The U.S. Energy Information Administration cut its crude oil price outlook through 2021, outlining a lower-for-longer price scenario due to demand-side coronavirus concerns and the inability of OPEC and its partners to agree on production cuts that would have stabilized the market.

Following Saudi Arabia's March 8 announcement that it would increase production, crude oil prices fell approximately 25%, sending some oil and gas stocks to post record losses.

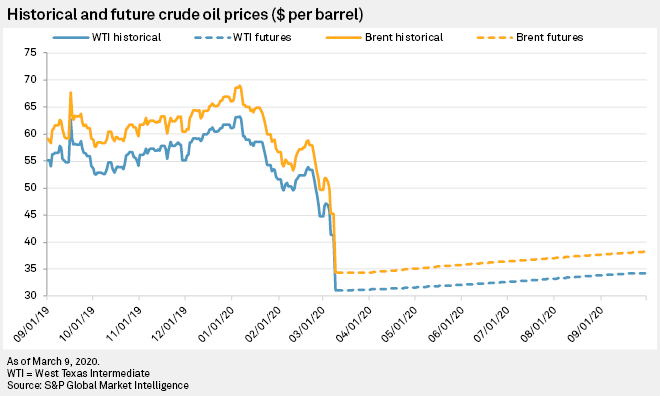

In its latest "Short-Term Energy Outlook," the EIA projected that West Texas Intermediate spot crude oil prices will decline from an average of $57.02/bbl in 2019 to $38.19/bbl in 2020 before averaging $50.36/bbl in 2021. The 2020 and 2021 projections are down 31.4% and 18.8%, respectively, from the prior forecast.

In 2019, Brent crude oil averaged $64.37/bbl. The EIA expects the global benchmark price to fall to $43.30/bbl in 2020, down 29.3% from the prior forecast, before climbing to $55.36/bbl in 2021, down 18.0% from the prior forecast.

The EIA said there is "significant uncertainty amid a highly volatile market environment" and outlined factors that led to its forecast revisions.

The EIA predicts lower demand from the spread of COVID-19 will "diminish by the third quarter of 2020," and drive 2020 global crude oil demand growth to 400,000 bbl/d, down from the January forecast of 1.3 million bbl/d. In coming up with its forecast, the agency considered the disease's impact, including slower economic growth, reduced air travel and "other reductions in demand," including lost petrochemical and road travel demand in China. In the absence of data, the EIA is relying on preliminary demand estimates and its own assumptions about the severity and duration of the disruption to Chinese oil demand.

On the supply side, the EIA "no longer expects active production management to target balanced global oil markets among OPEC members or partner countries. ... Unplanned supply outages in Libya add additional uncertainty to the ... forecast."

The EIA expects U.S. crude oil production will not slow until some time in third quarter, due to the lagging effect of producer activity on production. In 2021, U.S. oil production could fall for the first time since 2018. Production averaged a record 12.23 million barrels per day in 2019. The EIA forecast that U.S. crude oil production will average 12.99 million bbl/d in 2020 and 12.66 million bbl/d in 2021, for a 1.6% and 6.6% respective decline from the prior forecast.

During 2019, WTI traded at an average $7.34/bbl discount to Brent. The government expects the average discount to narrow to $5.11/bbl in 2020 before continuing lower to $5.00/bbl in 2021.