European asset managers will have to address long-standing challenges in 2020 or face the risk of failure, market observers warned, citing the need for differentiated strategies and adaptation to the demands of the COVID-19 pandemic as solutions.

The pandemic has been "a wake-up call" for the European asset management industry as the crisis accelerated sector trends and increased the need for immediate action on strategy and business model changes, management consultancy Zeb said in its 2020 asset management study.

The coronavirus has intensified headwinds such as heightened competition, fee compression and rising client expectations, according to Greenwich Associates, which is part of CRISIL, an S&P Global company. "Asset managers without a value proposition that resonates strongly with investors will struggle to grow and survive," Greenwich Associates said in a recent report.

Even without the impact of COVID-19, profit margins in European asset management were expected to fall over the next five years, with European assets under management also expected to grow at a lower rate than in the U.S. and Asia-Pacific. The pandemic has added a layer of uncertainty about future business and growth opportunities as market volatility triggered outflows and restrictions on movement affected client relationships.

Need for differentiation

The choice between economies of scale and specialization has become more pressing for asset managers due to the pandemic, but the key to long-term success is standing out from the crowd, according to the Zeb and Greenwich Associates' analyses. Historical trends in the sector have shown that "simply expanding in segments offering higher revenue margins is no guarantee of increased profitability" as having a larger share in retail or alternative assets is often associated with higher operating costs, Zeb said.

With COVID-19 preventing most physical meetings, asset managers have had to work harder on developing new client relationships, Mark Buckley, a principal at Greenwich Associates said in an interview. The abrupt shift to digital channels amid the pandemic has changed the expectations and preferences of existing clients and companies have been forced to rethink how they manage these relationships in the future, such as increasing the frequency of client communication, addressing a greater demand for advice and offering clients remote or digital services, he said.

Many institutional investors use 5 to 15 asset managers on average and will be sensitive to how well different companies adapt to the new challenges, Buckley said. In this environment, finding a competitive edge will be crucial even for large companies that have scale. They will have to make an effort to differentiate themselves by offering clients cheaper solutions that fit their specific investment needs, Greenwich Associates said.

Smaller firms at risk

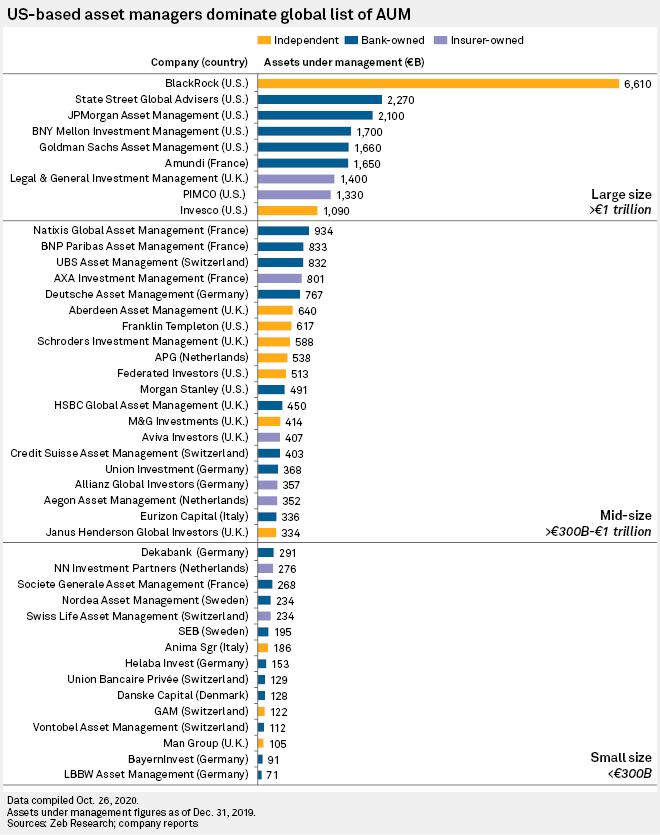

However, the pressure will be greatest on small and medium-sized companies, many of which had already felt the squeeze in recent years amid the growing popularity of passive management and rising regulatory costs, among others. In recent years, concentration in the sector has gradually increased, with the share of assets under management controlled by the 10 largest asset managers globally rising to 32% in 2019, according to Zeb.

"The COVID-19 shutdown has severely curtailed the ability of smaller and lesser-known managers to compete for new business. Meanwhile, the biggest "name-brand" managers are actually experiencing positive net asset flows," Greenwich Associates said in its report. The pandemic has made the strong stronger and the weak much weaker, it said. Therefore, the health crisis is likely to fuel another long-term trend in the asset management sector, which is consolidation, the research company said.

Small and medium-sized companies will have to find ways to keep their assets while continuing to grow, and all that at limited scale and with fewer resources. To be able to survive these companies need to differentiate themselves and refocus on certain types of clients or products, Buckley said.

Medium-sized asset managers with standard business models "that are not distinct in any way from those of their competitors" are at the greatest risk, Zeb said. These companies are not in trouble purely because of their size "but mainly due to their imperfect balance of focus and scalability," Carsten Wittrock, a Frankfurt-based partner at Zeb, said in an interview.

Mid-term outlook

Between 2015 and 2019, assets under management at the 44 asset managers with strong European footprints included in Zeb's sample have grown by approximately 8% per year but revenue and profit margins have declined at an average annual rate of 4% and 3%, respectively. At the same time the average cost-to-income ratio of the companies in the sample has hardly changed, edging down to 67% in 2019 from 68% in 2015, suggesting that the industry has not reduced its absolute cost base, Zeb said.

Moreover, companies are expected to record less growth at home. Europe was the second-largest market, accounting for 27% of total global AUM in 2019, but registered the weakest annual AUM growth, of only 5% per year, in 2015 to 2019, compared to a 12% compound annual growth rate in the U.S. and 21% in Asia, Zeb said, citing figures on the world's top 500 asset managers by Investment & Pensions Europe. European AUM is projected to grow at the slowest rate per year by 2025, of 3%, compared to 4% in North America and 12% in Asia-Pacific, RBC Capital Markets estimated in a September note.

The outlook for the next five years, even in the best-case scenario — assuming minimal market impact on asset prices and historic AUM, revenue and cost rates staying the same — includes a 20% drop in profit margin, Wittrock said. This "very optimistic scenario" assumes that financial markets continue to be decoupled from the real economy over the next five years, Zeb said. The consultancy explores two other scenarios, looking at a V-shaped economic recovery with an overall annual AUM growth rate down to 5.1% and a profit margin drop of 30% over five years, and a U-shaped recovery with AUM growth dropping to 1.3% per year and profit margins declining by 60%.

CRISIL and S&P Global Market Intelligence are owned by S&P Global Inc.