For the U.S. job market, it may be a case of short-term pain for long-term gain.

April's nonfarm payrolls report is expected to show 21.5 million fewer Americans working and an unemployment rate of 16.4%, according to the median of economists polled by Econoday. Not only would that be the worst employment report since at least WWII, it compares with relatively modest changes in Europe, where the European Commission has predicted a peak unemployment rate of 9.5% in 2020, up from 7.5% in 2019.

While on the surface that looks like a big fail for the U.S. response to the coronavirus pandemic, there are reasons to be optimistic that the U.S. unemployment rate will soon be back below that of its neighbors across the Atlantic.

U.S. and European governments took very different approaches to workers as their respective economies came to a coronavirus-induced standstill in March and April. In the U.S., support for workers has come in the form of the Paycheck Protection Program, which has provided $533.5 billion in loans to small businesses in the expectation that they spend the money paying wages and other select outlays, but many companies have been loath to take on borrowing that they may struggle to repay.

In Europe, companies have been encouraged to keep workers on their books in exchange for the government paying some or all of their wages. In the U.K., 80% of salaries up to £2,500 are being paid, while in Germany, 60% of salaries are being paid with no cap.

|

Oxford Economics calculates that the "shadow unemployment rate" of workers on such programs could be as much as 30% of the euro area workforce, about 50 million people.

While these people still have jobs now, they are vulnerable once the economy restarts and government support is withdrawn, particularly in sectors such as tourism, accommodation and food services, and wholesale and retail trade in southern Europe, Gregory Daco, chief U.S. economist at Oxford Economics, said in an interview.

While government support is masking the extent of coronavirus-related job losses in Europe today, the continent's more rigid labor market is likely to slow its rebound.

Trade union membership is much higher in the European Union than in the U.S., at 23% versus 10%, but the major difference in labor flexibility is the result of law. U.S. employment statutes allow more flexibility in areas such as making workers part-time rather than full-time and the ability to fire workers without fear of being taken to tribunal.

Financial crisis rebound

"On the rebound, we're likely to see more rapid rehiring in U.S. than Europe; typically, the hiring and firing costs are much lower," Daco said.

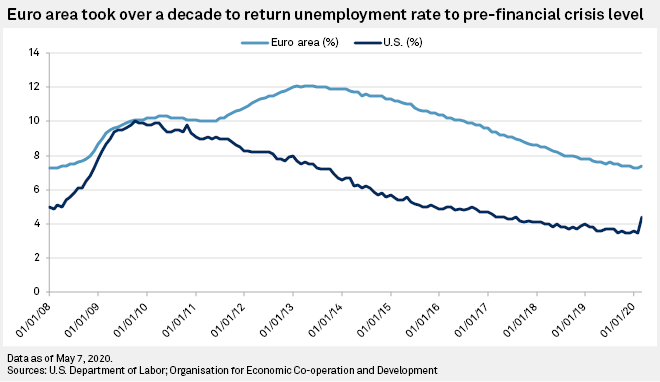

While there are some well-documented differences between the current economic crisis and the global financial crisis of 2008-2009, if that period is any guide, the difference in labor market recovery could be quite stark as it took the U.S. six years to return to pre-financial-crisis levels of unemployment compared with 10 years for the euro area.

The U.S unemployment rate surged from 5% in April 2008 to a peak of 10% in October 2009 before falling back to 5% in September 2015. Euro-area unemployment started at a higher level in April 2008 at 7.4%, peaked at 12.1% in February 2013 and only got back to its pre-crisis level in October 2019.

