Federal Reserve officials are severely underestimating the impact their move to tighten monetary policy will have on the labor market, economists said.

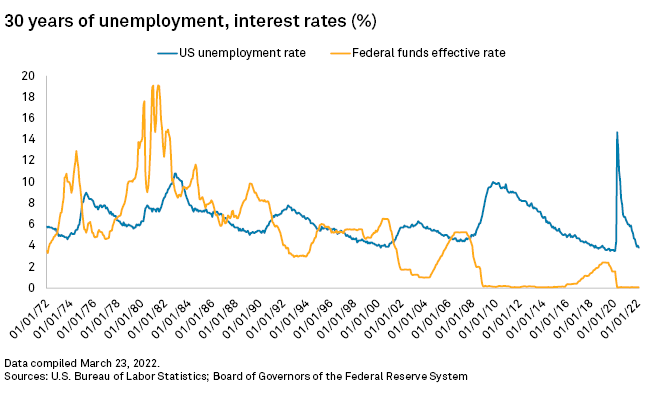

Most members of the rate-setting Federal Open Market Committee expect to hike rates nine times into 2023, pushing up the benchmark federal funds rate to 2.8%, up 120 basis points from where members forecast late last year. But while rate expectations have skyrocketed, Fed officials still expect the U.S. unemployment to remain at 3.5% in 2022 and 2023, views that were unchanged from their economic projections in December, according to the Fed's latest forecast summary.

Rosy outlook

"It's a pretty rosy outlook," said Michael Pugliese, an economist at Wells Fargo Securities, in an interview. "It's not that I think what the Fed is projecting here is impossible, but there's definitely a very real situation that it's going to be a much harder landing than what they have forecast."

By forecasting no change in the unemployment rate, Fed officials are ignoring the ultimate impact of raising rates, said Alfonso Peccatiello, author of The Macro Compass, a financial newsletter, and former head of investments at ING Germany.

"That's a 'la-la land' assessment of a super soft landing, which the Fed has basically almost never been able to engineer," Peccatiello said.

Under Fed projections, the benchmark rate will be roughly 40 to 50 basis points over the so-called neutral rate, which neither stimulates nor constrains the economy. These higher interest rates will hinder the ability of companies to refinance at affordable borrowing rates and the slowdown in borrowing will impede companies' hiring plans, most certainly causing a rise in unemployment, Peccatiello said.

Under the Fed's current rate hike prospects, unemployment will probably rise to 4.8% in 2023, well above the Fed's forecast of 3.5%, said Diane Swonk, chief economist at Grant Thornton.

"Basically, you slow down the economy to the point where you get layoffs," Swonk said.

The U.S. unemployment rate fell to 3.8% in February, its lowest point since the pandemic began. The labor force participation rate, or the number of workers in the population in the job market, remained at 62.3% in February, below pre-pandemic levels. That rate has yet to materially pick up over the past year, a troubling sign for long-term GDP growth prospects, Peccatiello said.

During his March 16 press conference, Fed Chairman Jerome Powell described the U.S. labor market as "tight to an unhealthy level," with roughly 1.7 job openings for every unemployed person. By raising rates, the Fed aims to slow demand, ease upward pressure on wages and, potentially, lessen the labor crunch. But Powell also indicated that the central bank's priority was addressing inflation.

"[We] do understand also that really you can't have maximum employment for any sustained period without price stability," Powell said. "So we need to focus on price stability, and particularly because the labor market is so strong and the economy is so strong. We feel like the economy can handle tighter monetary policy."

Difficult balance

Tom Barkin, president of the Federal Reserve Bank of Richmond, has cautioned that the Fed is in a "balancing act" as it tries to address inflation without upsetting the labor market.

"If we overcorrect, we can negatively impact employment," Barkin said in his prepared remarks before the Maryland Bankers Association on March 18.

That balancing act will be a focus for the Fed since even a slight increase in unemployment could trigger a recession, said Larry Meyer, CEO of Monetary Policy Analytics and a former Fed governor.

Raising rates without impacting employment "will be very difficult to achieve," Meyer said.

The balance is further complicated by uncertainty surrounding Russia's invasion of Ukraine, which has caused a spike in commodity prices globally and worsened the inflation outlook, said Pugliese. The ultimate impact of the Fed's policy shift depends on multiple factors that are in seemingly constant flux.

"Getting the magnitude right is really the hard part, and that's where mistakes can happen," Pugliese said. "It's a lot harder to know in real time how many rate hikes it's going to take before labor slows too much."

To curb inflation, the Fed may have no choice but to allow unemployment to rise, Swonk with Grant Thornton said. The Fed is limited by the "blunt" monetary tools they have, Swonk said.

"A period of higher unemployment to get rid of entrenched inflation is better than enduring inflation that lasts much longer," Swonk said. "Still, that doesn't make the people who have to endure the layoffs feel very good about it."