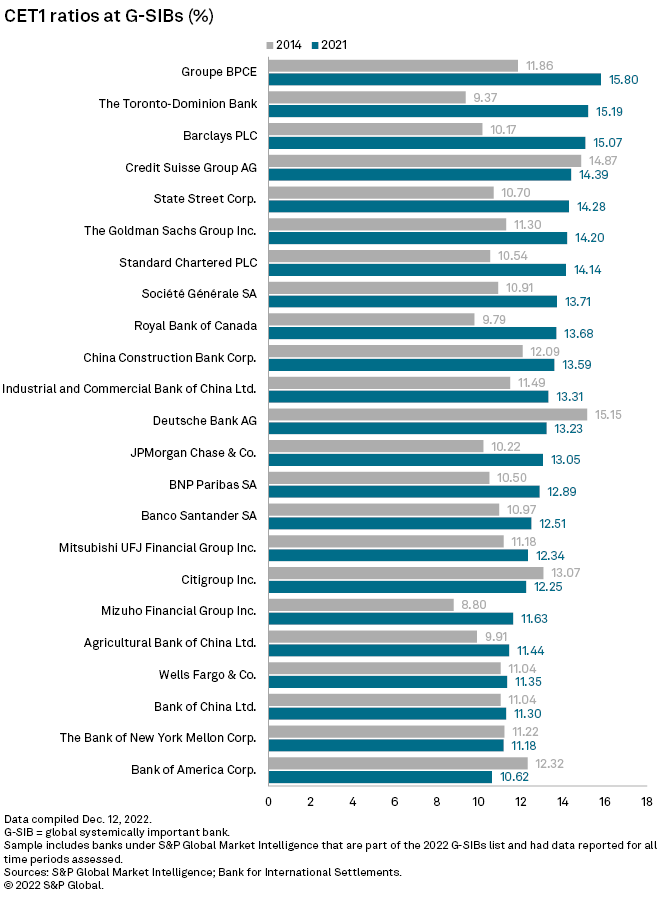

While their G-SIB surcharges fell, most European banks built up their CET1 ratios — a key measure for capitalization and ability to withstand systemic shocks. Apart from Deutsche Bank and Credit Suisse, which have suffered major financial losses and have been undergoing a series of restructurings, all banks raised their CET1 ratios by at least 150 basis points since 2014, S&P Global Market Intelligence data shows.

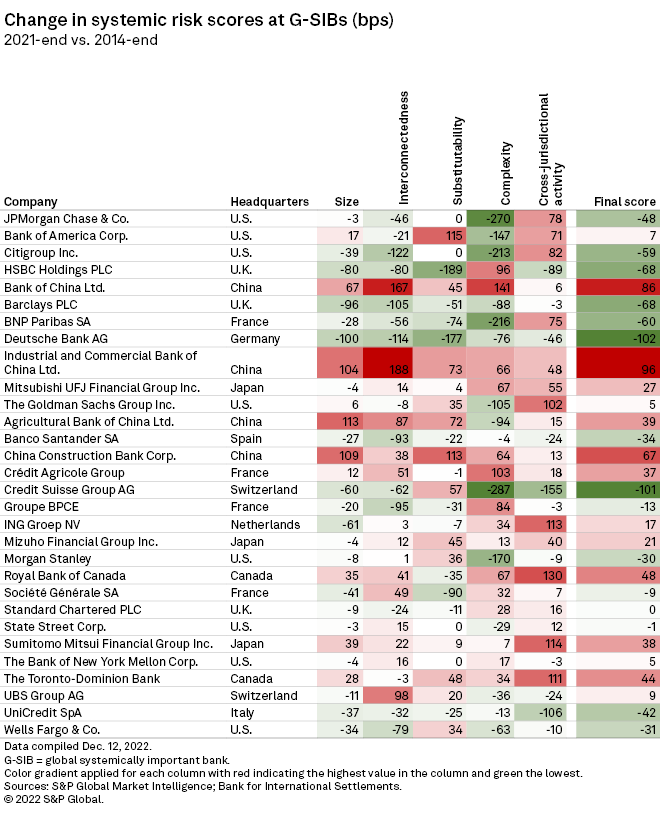

All European institutions bar Crédit Agricole shrunk in size between 2014 and 2021. Eleven out of the 13 European banks also shrunk in terms of substitutability, which measures the banks' payments and underwriting activity, fixed income and equity trading volumes, as well as assets under custody.

The only two to gain in substitutability were Credit Suisse and UBS, which both got a bump in that category in the latest list to feature the new risk metric — fixed income and equity trading volumes — for the first time.

The new risk metric is expected to prompt a reduction in the systemic scores of Chinese banks. While their size and G-SIB scores have grown rapidly since 2014, Chinese banks' fixed income and equity trading volumes remain well below those of their U.S. peers, Market Intelligence has estimated.

Nine out of the 13 European G-SIBs have recorded a reduction in interconnectedness, which measures intra-financial system assets and liabilities alongside outstanding securities. Eight of the banks have shrunk in terms of cross-jurisdictional activity and seven have become less complex.

Most big European banks slashed their global footprint and prioritized core markets as they curbed their risk appetite after the crisis. Several groups, including Deutsche Bank, Credit Suisse and HSBC, are undergoing major restructurings and continue their withdrawal from international markets.