| Nuclear power station with steaming cooling towers in Lower Saxony, Germany. The country opposed nuclear power's inclusion in the EU taxonomy but may now be forced to extend the use of such assets. |

Uranium prices, which reached a 10-year high in early March, driven by investor speculation, will see stronger fundamentals as European states turn to nuclear power in an effort to wean off Russian fossil fuels.

The European Commission plans to cut the EU's dependence on Russian natural gas by two-thirds in 2022 in response to the country's invasion of Ukraine. France, Poland and the United Kingdom have all announced plans to build more nuclear plants in recent months. Those announcements suggest a boost for uranium, which had been mired in a price slump since the 2011 nuclear disaster in Japan.

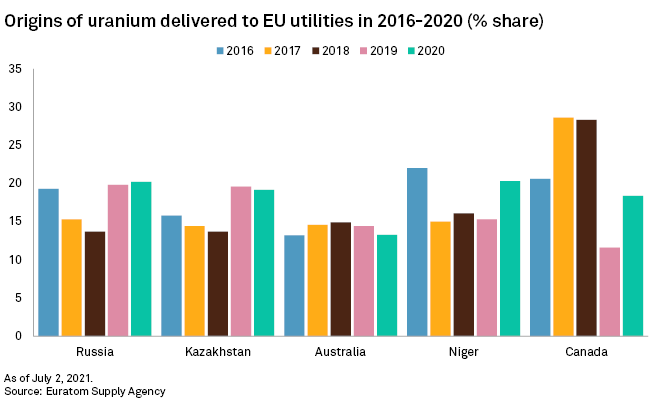

But if European governments seek to reduce one nation's leverage over their energy sector, they also must reduce their uranium purchasing from both Russia and Kazakhstan, a major yellow cake producer within Moscow's sphere of influence. About 40% of EU utilities' uranium imports came from Russia and Kazakhstan, according to the Euratom Supply Agency's latest data.

European governments appear willing to solve a uranium problem if it means getting off Russian natural gas.

"Even a rapid de-escalation of this conflict [in Ukraine] will leave a residual urgency to resolve Europe's compromised energy security" said Brandon Munro, CEO of ASX-listed uranium developer Bannerman Energy Ltd.. "With threats from Russia to cut off gas supply to Nord Stream 1 hanging over the continent, any prolonged energy crisis will have a profound effect on Europe's energy mix."

'You need to diversify'

Dependence on Moscow for energy was poised to increase if the Nord Stream 2 gas pipeline between Russia and Europe had been put into service. Its future is bleak, however, because of the war.

Europe's leaders, meanwhile, are reassessing their views on nuclear power in a net-zero world. "Now, with the realization that Europe in particular is hostage to Russian gas," uranium pricing is set to soar, Andrew Hines, head of research for financial services firm Shaw and Partners, told S&P Global Commodity Insights.

"Our message at the moment is 'long and on high alert,'" Haywood Securities said in a March 9 note on uranium investment, after the UxC Daily uranium price hit $53.25 per pound amid Bloomberg reports of potential U.S. sanctions against Russia-owned Rosatom and talk of an export ban potentially including nuclear fuel.

The EU accounts for a quarter of global uranium demand and depends on nuclear for 25% of its electricity. The continent needs a higher proportion of baseload power, and that would only rise under current plans.

Though Europe is strongly divided on nuclear power, it is due to "come into play" along with coal and renewables, as the continent works to diversify and pivot away from Russian energy sources, Gerben Hieminga, ING Bank's Netherlands-based senior economist, told Commodity Insights in an email interview.

"This Russian-Ukraine issue has spooked the fuel buyers," Duncan Craib, managing director of Boss Energy Ltd., told Commodity Insights regarding both European and North American utilities that have approached his company about the South Australian Honeymoon uranium project Boss raised A$120 million on March 18 to restart.

"Their confidence is shaken, and I don't think there's any walking back from that, either," Craib said. "Even in the event of a peaceful resolution, which we hope for, the message is pretty clear — you can't have all your eggs in one basket. You need to diversify."

Portions of Europe accept nuclear

French President Emmanuel Macron announced a goal in February of starting construction of six nuclear reactors by 2028. British Prime Minister Boris Johnson proposed building a second nuclear power plant in response to Russia's Ukraine invasion, The Times reported March 14. Poland plans to build its first six reactors over the next 20 years for up to 9.9 GW of capacity, and the Olkiluoto 3 plant was connected to Finland's national grid March 12.

Czechia aims to generate 46% to 58% of its electricity from nuclear power by 2040, having enacted a law in January to facilitate nuclear plant financing and excluded Russian and Chinese companies from participating in building new reactors.

Nuclear energy has greater impetus since a group of over 100 members of the European Parliament successfully appealed to the European Commission to include nuclear power under the Sustainable Finance Taxonomy.

Not every country is on board. Germany, Austria and Luxembourg opposed that inclusion. And Germany said that after reviewing its portfolio, it still plans to close its remaining nuclear reactors, Euractiv reported March 9.

Uranium still in Russia's influence

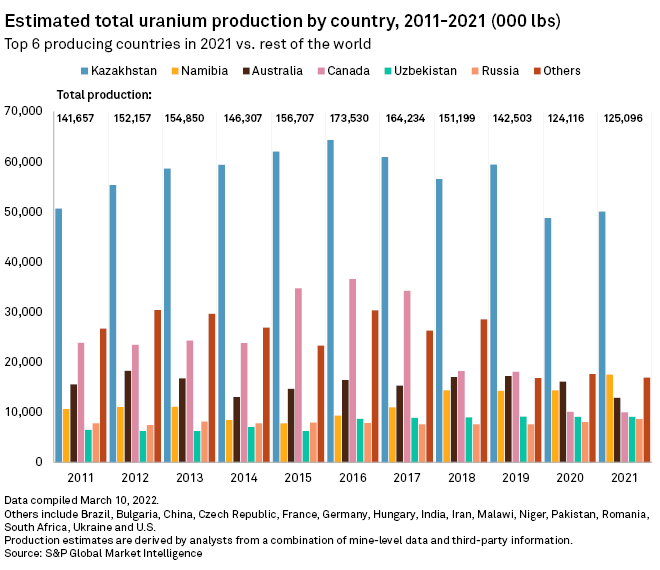

Kazakhstan is a world leader in uranium production, with national producer Kazatomprom expecting 2021 output to be 22,500 tonnes to 22,800 tonnes, exported principally to China, South and Eastern Asia, Europe and North America. Europe once relied heavily on Canada, but it shifted its buying to Kazakhstan in 2020 and 2021, according to Euratom's data.

"Kazakhstan is the biggest producer of yellow cake, and it wasn't so long ago that you had 2,000 Russian peacekeepers in Kazakhstan, a former Soviet state, quelling civil unrest," James Bullen, an equity analyst for Canaccord Genuity, told S&P Global Commodity Insights.

Russia accounts for over half the world's uranium enrichment capacity, according to the World Nuclear Association.

"If you start imposing sanctions on Russian energy exports and stop buying uranium from them," said Hines, the research manager from Shaw and Partners, "then there is a big problem looming."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.