After largely falling over the past five months, the US dollar is in position to rebound as persistently high inflation has significantly pushed back expectations for a monetary policy pivot from the Federal Reserve.

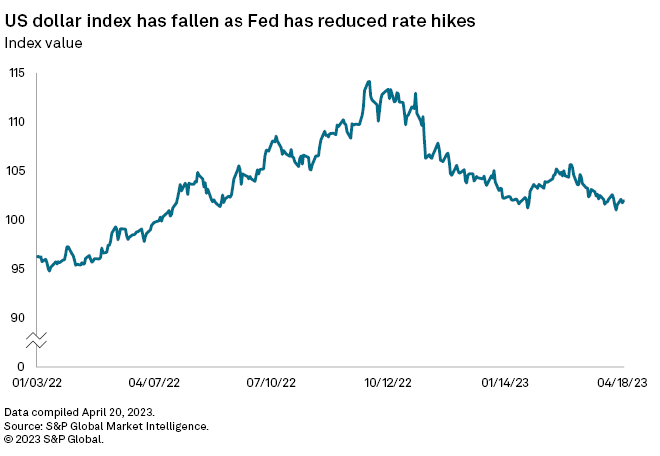

The dollar index, which measures the greenback against a basket of six G-10 currencies, has fallen about 8.5% since Nov. 2, 2022, when the Fed approved a fourth-consecutive 75-basis-point hike to its benchmark federal funds rate. The Fed has since approved an additional 100-basis-points' worth of rate increases across three Federal Open Market Committee meetings.

The dollar had fallen on speculation that the Fed might pause rate hikes, ending the central bank's most aggressive rate-raising cycle in its history. The dollar tends to rise with rate increases as investors move to dollar-denominated investments, such as US Treasury bonds, in order to take advantage of rising interest rates.

But as inflation remains well above the Fed's 2% target, the central bank is increasingly expected to keep rates high for much longer than previously anticipated, a shift that will likely boost the dollar in the coming weeks.

"We are of the view that the Fed will not pivot to a looser monetary policy until next year," said Jane Foley, head of FX strategy at Rabobank. "We, therefore, expect the market to reprice to a higher for longer Fed view in the coming months, which could provide the [US dollar] some support."

Hiking odds

The vast majority of futures market traders expect the Fed to boost rates by 25 basis points at its May meeting and a growing number believe a similar hike will occur in June.

On April 20, the odds of a quarter-point rate hike in May were at 85%, compared to about 39% a month earlier, while the odds of another 25-basis-point increase in June were at about 30%, up from 0% a month earlier, according to the CME FedWatch Tool, which measures investor sentiment in the Fed funds futures market. The majority of futures market investors believe the Fed will cut rates late this year. A month ago they were betting on cuts beginning in June.

"The Fed does not want to repeat the mistake of the 1970s, so rates will stay higher for longer," said Edward Moya, a senior market analyst with OANDA. "That means when they are done hiking rates this summer, they will try to stay on hold until early next year."

As long as Fed officials put off rate cuts, the dollar will likely go higher, said Win Thin, global head of currency strategy at financial services company Brown Brothers Harriman. Even if the central bank pauses hikes or eventually cuts rates, its quantitative tightening measures will continue, further constricting financial conditions in the economy.

"The end of Fed hiking is not necessarily dollar negative," Thin said.

The dollar rallied against its G-10 peers as the Fed ramped up rate increase in March 2022 after two years of keeping them near zero. But since its last 75-basis-point increase in November 2022, the dollar has lost ground against every G-10 peer except the Norwegian krone.

The dollar's performance in coming months against its peers remains unclear as other central banks likely look to keep rates higher than many originally expected as inflation remains hot.

"Markets have started to come around to the Fed's 'higher for longer' view on interest rates in recent weeks, but it hasn't helped the greenback much as investors have similarly raised their expectations for interest rates in other major economies as well," said Matthew Weller, global head of market research at FOREX.com and City Index. "Currencies are a relative game, and when we see coordinated evidence of sticky inflation and higher interest rates across the globe, it doesn't necessarily benefit one currency over another."