Banks working with cryptocurrency companies are largely sticking with the asset class even after a turbulent second quarter that sapped valuations.

Liquidity tightening among crypto lenders in the second quarter gave the banks that work with them a stress test at first hand, and executives said they learned from the events to adjust their risk appetite and better understand crypto companies' level of resiliency. Several reported that the growth of new customers in crypto offset the impact of the unfavorable market shocks.

"I do think there is a lot more room for the market to experience volatility and drop. That being said, it becomes a really good opportunity for a bank like ours, in that for us partnerships are paramount in this space," Sahil Goswami, head of crypto and web3 at MVB Bank Inc. said in an interview. MVB Bank is a unit of MVB Financial Corp.

MVB will continue to form partnerships with crypto companies that can prove to succeed in this bear market, Goswami said. In digital assets, MVB is heavily focused on facilitating payments, such as helping companies to pay their employees in bitcoin, MVB Financial COO John Marion said in a joint interview.

The market capitalization of crypto has plummeted to $1.093 trillion on Aug. 9 from nearly $3 trillion in November 2021, according to CoinMarketCap.com. The decline came as the collapse of algorithm stablecoin pair LUNA tokens and TerraUSD in May triggered the insolvency of crypto hedge fund Three Arrows Capital Pte. Ltd. Lenders to the hedge fund including Voyager Digital Ltd. and Celsius Network Ltd. also filed for bankruptcy.

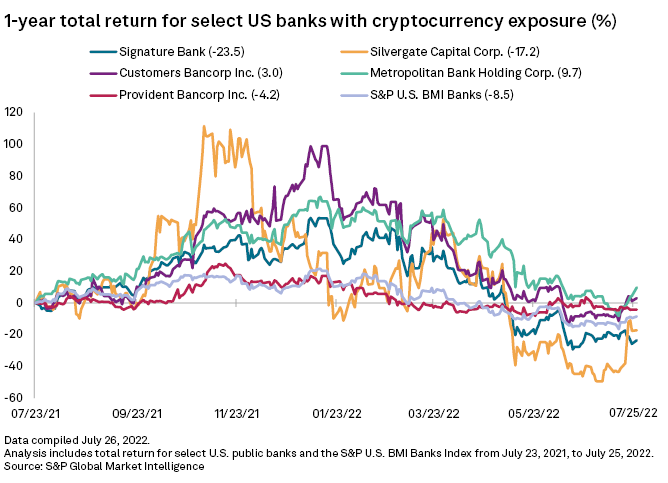

As events started to unfold in May, shares of Silvergate Capital Corp. and Signature Bank plummeted. The stock price of Metropolitan Bank Holding Corp. and Customers Bancorp Inc. also dropped more sharply than the benchmark around the same time, according to data compiled by S&P Global Market Intelligence.

The banks' valuations fell because digital assets, with reduced market capitalization, are now a smaller asset class for which to provide banking services, Ian Epstein, CEO of brokerage Enigma Securities, said in an interview.

"I would argue that that's a very different situation than banks taking any kind of real balance sheet hit, or any kind of need to provision for losses," Epstein said.

Extra caution on loans, deposits

Banks' economic attraction to digital assets stems mainly from fee income generated from treasury management services for crypto companies and facilitating payments between fiat currency and crypto. Banks also grow deposits by providing crypto companies with noninterest-bearing depository accounts. A handful have been exploring the potential to add net interest income under the current regulatory framework, by accepting bitcoin or ethereum as collateral for loans.

Some banks began taking extra caution in the second quarter. Signature Bank and Customers Bank said they slowed the processes of underwriting loans collateralized by crypto. Silvergate Capital Corp., however, grew such loans by 28% to $1.4 billion in the second quarter.

The liquidity issues that spread quickly among nonbank lenders, such as Voyager and Celsius, underscored the importance of disciplined and thoughtful lending practices, executives said.

"It's these nonbank lending platforms that were in many cases offering enhanced yield on crypto assets, in ways that they wouldn't be able to if they were a bank," Adam Waite, managing director at D.A. Davidson & Co. focused on blockchain and digital assets, said in an interview.

Nonbanks' lending practices in crypto are an opaque market at the moment as a result of a lack of transparency on credit counterparties and a more aggressive use of financial leverage, Waite said. Lenders to crypto companies will have to take lessons from their second-quarter stumbles, he said.

On the deposit side, Metropolitan Commercial Bank has an internal policy to keep the mix of deposits collected from digital asset clients under 50% of the total available for investment or lending. But it has opted to maintain 100% of those deposits in its Federal Reserve account in light of the recent market turmoil, the bank's president and CEO, Mark DeFazio, said during an earnings call July 22.

The extra caution on deposits came as Metropolitan has pivoted away from actively growing its crypto business, "with the caveat that we were well-positioned to benefit from volatility without putting the bank at undue risk," DeFazio said during the call.

In the case of a broad liquidity tightening, "Certainly from a financial risks perspective, probably our biggest concern is that one of our crypto customers experiences substantial shock ... and a huge amount of deposits runs off the balance sheet quickly," Customers Bank's head of digital banking, Christopher Smalley, said in an interview.

The bank's total demand deposits increased by $4.4 billion, or 64.0% year over year to $11.3 billion in the second quarter. About half of the deposit growth was driven by its blockchain payment network, according to an earnings release. As the crypto market is more stabilized, Customer Bank has resumed talks to take crypto-backed loans.

Consumer protection another focus

Besides the risks involved in commercial banking for crypto companies, banks also face compliance risks related to the crypto companies' interactions with customers.

On July 28, the Federal Deposit Insurance Corp. and the Federal Reserve Board issued a letter asking crypto lending platform Voyager to cease false promises saying Voyager is insured by the FDIC. While Metropolitan Commercial Bank holds Voyager's customers' funds, the FDIC insurance protects the funds against the failure of the bank, rather than Voyager.

Consumers buy crypto on Voyager's platforms and lend their digital assets to Voyager for higher yields on their holdings. The features fit the description of a retail non-deposit investment product, and regulators have made clear that the disclosures should say that the product is not FDIC-insured and there is a risk of loss, said Jonah Crane, partner at advisory and investment firm Klaros Group.

“It's clear that the regulators have been focusing on this issue generally. They had heightened concerns about some of the crypto products they saw,” Crane said.

MVB Bank applies extra diligence on compliance for its offerings to crypto companies in contact with consumers, Marion said. MVB uses Mastercard Inc.'s crypto intelligence unit CipherTrace Inc. to evaluate the adequacy of crypto exchanges' know-your-customer functions, and uses Blockchain Intelligence Group to help monitor suspicious activities on exchanges.

"We wanted to be extra careful, so that we avoided a Voyager-type situation where there is regulatory uncertainty around what was FDIC insured, what the customers' perception of that was," Marion said.