A rapid reversal in bank balance sheet flows as the Federal Reserve tightens interest rates was apparent in the third quarter.

Lending rose in the period and banks pared holdings of cash and securities as deposits drained out of the industry, raising concerns that some banks with weaker holds on customers' money could get pinched.

Investors will keep a close eye on changes in deposit balances and deposit costs, according to analysts at Keefe Bruyette & Woods. Analysts at Raymond James gave a similar perspective in an Oct. 10 note, writing that investors are "keyed on deposit bases, focusing on flows, migration and pricing trends, and will likely be a key differentiator in stock performance heading into 2023."

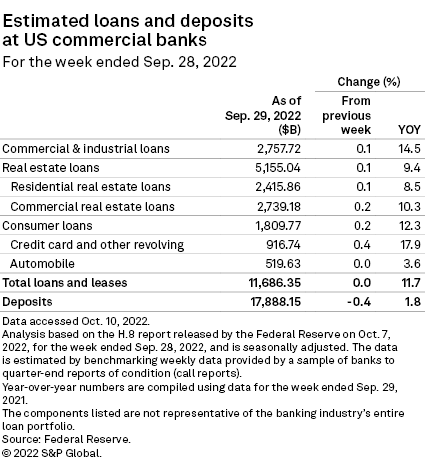

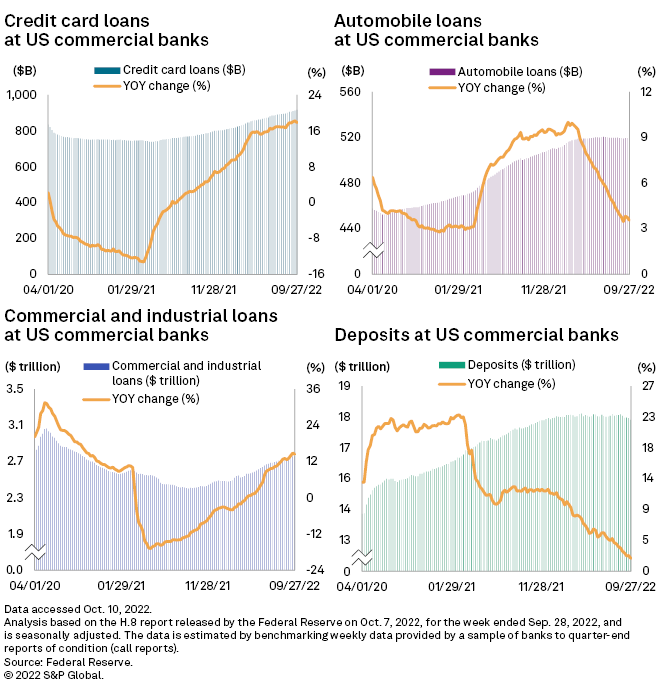

Deposits across U.S. banks fell 1.1% from June 29 to $17.779 trillion on Sept. 28, according to weekly Fed data without seasonal adjustment. That figure was a bit smaller than the 1.4% decline from March 30 to June 29, but the second quarter is generally boosted by seasonal factors like tax refunds.

After seasonal adjustment, deposits were down 0.8% from June 29 to Sept. 28, after having held steady from March 30 to June 29. Compass Point analyst David Rochester in an Oct. 10 note said the third-quarter 2022 trend was the weakest for the period in the last 10 years.

Analysts are warning that banks with strong funding needs and smaller pools of consumer and business transaction deposits, which tend to be more stable and less price sensitive, will come under particularly sharp pressure to pay up for deposits after a muted reaction to the start of the rate-hiking cycle.

|

|

Mix shift

With deposits flowing out and banks happy to add margin-enhancing loans to their asset portfolios, banks continued to shed cash and securities, according to the weekly data. Cash fell 6.8% from June 29 to $3.156 trillion on Sept. 28 after seasonal adjustment, and securities holdings fell 2.6% to $5.627 trillion.

The loan growth and deposit declines have put upward pressure on loan-to-deposit ratios, though that key measure of liquidity remained well below pre-pandemic norms of more than 75% at 65.3% on Sept. 28, according to the seasonally adjusted weekly data. The data suggests that banks still have considerable excess liquidity cushions.