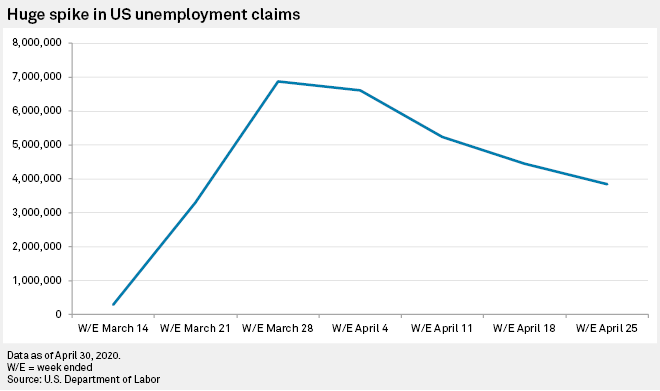

U.S. unemployment started the coronavirus crisis at a 50-year low of 3.5% in February before jumping to 4.4% in March. Weekly unemployment claims of 3.3 million and 6.9 million in the second half of March and a further 20.1 million during April suggest a catastrophic nonfarm payroll number being released May 8.

"You're also going to see millions of jobs coming back over the course of two years in the U.S., but you're going to see them come back in different areas," Daco said. "It's very different from the European economy, where some jobs will come back but some people will have a harder time regaining those lost jobs as the cuts are more likely to be permanent."

Still, it is unlikely to be a smooth road to recovery for the U.S. labor market either.

S&P Global Ratings Chief U.S. Economist Beth Ann Bovino told S&P Global Market Intelligence that even under a cautious, gradual reopening, she does not see the pre-crisis unemployment rate of 3.5% returning until 2023 at the earliest.

Progress is likely to be hampered by the possibility of a second wave of the pandemic in October or November that may stop companies from hiring as they continue to repair their "financial homes," Bovino said. Some business, such as restaurants and retailers, will be kept from full capacity by lingering social distancing measures, Bovino said.

Consumer

If these two primarily consumption-focused economies are to recover quickly, they will need households to be prepared to spend.

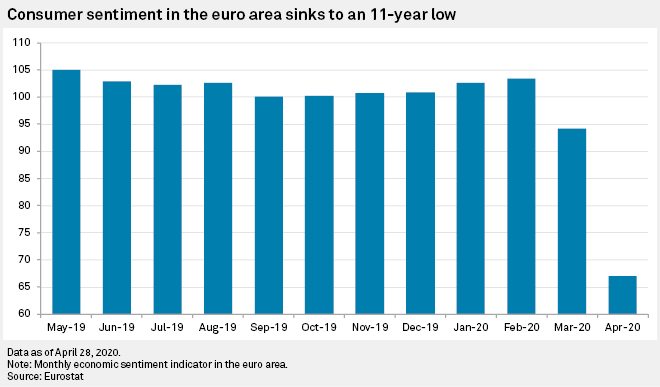

The monthly economic sentiment indicator in the euro area collapsed by 22.7 points in April to 67.0, the lowest level since March 2009. The actual figure is likely to have been worse as data collection in Italy was impossible owing to the extensive lockdowns.

|

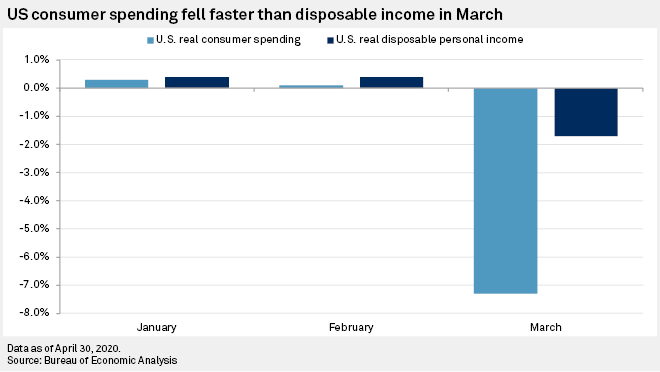

In the U.S., the 7.3% decline in real consumer spending in March, the latest available data, was the largest monthly drop on record, with spending on autos, clothing and recreation, accommodation and nonessential healthcare services all falling sharply.

Daco expects the lag in job recovery in the U.S. to give European consumption a brief advantage post-lockdown but for that to fizzle out.

"[European policies] may favor more rapid spending on the European front, but given the flexibility in the labor market in the U.S., if people start to get hired faster, you'll see consumption start to recover," Daco said. "It may be a matter of a month or two in the difference in the rebounds, but I think the flexibility of the labor markets will benefit the U.S. in the longer run."

|