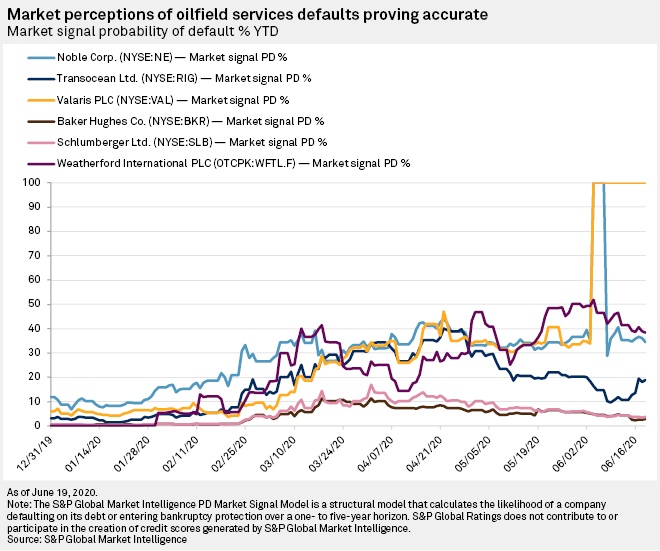

The short-term default risk for oilfield services and drilling companies is "very high," reflecting depressed industry conditions driven by the coronavirus pandemic, S&P Global Ratings said June 19. As companies across the sector look to restructure debt, offshore drillers are most at risk of default, the rating agency said.

Ratings said about 60% of its corporate ratings are speculative-grade, rated BB+ or below. Of those, about 85% are oilfield services and drilling companies, and 50% are rated CCC or below.

Oilfield services majors Schlumberger Ltd. and Baker Hughes Co., rated A and A-, respectively, and Halliburton Co., rated BBB+, are among the seven investment-grade companies in the sector. Transocean Ltd. and Weatherford International PLC, each rated CCC, and Valaris PLC, with a D rating, are among the 38 companies listed as speculative-grade by the rating agency.

The rating outlook is either negative or CreditWatch with negative implications for 80% of the companies.

"When the COVID-19 pandemic hit, the sector's credit quality was already on shaky ground," Ratings said. "Although market activity had picked up before the pandemic since the bottom of the cycle in 2016, [oilfield services] companies had never recaptured their pre-downturn margins and had weak credit metrics overall. The demand destruction from COVID-19 has only made the situation worse."

Moreover, Ratings expects spending on oil and gas exploration and production to fall 15% to 30% in 2020, deflating global demand for oilfield services, as producers sharply curtail capital expenditures for the balance of the year to protect cash flows and balance sheets.

International activity has been more resilient due in part to the long-cycle nature of projects, Ratings said. Still, Ratings said it expects international exploration activity to decline, particularly offshore, where low oil prices challenge project economics.

The rating agency said oilfield services companies are adapting by cutting costs and merging with peers to gain economies of scale. "These self-help measures are unlikely to be enough to meaningfully improve leverage without a recovery in overall demand," Ratings said.

Oilfield services and drilling companies entered 2020 with very high cash flow leverage, and the COVID-19 pandemic could push many into default as weak access to capital markets will make it difficult for the low-rated oilfield services companies to refinance debt.

"We believe offshore drillers, in particular, are likely to engage in debt restructurings we would view as distressed — thus tantamount to default — this year," Ratings said.