S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Private equity investment in North America's renewable energy sector is on the rise, a trend that is likely to gain momentum with the recent passage of landmark climate legislation in the U.S.

The Inflation Reduction Act, or IRA, signed into law Aug. 16 by President Joe Biden contains $369 billion for domestic clean energy and climate priorities over the next decade. But the real game-changer for private equity is how the law handles the tax credits that entice investment in renewable power and other technologies intended to cut planet-warming carbon emissions.

The law not only adds new credits, it creates a stable 10- to 15-year runway for investment by extending the lifespan of existing credits, said Michael Masri, a partner at Kirkland & Ellis LLP who specializes in tax law and renewables. That is a big change from the past, when credits often ran for just a year or two and were subject to frequent renewal.

"People want to invest long term, and it's very hard, given what they've been doing historically, getting people comfortable that they could really hire people, invest in this space and know — with some level of stability — these credits will be around," Masri said.

Private equity has noticed.

Read more about what TPG Inc. Executive Chairman James George Coulter had to say about the IRA's impact on the firm's existing and future investments in clean energy businesses.

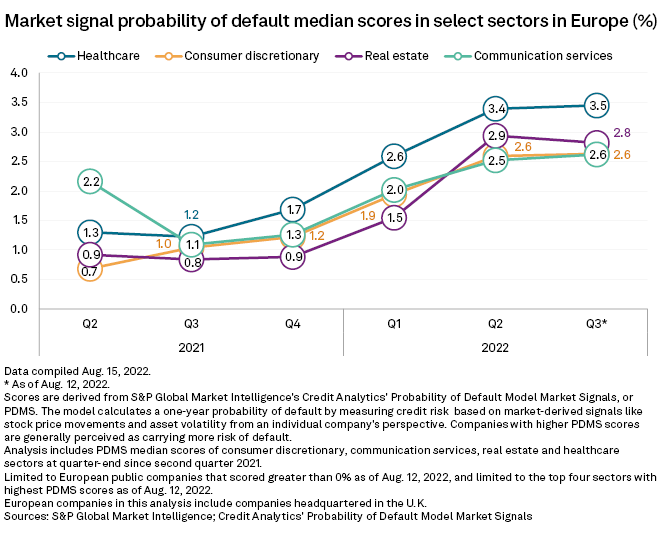

CHART OF THE WEEK: Tracking default risk in Europe

⮞ Sector risk puts downward pressure on company valuations, and a recent analysis used the probability of default to suggest Europe's riskiest sector is healthcare.

⮞ Additionally, the euro remains close to parity with the U.S. dollar, creating an opportunity for private equity to invest at a discount.

⮞ S&P Global Market Intelligence went searching for clues to where those discounts might be found and uncovered 10 private healthcare companies with the highest revenue growth over the last three years and more short-term debt than assets.

DEALS AND FUNDRAISING

* Apollo Global Management Inc.-backed Yahoo Inc. purchased Factual Inc., an algorithm-based news rating company.

* ManTech International Corp. shareholders approved the planned takeover of the company by The Carlyle Group Inc. at $96 per share in cash. The target company provides technologies and solutions for mission-critical national security programs. The deal is expected to be completed in the week of Sept. 12.

* Baypine LP closed its first private equity fund, BayPine Capital Partners Fund I, above the $2.0 billion target, raising about $2.2 billion.

* Ardian collected $2.1 billion in capital commitments for Ardian Americas Infrastructure Fund V LP, its latest U.S. infrastructure fund.

* Hamilton Lane Inc. concluded its largest-ever private credit fund, Hamilton Lane Strategic Opportunities Fund VII LP, with about $953 million in capital commitments.

ELSEWHERE IN THE INDUSTRY

* SK Capital Partners invested in VanDeMark Chemical Inc., which produces life sciences chemical intermediates and derivatives. Comvest Partners, an existing investor of VanDeMark, will continue to co-own the business. Also, SK Capital sold specialty polymer producer NuCera Solutions LLC to Chase Corp.

* BC Partners and Pollen Street Capital Ltd. postponed their plans to sell U.K.-based lender Shawbrook Bank Ltd., London's Financial Times reported. The private equity owners, which were targeting a price of about £2 billion, could revisit a sale in 12 or 18 months, people with knowledge of the matter told the publication.

* Ampersand Management LLC and a biotechnology investor closed the acquisition of Australian biopharmaceutical contract development and manufacturing organization Luina Bio, which changed its name to AcuraBio.

FOCUS ON: FINTECH

* Ares Management Corp. unit Ares Wealth Management Solutions LLC expanded its partnership with global financial technology platform Institutional Capital Network Inc., or iCapital. The expanded partnership gives financial advisers increased access to Ares' alternative investment solutions.

*Drawbridge, which provides cybersecurity software and services to the financial services sector, received a capital injection from Francisco Partners Management LP. Existing investor Long Ridge Equity Partners LLC and Drawbridge's leadership team will keep a significant stake in the company.

* Oakley Capital Investments Ltd. provided a follow-on investment to Italian insurance brokerage and online price comparison platform Facile.it SpA.