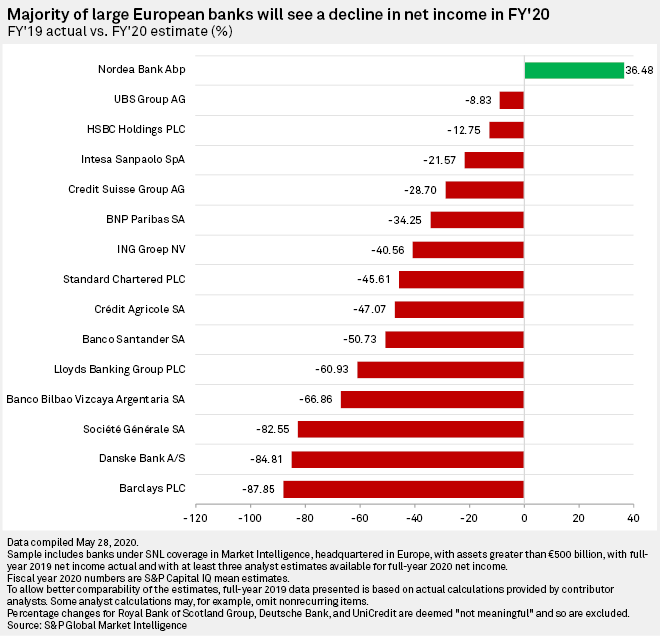

Most large European banks are set to see a decline in net income for full year 2020, with some expected to record a fall of nearly 90% year over year and others likely to swing to a loss, according to research from S&P Global Market Intelligence.

Analyst estimates show that only Finland-based Nordea Bank Abp will see an improvement, with a near 37% year-over-year rise in net income, while U.K. banks including Barclays PLC are set to be among the worst performers. The sample includes banks with assets greater than €500 billion for which at least three analyst estimates were available.

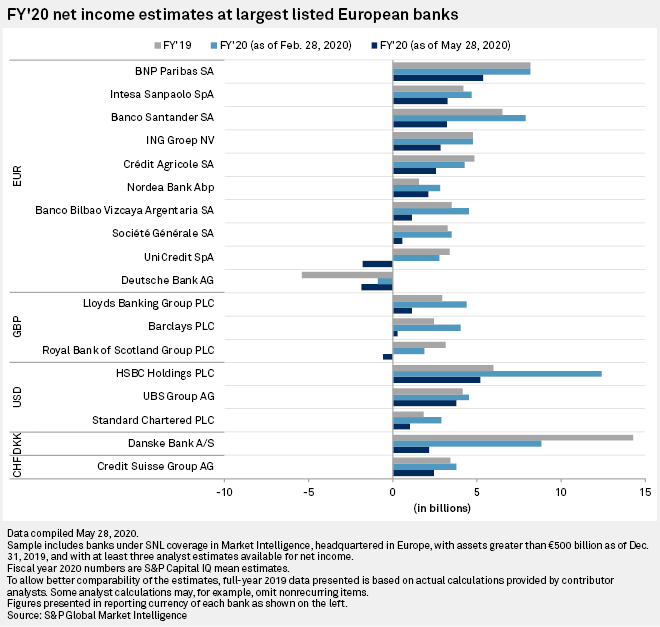

The estimates have been revised down significantly in light of the coronavirus crisis. In February, before the full effect of the pandemic was felt across Europe, estimates for 2020 net income were mostly ahead of 2019 results.

But by the end of May, when COVID-19 had ravaged economies across Europe, the estimates had been sharply cut in every case.

UK banks hit hard

In early May the Bank of England said British lenders could lose £80 billion after it forecast a 14% drop in the U.K.'s annual economic output for 2020.

The central bank said banks would have to draw on 45% of the capital buffers they have available above minimum capital requirements, while the average common equity Tier 1 capital ratio for the sector would fall to 11% from 14.8%.

Reporting first-quarter results in May, major British banks significantly increased their loan loss provisions to more than £7.5 billion, nearly 6x the sum set aside in the same period last year.

But an S&P Global Ratings report suggested systemwide U.K. domestic credit losses would rise to £18.5 billion in 2020, or 100 basis points of domestic lending — more than 4x the 2019 level. It warned that the losses may be higher still, and said credit losses in 2020 will be higher than the total credit losses over the past five years, with consumer credit most affected.

The rating agency said the credit loss estimates reflected the "radically more negative environment" resulting from the pandemic. The expected consequences of the pandemic — higher unemployment and corporate failures — are set to feed through to bank asset quality and higher credit losses, it said. It also said it believed the measures adopted to contain the virus have pushed the global economy into recession.

Barclays is forecast to endure a near-90% decline in net income compared with 2019. In the first quarter it made a £2.16 billion loan loss provision with CEO Jes Staley saying it had used "a very challenging forecast" in its credit models, including a projection for unemployment to reach 6.7% and economic output of negative 8%.

Analysts estimate that Lloyds Banking Group PLC will suffer a 60.93% decline in net income. Royal Bank of Scotland Group PLC is expected to swing to a loss of £580 million, compared to a profit of £3.13 billion in 2019. Italy's UniCredit SpA and troubled German lender Deutsche Bank AG are also expected to record a net loss this year.

RBS CEO Alison Rose was criticized by analysts when unveiling the bank's first-quarter results after she said the bank considered it too early to estimate the scale of the economic impact of the coronavirus as there was no consensus among forecasters on the impact of the lockdown or the effectiveness of the government's response. Nevertheless, the bank's first-quarter impairment charge totaled £802 million.

Nordic, Swiss banks

Nordea is the only bank in the sample which is forecast to see an increase in net income in 2020. It reported credit impairments of €154 million in the first quarter.

However, the second-largest lender in the Nordic region after Nordea, Danske Bank A/S, updated its macroeconomic assumptions under the IFRS 9 accounting model while Nordea did not. Nordea felt it was too early to assess the crisis' full impact, it said, while Danske adopted the standard, which requires banks to take a forward-looking view and apply macroeconomic forecasts when estimating expected credit losses. Danske recorded impairments of 4.34 billion Danish kroner in the first quarter.

One of the banks likely to be most resilient, according to the research, is Switzerland-based UBS Group AG. CEO Sergio Ermotti said at its first-quarter results in April that its diversification and risk profile made it better equipped than most to deal with adverse scenarios.

The bank's business model is "fundamentally resilient" with a small, capital-light investment bank, a specialized global wealth management arm and a strong universal bank in Switzerland, he said.