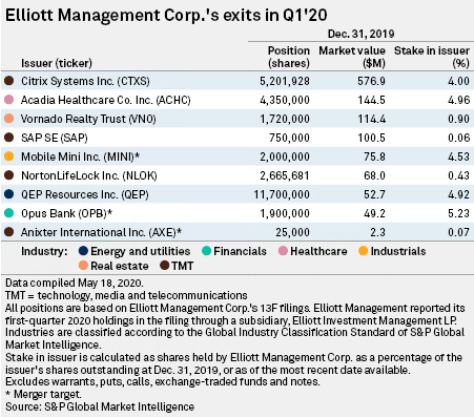

Elliott Management Corp.'s divestiture of $576.9 million worth of Citrix Systems Inc. stock marked its biggest exit in the first quarter of 2020.

In addition to its 4% interest in Citrix, the New York-based hedge fund jettisoned a 4.96% stake in Acadia Healthcare Co. Inc. worth $144.5 million and a 0.9% stake in Vornado Realty Trust worth $114.4 million. The sale of a 0.06% position in SAP SE stock worth $100.5 million was Elliott's only other divestiture netting it more than $100 million.

The sale of a 4.92% stake in QEP Resources Inc. worth $52.7 million was Elliott's only exit of an energy company in the quarter, the firm's seventh largest cash out on a list of nine exits.

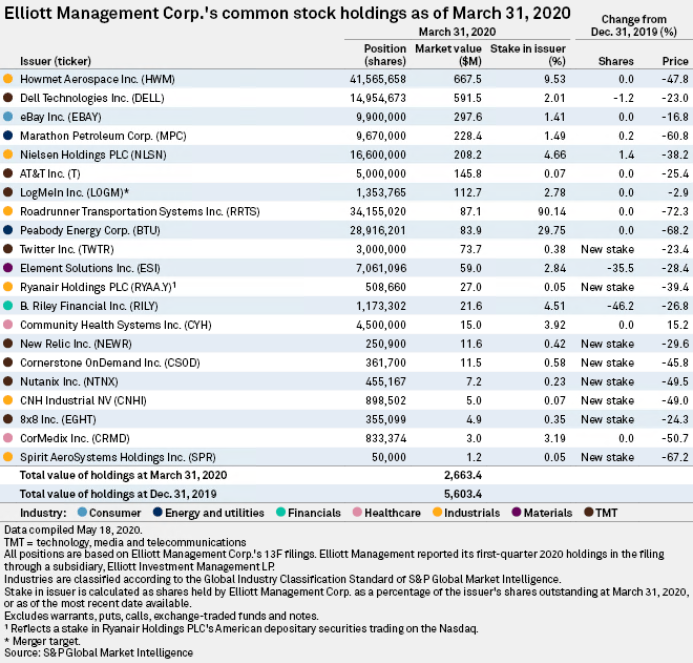

Elliott has a 9.53% stake in Howmet Aerospace Inc., which is worth $667.5 million and represents the firm's largest investment. Dell Technologies Inc. retained its number two spot on the list, with Elliott owning a 2.01% stake worth $591.5 million.

A 1.49% stake in Marathon Petroleum Corp. worth $228.4 million was Elliott's largest energy holding at the end of the first quarter, in fourth place among all investments behind the hedge fund's 1.41% shareholding in eBay Inc., worth $297.6 million.

Investments in Nielsen Holdings PLC, AT&T Inc. and LogMeIn Inc. round out the list of seven companies in which Elliott has stakes worth upward of $100 million, with a $208.2 million position in Nielsen, $145.8 million in AT&T and $112.7 million in LogMeIn.

Elliott retains a 29.75% interest in beleaguered coal company Peabody Energy Corp. worth $83.9 million.

Elliott subsidiary Elliott Investment Management LP reported its quarterly divestitures and ownership interests in a Form 13F filing with the U.S. Securities and Exchange Commission on May 15.