Wind turbines under construction near Biegen, Germany. Numerous renewables developers were bought in 2021 as Europe recorded €80 billion of M&A transactions.

|

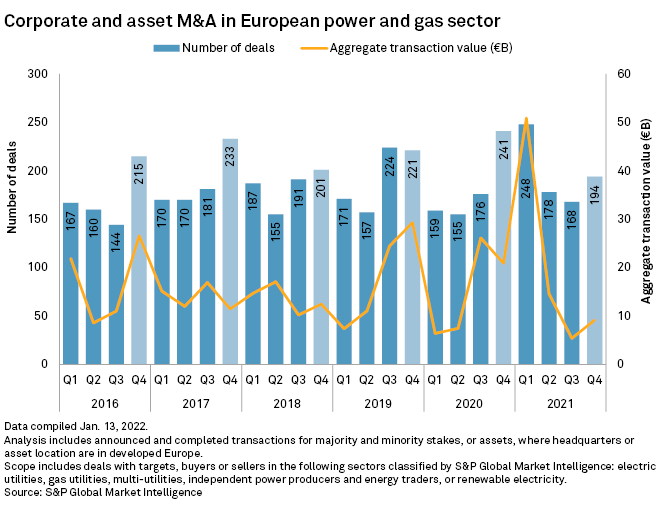

The acquisition of renewable energy developers with lucrative project pipelines helped propel European power sector deal-making activity in 2021 to its highest level in at least six years.

European power and gas companies announced or closed 788 M&A transactions during the year, according to S&P Global Market Intelligence data, with aggregate deal value close to €80 billion.

The early part of 2021 in particular saw frenzied activity, with the first quarter recording more M&A transactions than any of the preceding 24 quarters, driven in part by fallout from the pandemic.

Within 2021's total are numerous deals where utilities, oil supermajors or other investors acquired specialist renewables companies to gain access to experienced management teams and gigawatt-scale development pipelines.

"In 2021, the number of developers and technology providers that have been bought have represented a significant part of what we do," said Clément Weber of Green Giraffe, a financial advisory firm focused on renewables.

'Fierce' competition

Such deals included Engie SA partnering with Crédit Agricole Assurances SA to buy Spanish renewable power producer Eolia Renovables de Inversiones SCR SA, and Ørsted A/S taking over Brookfield Renewable Partners LP's onshore wind business in Ireland and the U.K. EDP Renováveis SA also made its first steps in the Asia-Pacific region, agreeing to acquire a majority stake in Singapore-headquartered developer Sunseap Group Pte. Ltd.

Financial players like J.P. Morgan Investment Management Inc., EQT Partners AB and APG Asset Management NV also took stakes in European renewables developers in 2021.

"Competition in the industry is fierce and more and more financial investors are willing to take more development risk," said Michael Ebner, managing director of sustainable infrastructure at KGAL Investment Management GmbH & Co. KG, which agreed in early January 2022 to buy half of German wind and solar developer GP Joule Projekt GmbH & Co. KG.

One difficulty with these kinds of transactions, however, is accurately valuing a project pipeline, especially if the target companies are active across multiple countries and have assets at different stages of development.

The value in a ready-made platform is in the experience of its management team and the expectation that a market will exist for its projects, according to Iñigo Asensio, managing director of M&A and investments at Matrix Renewables Spain SL, who said platforms are being traded at a "huge premium" as a result.

"The people have so much value that if tomorrow they leave the company, you lose your future," Asensio said in an interview. "That's the reality."

Future deal flow

Sustaining the level of deal flow surrounding traditional renewables platforms might be difficult in the near term given the level of consolidation that has already occurred across Europe.

"I don't see the right [operating] volume in the existing platforms today," Asensio said. "[They] need to become more mature in order for third parties to have the appetite to buy."

However, opportunities are now emerging in nascent sectors like floating wind, electric vehicle charging and other clean technology companies. "There is enough that is created — new companies, new pipelines, new ideas — that the number of platforms is still continuing to increase," Green Giraffe's Weber said in an interview.

New types of deals — beyond just traditional acquisitions — are also appearing, including early-stage partnerships combining smaller players and heavyweight investors.

"We see more and more M&A transactions that are ... almost cooperation agreements between a local partner that knows everything that needs to be done [in project development] and an international, deep-pocketed, strategic player," Weber said.

'Piles of cash'

Such opportunities could appeal to oil supermajors which, as a result of high gas and electricity prices, "are sitting on piles of cash" that needs to be invested, according to Sunny Aurora, a partner in the power and utilities team at consultancy EY.

"My personal view is that in the drive toward electrification, you will see a lot more investment [in renewables] from companies like these," he said in an interview.

The likes of BP PLC and TotalEnergies SE are going big on offshore wind and have also bought development companies in the past to organically grow their renewable power portfolios. The companies have targets to reach 50 GW and 100 GW of renewables capacity, respectively, by 2030.

Utilities and oil companies "can cover even more of the value chain" than purely financial investors, according to Francesco Cacciabue, partner and CFO at renewables fund manager Glennmont Partners, including areas like distribution and retail supply.

Buying or partnering with specialist development teams "gives them firepower in terms of megawatts," Cacciabue said in an interview.