Still, other measures suggest that bank funding is tighter than it otherwise appears. An "enhanced" liquidity ratio representing cash and available-for-sale securities, which are relatively easy for banks to unload, as a percentage of earning assets had already fallen from a pandemic high of 37% to 21% in the second quarter across large-cap banks, KBW analysts said in Sept. 15 note.

The weekly data also shows banks looking to fund themselves with large time deposits, which tend to be relatively costly. Despite the overall decline in deposits, large time balances jumped 5.1% from June 29 to a seasonally adjusted $1.536 trillion at Sept. 28.

Raymond James analysts believe third-quarter earnings are likely to be the last to drive upward revisions in EPS estimates for most banks.

"You have several headwinds, most specifically in the form of deposit betas ratcheting up and the relative inability to pass" further rate hikes along to borrowers, Raymond James analyst Michael Rose said. Deposit betas are changes in deposit prices relative to underlying rates.

"It's just kind of the point where you're going to get to a peak in net interest margins likely in the first half of [next] year for most banks and then we'll likely roll over," Rose added.

|

* Listen to a podcast on how recessionary fears are keeping bank investors on the sidelines.

* Register for a webinar on the outlook for bank M&A

* Download a template to compare a bank's financials to industry aggregate totals.

Slower but strong lending

Industrywide loan growth was robust in the third quarter with a 2.5% increase from June 29 to a seasonally adjusted $11.686 trillion at Sept. 28. That includes a 3.1% increase in commercial and industrial loans and a 3.6% increase in credit card loans, which analysts said reflects inflation and use of savings by consumers who are continuing to spend.

Seasonally adjusted loans increased by a blistering 3.7% from March 30 to June 29.

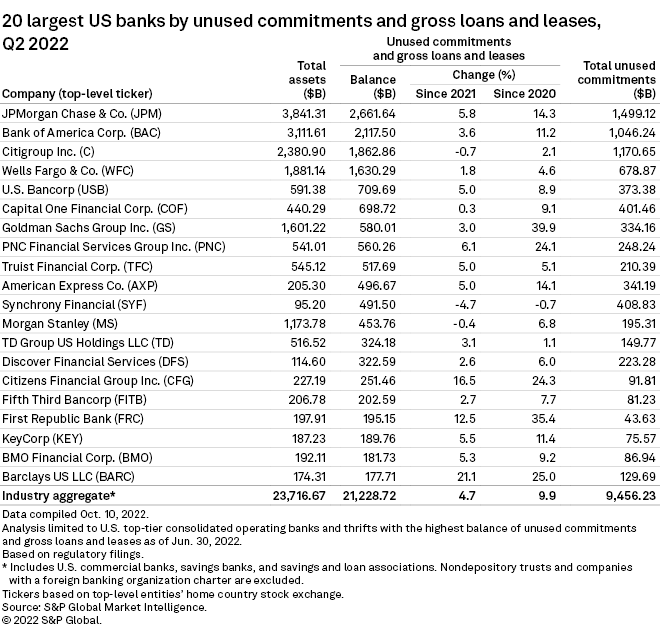

Banks have continued to increase unused credit lines, which grew 4.7% in the first half of the year to $9.456 trillion at June 30, according to S&P Global Market Intelligence data. They have also started to tighten commercial loan standards; institutions like Wells Fargo & Co. have said they expect growth to slow as the Fed hits the brakes.

While banks are being more cautious because of the potential for a recession, they are also continuing to benefit from borrowing by clients that would have issued securities in steadier market conditions, Marla Willner, head of commercial credit management and strategic initiatives at The Toronto-Dominion Bank said in an interview.

"There generally is a feeling that the economy is doing reasonably well," she said. "We certainly still have a lot of liquidity on our balance sheet and are looking to grow."

Investors are likely to be skeptical of banks that forecast accelerated growth to persist, however, according to Raymond James analysts.

"Higher paces of growth are becoming red flags given perceptions of 'buying' loans or stretching on credit," they said.

|