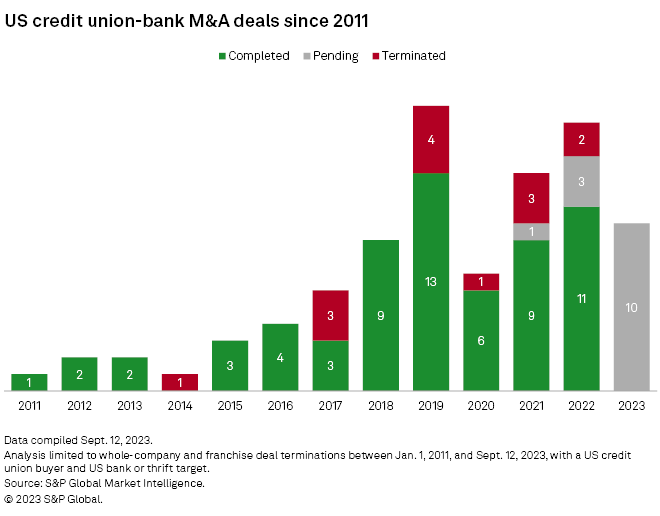

Credit union acquisitions of banks have accelerated in the past decade, but not all of those deals make it across the finish line.

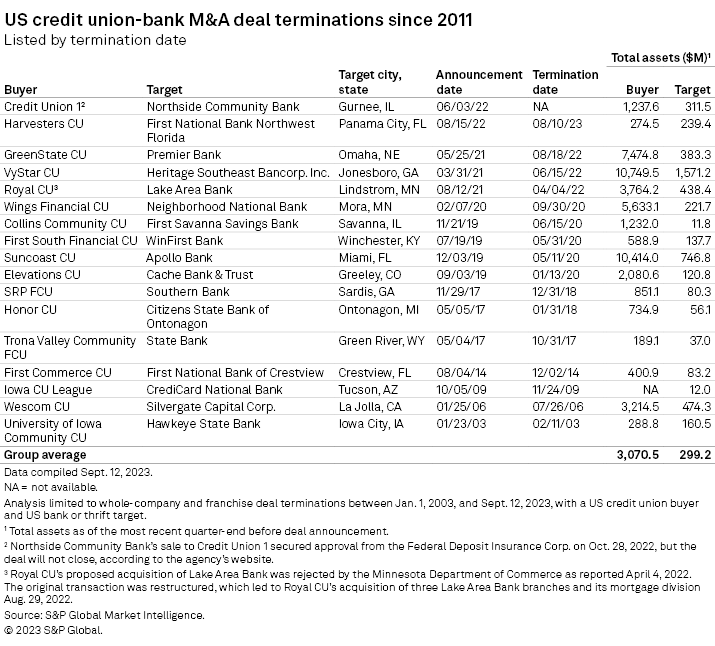

Since 2011, credit unions have announced 91 bank acquisitions, but 14 of those, or over 15%, fell apart. During the same period, the rate is much lower for deals between two banks with just 3.8% of the more than 2,700 announcements being terminated.

Still, similar to traditional bank deals, some recent collapses have been the result of the macroeconomic environment in which interest rates have risen rapidly and distorted deal math, advisers said. Regulatory hurdles could also be the culprit for some terminations, as multiple advisers also noted that regulators' reviews of these deals have become more stringent.

"It's a little bit more difficult on the regulatory front," Charley McQueen, president and CEO of McQueen Financial Advisors, said in an interview. "They're all looking at the same thing and making sure it's the right thing to do and no one is going to be put in a bad position. No one wants to come out of a transaction and have a tough capital position or a bad earnings structure."

Capital and liquidity are major focuses for the regulatory agencies that have to approve these deals, which include both the National Credit Union Administration and the various relevant banking agencies, both federal and state.

One way a credit union can ensure its capital position is strong is through subordinated debt, but they should avail themselves of that funding before striking the deal, instead of after regulators raise issues, advisers said.

"You're a much more solid buyer by having something on your books ahead of time and a deal is not subject to you raising sub debt," McQueen said.

VyStar CU raised $200 million in subordinated debt in 2022, the largest ever such raise by a credit union, as it waited for regulatory approval of its now-terminated acquisition of Heritage Southeast Bank. An analysis by S&P Global Market Intelligence in June 2022 found that the raise might have been done to help the pending transaction gain regulatory approval by ensuring Vystar CU's net worth ratio remained well above regulatory standards, but the deal eventually was terminated due to regulatory hurdles.

Regulators are also zeroed in on interest rate risk management.

"We're really seeing a higher level of scrutiny on overall interest risk management component of the transaction," McQueen said. "They really want to see the combined entity and the true risk that they have. I think a chunk of that is to really validate the forward earnings."

A deal might also raise red flags if the two institutions are similar sizes, according to Tom Rudkin, DD&F Consulting Group Principal.

"If the credit union tries ... buying a bank that's one-third the size or higher, that will really attract a lot of scrutiny by the regulators to see if it really is going to make sense," Rudkin said.

Harvesters CU and First National Bank Northwest Florida announced their tie-up in August 2022, and the two companies were similar in size: Harvesters CU reported $274.5 million in total assets as of June 30, 2022, while First National Bank Northwest Florida reported $239.4 million as of the same date, according to S&P Global Market Intelligence data.

That deal fell through this year, and now First National Bank Northwest Florida is set to be acquired by Innovations Financial CU, which had $399.8 million in assets at June 30, compared to the bank's $169.2 million at the same date.

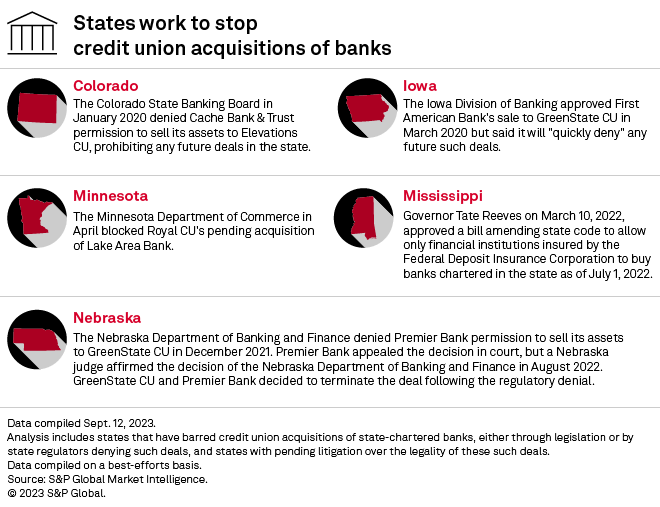

States stifle

At least four of the 15 deals that have fallen apart since 2011 are the result of state regulatory agencies not approving the deals. That was the case in Colorado, Nebraska, Iowa and Minnesota.

It is rare that federal regulators will shoot down a deal, but state agencies "can choose to be susceptible to politics and create issues," said Michael Bell, partner and co-leader of the financial institutions practice at Honigman LLP. The banking industry is largely against these deals, arguing that credit unions' tax-exempt status gives them an unfair advantage in M&A.

As such, it can be a risk to be the first credit union and bank to strike one of these deals in a state, advisers said. The key to avoiding this issue is to have an open dialogue with regulators.

"Pre-conversations [with regulators] have really improved," McQueen said. "There was an assumption that it would get approved before and now it's not just an assumption, it's validated ahead of time."