Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Dec, 2024

Most US office real estate investment trusts ended the third quarter with weaker operating metrics compared with the previous three-month period as demand for offices continued to drop amid higher rent.

Funds from operations, recurring EBITDA drop for several REITs

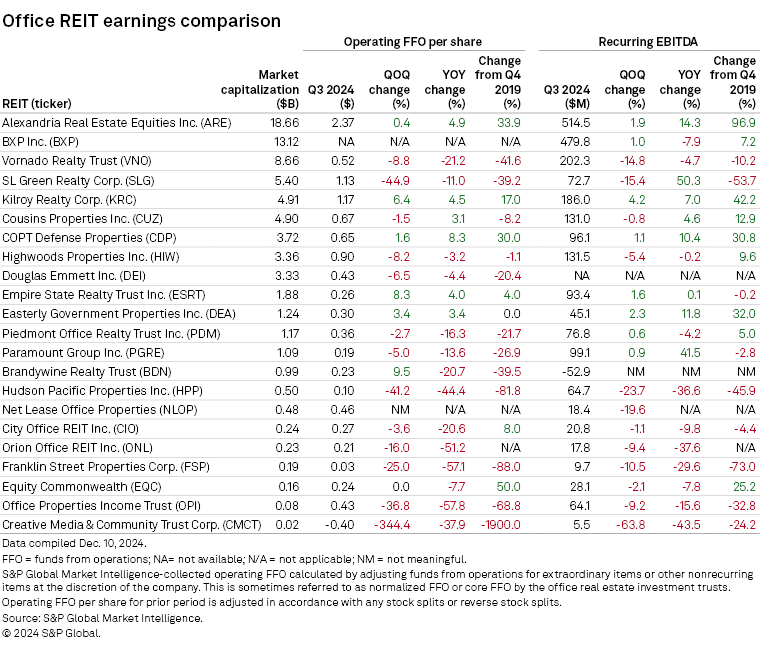

Thirteen of 22 office REITs in the US posted quarter-over-quarter declines in operating funds from operations (FFO) per share during the third quarter. Seven logged sequential increases, and one — Equity Commonwealth — reported operating FFO per share that was flat from the prior quarter, according to an S&P Global Market Intelligence analysis.

Market Intelligence defines operating FFO as FFO adjusted for extraordinary items or other nonrecurring items at the discretion of the company. Office REITs sometimes refer to this as normalized FFO or core FFO.

Among the office REITs included in the analysis, Creative Media & Community Trust Corp. recorded the steepest sequential drop in operating FFO per share, with the metric declining to a loss of 40 cents in the third quarter from a loss of 9 cents the prior quarter. Compared with the same period in 2023, the REIT's operating FFO per share plunged 37.9% from a loss of 29 cents.

During Creative Media's Nov. 8 earnings call, CFO Barry Berlin attributed the FFO decline to the redeemable preferred stock redemptions of $15.7 million as well as the decrease of $3.6 million in segment net operating income. The decrease in core FFO, however, was driven mainly by the drop in segment net operating income and was not affected by the increase in redeemable preferred stock redemptions since these are excluded from the calculation of the core FFO, according to the executive.

SL Green Realty Corp. reported the second-biggest drop in operating FFO per share compared with the previous quarter, with the metric dropping 44.9% to $1.13. On a year-over-year basis, the REIT's operating FFO per share decreased 11.0% from $1.27 per share.

Hudson Pacific Properties Inc. posted a 41.2% sequential drop in operating FFO per share to 10 cents, which is down 44.4% from the same period a year ago.

"The year-over-year change in FFO excluding the specified items, was mostly attributable to the factors affecting revenue and lower FFO from noncontrolling interests following our purchase of our partner's interest in 1455 Market earlier this year," said CFO Harout Diramerian during Hudson Pacific Properties' earnings call on Nov. 12. For the fourth quarter, the REIT expects FFO per diluted share to range from 9 cents to 13 cents, according to Diramerian.

Three other office REITs reported double-digit quarter-over-quarter declines in operating FFO per share during the third quarter: Office Properties Income Trust, Franklin Street Properties Corp. and Orion Office REIT Inc.

In terms of recurring EBITDA, 13 office REITs reported quarter-over-quarter declines during the third quarter, while eight recorded gains.

Brandywine Realty Trust logged the largest quarterly drop, with its recurring EBITDA falling to a loss of $52.9 million from positive $56.8 million in the previous quarter. Creative Media and Hudson Pacific Properties followed, posting quarter-over-quarter declines of 63.8% and 23.7%, respectively.

Occupancy rate at historic lows; higher median rent

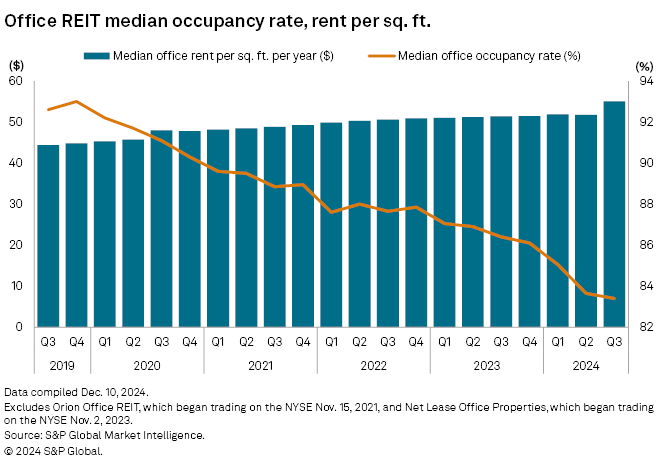

During the third quarter, US office REITs' median occupancy rate dropped by 25 basis points quarter over quarter and 300 basis points year over year to 83.4%, the lowest it has been since at least the start of 2017.

