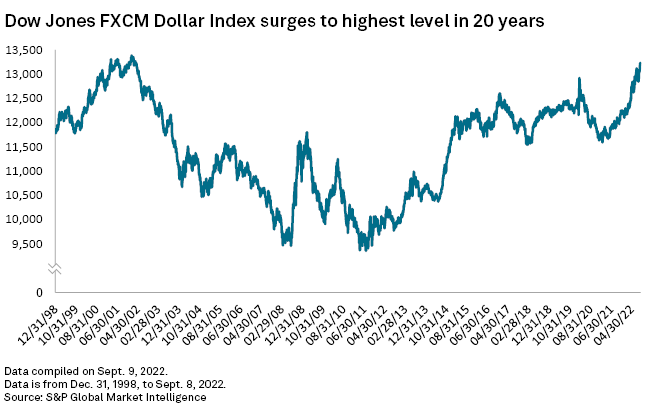

The U.S. dollar has soared to its highest point in 20 years, buoyed by the Federal Reserve's aggressive rate hike push and an ongoing European energy crisis.

The Dow Jones FXCM Dollar Index on Sept. 6 reached its highest level since March 2002. The index measures the dollar's value against the euro, the British pound, the Japanese yen and the Australian dollar. The index is up about 7.2% since March 16, when the Fed first began hiking rates after about two years of keeping its benchmark federal funds rate near-0% in order to blunt the economic impacts of the pandemic.

A strong dollar lowers the costs of imports into the U.S., makes international travel cheaper for Americans and the strengthens the greenback's status as the world's reserve currency. As the Fed continues to tighten monetary inflation in its battle with inflation and economic conditions worsen abroad, the dollar is likely to strengthen further, potentially surging to its highest level since the mid-1980s, foreign exchange strategists said.

"The two largest economic zones outside of the U.S. — namely Europe and China — are mired in deep structural challenges that do not yet show signs of improving," said Anujeet Sareen, portfolio manager with Brandywine Global. "It's possible the dollar continues to overshoot until some of these pressures abate, or the U.S. domestic economy slows."

The dollar will continue to rally against its currency peers until the Fed stops hiking rates, other central banks start matching rates with those in the U.S. or energy prices start to substantially decline, Sareen said.

Fed tightens

The dollar tends to strengthen when the Fed boosts its benchmark federal funds rate, as more global investors are drawn to U.S. government bonds and other dollar-denominated investments bolstered by rising interest rates. The central bank has boosted rates by 225 basis points since March and is expected to hike by another 75 basis points later this month.

"The Fed is aggressively tightening and the economy is so far taking it in its stride," said Craig Erlam, a senior market strategist with Oanda. "Compare that with other countries that are doing so to a lesser extent with much more fragile economies and the appeal of the dollar increases."

On Sept. 8, the European Central Bank announced a 75-basis-point interest rate rise, moving its benchmark rate from 0%. The Bank of England on Aug. 4 increased interest rates from 1.25% to 1.75%, its largest hike since 1995. Its next rate decision will be announced Sept. 22, a day after the Federal Reserve's next hike is expected to be announced. The Bank of Japan, which has kept rates at an ultra-low negative 0.1%, has yet to hike rates this cycle.

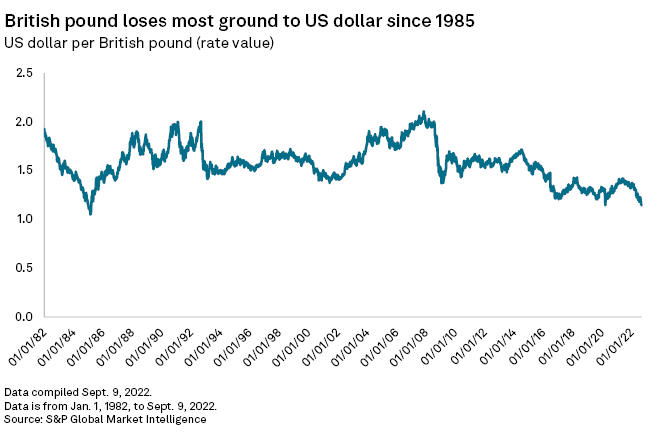

The dollar is so far outperforming other currencies this year. The relative strength of the dollar to the pound, for example, is higher than it has been since 1985. The Japanese yen to the dollar is at its lowest point since 1998. The Swedish krona to the dollar is at its lowest since 2001.

The pound and krona are being hit by the worsening growth outlook and severe energy flow disruptions in Europe due to Russia's war in Ukraine. Meanwhile, the Japanese yen has been hurt by the rebound in Treasury yields since the beginning of August, said Francesco Pesole, a foreign exchange strategist with ING. The yen tends to weaken while Treasury yields rise as investors are able to borrow yen more cheaply to buy higher-yielding dollars.

"The dollar rally has been fueled by a combination of hawkish Fed and supported rate expectations … growth divergence with Europe thanks to the U.S. energy independence, and a still unstable global risk sentiment, which increases safe-haven flows into the greenback," Pesole said.

Markets expect the Fed to continue to push rates up into 2023, further fueling the dollar rally. Europe's energy crisis has given the dollar additional strength.

"The U.S. is relatively insulated from the energy shock that the U.K., Europe, and the rest of the world are seeing, so the Fed's tightening cycle is more likely to have the intended effect of lowering inflation and cooling the economy without pushing it into a deep recession," said Matthew Weller, global head of research with FOREX.com and City Index.