Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Sep, 2021

By Lauren Seay and Zain Tariq

Two U.S. banks crossed $10 billion in total assets during the second quarter.

Surpassing $10 billion in total assets is a critical point for U.S. community banks. The threshold comes with growing pains, such as the Durbin amendment, which limits the amount of interchange fee income an institution can collect, and increased scrutiny from the bank's existing regulator and new oversight from the Consumer Financial Protection Bureau, which drives up expenses.

Silvergate Capital Corp., which focuses on banking for digital currencies and the companies behind them, reported $12.30 billion in total assets as of June 30, up 58% from $7.76 billion in the first quarter and up 425% from $2.34 billion in the year-ago period.

|

Much of that growth was connected to rapid deposit growth the La Jolla, Calif.-based bank posted over the past few quarters: The company reported $11.37 billion in total deposits in the second quarter, a more than tenfold increase from $1.67 billion in the second quarter of 2020. The company deployed some of those deposits by purchasing interest-earning assets, including $4.5 billion of short- and long-term securities during the second quarter, President and CEO Alan Lane said during the company's most recent earnings call.

Silvergate's available-for-sale securities skyrocketed to $6.18 billion as of June 30 from $939 million as of Dec. 31, 2020, according to its latest Form 10-Q.

Average deposits from digital currency customers totaled $9.9 billion in the quarter, up $3.5 billion from the prior quarter, largely due to the Silvergate Exchange Network, the company's proprietary payment network for participants in the cryptocurrency industry.

Despite a hot-and-cold start to the year for bitcoin, in which the largest cryptocurrency by market cap saw both increasing mainstream interest and plummeting prices, Silvergate saw a boom in activity. That held true even during the second quarter, when the price of Bitcoin tanked by nearly half.

The second quarter "should serve as a notice for investors who believe that [Silvergate] is tied to Bitcoin," Compass Point analyst Michael Del Grosso wrote in a July 20 note. "Fundamentally we believe this is misplaced and [the second quarter] is evidence that it can grow through periods of market turmoil."

Silvergate declined to comment for this story.

The only other bank to cross the threshold during the quarter was Fargo, N.D.-based State Bankshares Inc. Many community banks experienced rapid asset growth since the second quarter of 2020 as a result of the Small Business Administration's Paycheck Protection Program and an influx of deposits that has yet to subside.

Despite a 45% quarter-over-quarter decline in its PPP loans, State Bankshares reported $10.31 billion in total assets during the quarter, up from $8.25 billion in the year-ago quarter.

|

In November 2020, the Federal Reserve, Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency came together to offer temporary relief for community banks whose assets ballooned throughout the pandemic. Banks have until the end of this year to shrink back below $10 billion in order to not become subject to the Durbin amendment at June 30, 2022.

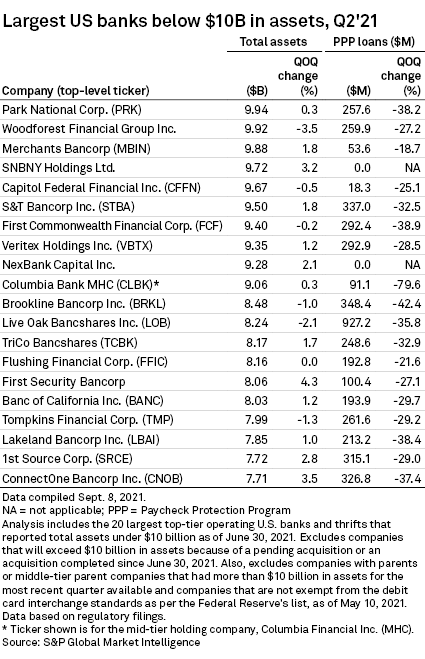

Ten community banks hovered right below the threshold with at least $9 billion in total assets in the second quarter. Newark, Ohio-based Park National Corp. was just shy of $10 billion, with $9.94 billion in total assets as of June 30.

Banks often opt to leap above $10 billion in total assets through M&A in order to offset the lost revenue from decreased interchange fee income and increased expenses from increased regulation. Three community banks are expected to cross the threshold as a result of M&A: Stuart, Fla.-based Seacoast Banking Corp. of Florida, Dallas-based First Foundation Inc. and Southern Pines, N.C.-based First Bancorp

Seacoast announced in August two bank acquisitions at once, which will position the bank around $10.5 billion in total assets upon closing. The two deals will provide an aggregate of $14.5 million in pretax income and provide a 60% offset of the financial impact from the Durbin amendment, President and CEO Chuck Shaffer said on a conference call to discuss the deal.

"We expect the remaining 40% to be resolved through further acquisitions in our target Florida markets," he said.