Franklin Street Properties Corp.'s office occupancy rate of 67.9%, down from 70.2% in the previous quarter, was the lowest among the 22 REITs included in Market Intelligence's analysis.

"The decrease in lease occupancy during 2024 has been attributable to multiple property dispositions and to lease expirations," Franklin Street Executive Vice President John Donahue said on an Oct. 30 earnings call.

Equity Commonwealth had the second-lowest office occupancy rate at 69.7%, a decline from 71.4% in the second quarter.

COPT Defense Properties, on the other hand, recorded the highest office occupancy rate of 94.8%, followed by Piedmont Office Realty Trust Inc. with 88.8% and Cousins Properties Inc. with of 88.4%.

– For further company research, try the North America Real Estate Two-Page Profile template.

– Read some of the day's top real estate news and insights from S&P Global Market Intelligence.

– Set email alerts for future Data Dispatch articles.

The median rent across US office REITs rose to $55.09 per square foot per year during the third quarter, an increase of 6.4% from the previous quarter and up 7.2% year over year.

Among the REITs included in the analysis, Paramount Group Inc. had the highest average office rent at $93.14 per square foot per year, followed by Vornado Realty Trust at $87.60 per square foot per year and BXP Inc. at $80.62 per square foot per year.

Cousins Properties posted the biggest sequential hike in average office rent during the third quarter, logging an increase of 20.1% to $45.21 per square foot per year. Franklin Street and Creative Media recorded the second- and third-largest quarter over quarter increases of 3.5% and 2.5%, respectively.

On the flip side, Vornado posted a 2.4% quarter-over-quarter decline in average office rent to $87.6 per square foot per year. Hudson Pacific had the second-biggest drop, with its average office rent going down 1.3% from the second quarter to $55.09 per square foot per year during the third quarter.

Property transactions

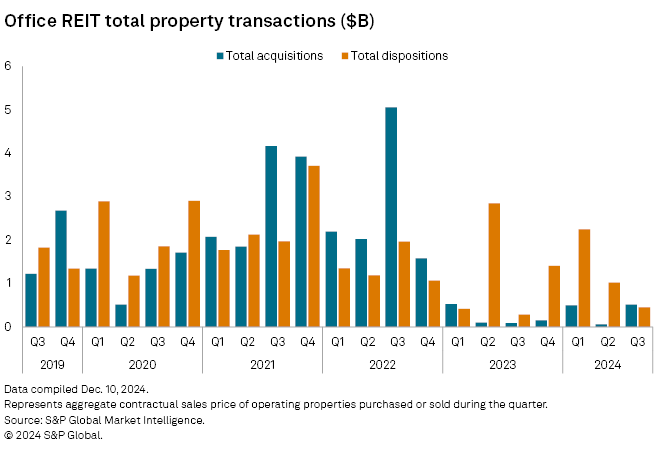

The value of property acquisitions by US office REITs rose to $512.9 million in the third quarter, from $59.1 million in the prior quarter and $85.9 million in the prior-year quarter. Dispositions totaled $447.7 million, down from $1.02 billion in the linked quarter and up from $283.9 million in the year-ago period.

Easterly Government Properties Inc. was the top acquirer, purchasing properties worth $199.8 million. Its acquisitions during the third quarter included a 193,100 square foot outpatient facility leased to the Department of Veterans Affairs in Jacksonville, Florida, and a 99,246 square foot facility leased to Northrop Grumman Systems Corp.

Empire State Realty Trust Inc. ranked second, with acquisitions amounting to $143.0 million, followed by Cousins Properties with $83.3 million.

In terms of dispositions, Alexandria Real Estate Equities Inc. topped the list, with properties sold totaling $221.4 million.

Stock performance

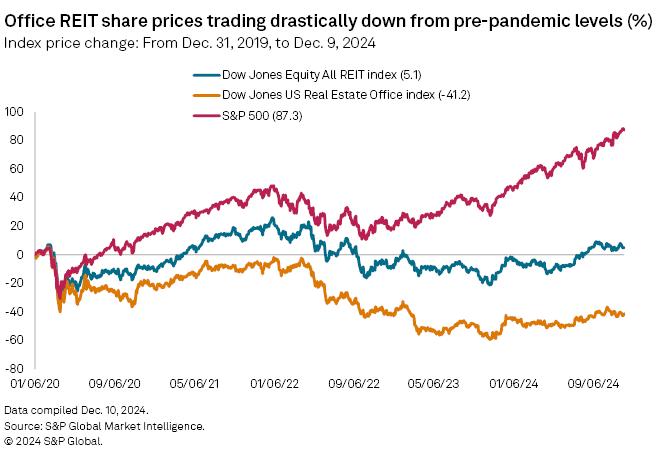

US office REIT stocks outperformed the Dow Jones Equity All REIT Index during the third quarter as well as the S&P 500. The Dow Jones US Real Estate Office Index closed the third quarter with a total return of 17.6%, compared to a 16.8% return for the Dow Jones Equity All REIT Index and a 5.9% return for the S&P 500.

As of Dec. 9, the Dow Jones US Real Estate Office Index was down 41.2% compared to the end of 2019. The index also underperformed the broader Dow Jones Equity All REIT Index, which rose 5.1% over the same period.