When COVID-19 first swept through Europe, Ceská sporitelna a. s. knew it would have to improve its ability to sell products and service customers through online and mobile channels, Josef Boček, a strategy analyst at the Czech Republic's second-largest lender by assets, told S&P Global Market Intelligence.

The bank launched an exercise it labeled "new normal," adjusting existing objectives to rapidly shifting client demand and setting new targets for digital sales and servicing for the next 18 months. In 2021, Ceská sporitelna knows exactly how many digital products it wants to sell and how many services should be available online this year.

"All of that is already incorporated since the first wave of the pandemic. ... We, of course, weren't the only one. It was a similar exercise across the whole Czech banking sector," Boček said.

Czech banks stand out

While digitalization on the continent has been led by Western European countries — mainly from the Nordics, the Netherlands and the U.K. — central and Eastern European economies have been catching up in recent years and the Czech Republic is among the fastest transforming markets in the region.

The country ranked third, behind Denmark and the Netherlands, in the European Investment Bank's 2019-2020 digitalization index and was the best-performing nation in terms of "investments in software and data as well as in organization and business process improvements."

The nature of their domestic market, as well as the right combination of consumer demand, competitive pressure, infrastructure and financial power, sets up Czech banks to be at the forefront of CEE banking digitalization in the post-COVID-19 years.

The Czech banking sector is highly concentrated with the top three lenders — Ceskoslovenská obchodní banka a. s., Ceská sporitelna and Komercní banka a.s. — holding a combined market share of 61% at 2020-end, S&P Global Ratings credit analyst Cihan Duran said in an interview. This has given the banks enough pricing power to maintain profitability while investing in digitalization, Duran said. Higher interest rates in their home market also buoyed Czech banks' earnings in the years leading up to the pandemic.

Despite the negative impact of the pandemic, Czech banks are more efficient and profitable than many credit institutions across CEE and Western Europe, recording the sixth-lowest cost-to-income ratio and the seventh-highest return on equity in the EU and the European Economic Area in the fourth quarter of 2020, European Banking Authority data shows.

Banks in other CEE countries, such as Romania, Hungary and Slovenia, also ranked high in terms of profits and efficiency. This has been a key driver of faster digitalization across CEE because higher profits enabled many banks to invest more in IT and digital than some lenders in the West, according to S&P Global Ratings.

Digitally friendly

Like many banks across CEE, Czech institutions have often adopted new technologies faster and more smoothly than some Western peers. After the political and economic changes of the 1990s, banking in CEE "started almost from scratch," which made it easier for both lenders and their clients to embrace innovation, Pawel Rychlinski, CEE division president at Mastercard Europe, said in an email. "That is why in CEE countries contactless technology, among others, was so quickly and perfectly adopted, and why bank clients began to use the benefits of online and mobile banking so seamlessly."

Mastercard's recent Evolution of Banking Study found that 57% of Eastern Europeans are interested in new financial solutions, compared to 44% of Western Europeans. After COVID-19, 50% of CEE respondents said they will use online and mobile banking more frequently, versus 39% of consumers in the West.

Large Czech and Polish banks are among the most digitally advanced in Europe and are well prepared to offer product innovations in the future, according to S&P Global Ratings, though it warned that this will require heavy investment.

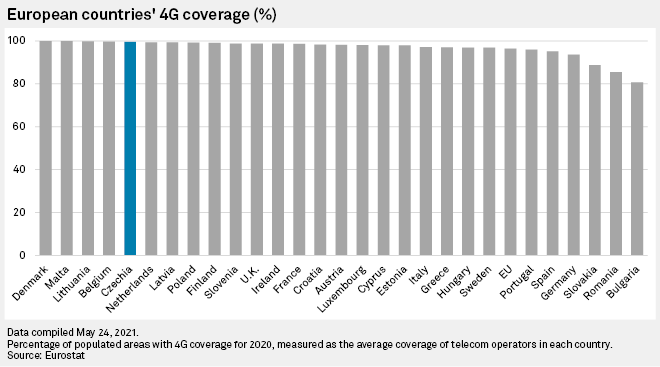

"Pushy" customers are an important driver of rapid digitalization as they put pressure on banks to innovate, according to Duran. In 2020, the Czech Republic ranked 10th in the EU by share of online banking users, ahead of all CEE countries and most Western economies, Eurostat data shows. The Czech Republic is ahead of almost all CEE countries in terms of overall internet usage with 84.7% of adults online, while its 4G coverage is well above the EU average.

Bank branch density in the Czech Republic was below most big EU economies and the bloc's average in 2019, and lenders accelerated the reduction of their physical networks during the pandemic in 2020. Given the already low branch density, "the whole sector is pretty much optimized," Ceská sporitelna's Boček said.

Future efforts, at his organization at least, will focus on adjusting branch services to the new digital paradigm and giving clients a reason to bank in person. For example, Ceská sporitelna is inviting clients for a one-hour interview to go over their transactional history, compare it to similar data for peer groups and offer advice on savings on various products, including utilities, Boček said.

Neobanks raise bar

Large incumbent banks in CEE cannot afford to miss a beat when keeping up with new technologies and changing client preferences because this could "put significant pressure on profitability or even threaten the viability of some banks' business models," S&P Global Ratings said in its analysis.

The growing strength of challenger banks puts further emphasis on continued digital investment. Moneta Money Bank a.s. is shaping up to be traditional lenders' top rival, especially since it announced its plan to merge with Air Bank a.s., which Duran said will create "a digital champion" in the Czech Republic.

"The Czech banking market remains highly competitive ... and as more clients are exposed to the convenience of online banking, the importance of digitalization as a competitive dimension will only increase," said Tomáš Spurný, CEO of Moneta, in an email.

Since April, Czech citizens have been able to use their banking credentials to identify themselves online, "which will dramatically simplify online know-your-customer procedures and open the way for another wave of innovation," Spurný said.