Gas utility stocks rebounded in the final quarter of 2022, though a complex macroeconomic landscape and high commodity prices made it difficult to predict the sector's prospects in the new year.

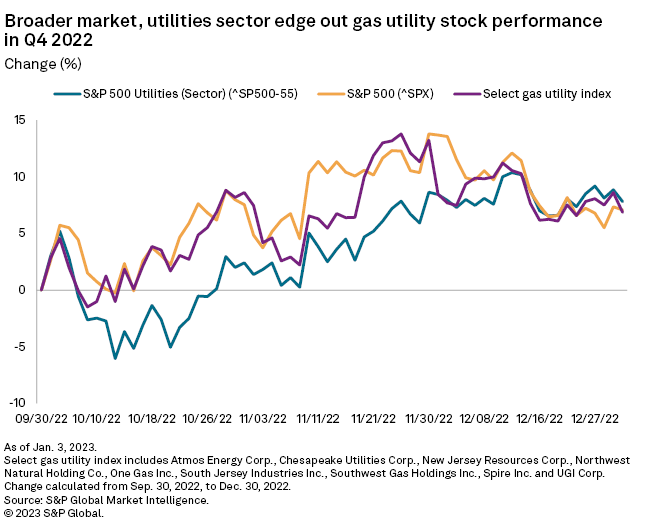

An index of nine gas utilities selected by S&P Global Commodity Insights rose 6.9% in the fourth quarter, rallying from a steep decline in the previous quarter. The stocks largely kept pace with the S&P 500 and the S&P 500 Utilities sector, which rose 7.1% and 7.8%, respectively, in the fourth quarter.

It was the best performance for the basket of gas utility stocks since the final quarter of 2021. However, it was not enough to push the index into the black for the year.

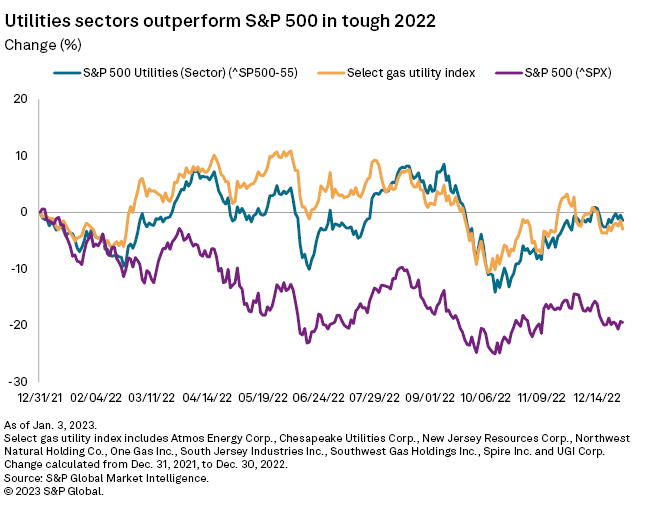

The fourth quarter rally lost steam in the final two weeks of 2022, resulting in a 3% annual decline for the index. The gas utilities ran slightly behind the S&P 500 Utilities sector, which fell 1.4% on the year. The select index easily topped the broader market's abysmal performance; the S&P 500 plunged 19.4% in 2022.

Trading in utilities was bumpy throughout the second half of 2022 as market narratives shifted constantly amid "the end of a decade-plus years of unprecedented monetary easing, economic recessionary concerns and looming softening in earnings," Nasdaq IR Intelligence senior analyst Massud Ghaussy told Commodity Insights.

In Ghaussy's view, it was remarkable that utilities rallied even as the gap between the sector's dividend yield and the U.S. 30-Year Treasury yield widened. The utility sector's dividend yield is now trading below the long-term government debt yield, a historical anomaly that implies investors view utilities as less risky, the analyst said.

Ghaussy offered a few explanations. Investors may be willing to pay a premium for high-quality defensive stocks ahead of an anticipated economic slowdown. The market may also expect rate cuts in 2023 despite the U.S. Federal Reserve's messaging. Lastly, income-oriented sectors could be benefitting from peaking inflation and stabilizing yields.

* Access more details on energy and utility news

* Dig into news and analysis from Regulatory Research Associates.

* Explore Data Dispatches for more data-driven market insights.

Yet sentiment on gas utility stock remains mixed, Ghaussy said. Some investors are looking for undervalued defensive stocks after utilities outperformed the market, while others are awaiting a pullback before increasing their exposure to the sector, Ghaussy said.

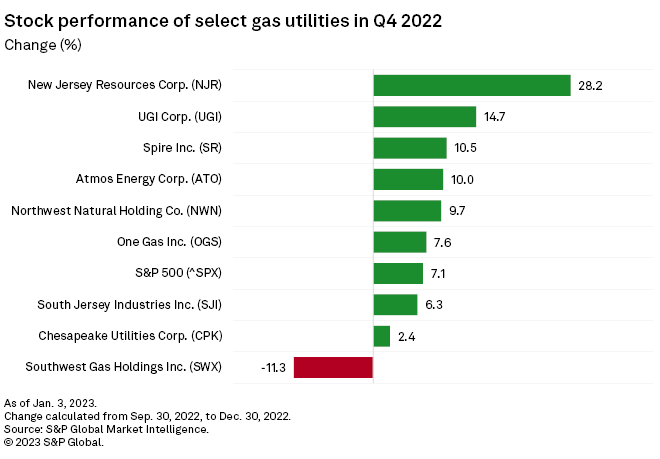

All nine gas utility stocks outperformed the S&P 500 in 2022. In the fourth quarter, only Southwest Gas Holdings Inc. lost market value, plunging after the company reported disappointing earnings and sold its midstream business at a loss.

Some other gas utilities experienced stock price pullbacks after warning that inflation and rising interest rates would weigh on earnings.

Scotiabank recently raised concerns that elevated utility bills could lead to rising unpaid balances, putting pressure on earnings in 2023. Investors have also inquired whether unfavorable rate case outcomes signal that affordability concerns are bleeding into regulators' decision-making.

"For now, we're cautiously optimistic," Scotiabank said in a Dec. 13, 2022, research note. "That said, if investors are nervous about these premium regulatory environments, what will happen to stocks of utilities operating in states that are already more challenging if those get even worse?"

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.