Credit Suisse Group AG will embark on yet another strategy review, this time under a new chief, following a string of losses caused by scandals and exacerbated by market pressures.

The embattled Zurich-based bank is replacing CEO Thomas Gottstein with Ulrich Körner on Aug. 1 as it implements a "comprehensive strategic review." The fresh revamp builds on one launched in November 2021, and aims to create "a more focused, agile group" with a significantly lower cost base, according to a July 27 release.

"The priority ... will be to enhance our positions in wealth management, the Swiss bank and asset management, while considering options for fundamentally reshaping the investment bank," Chairman Axel Lehmann said during an analyst and investor earnings presentation. He said the review would be "bold", "deep" and "far-reaching", but also done in a "reasonable way."

Transforming the loss-making investment bank into a "capital-light" business formed a key point of the new strategy review. The November 2021 strategy envisaged significant capital shifted out of the division and funneled mostly to the flagship wealth management business. Credit Suisse has already achieved the release of capital, Gottstein said.

Executives did not directly answer a question about a potential further shrinking of the investment bank, saying only that the business will be transformed.

Credit Suisse will explore "strategic options" for its securitized products business, including opening it up to third-party capital. Such an action will allow the business, which has roughly CHF20 billion of risk-weighted assets, to maximize its franchise's potential, according CFO David Mathers. The business has yielded returns consistently exceeding the cost of capital, Mathers said, without disclosing further details about the business' financial performance.

There would be appetite if the bank followed the third-party capital route, according to Mathers. “I’ve already received one e-mail this morning,” he said.

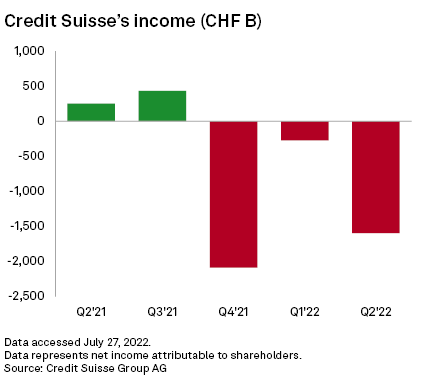

'Disappointing' Q2

Credit Suisse posted a CHF1.59 billion second-quarter loss, its third consecutive quarterly loss, which executives repeatedly called "disappointing."

"The result reflects weak customer flows and ongoing client deleveraging amid heightened market volatility," said CFRA analyst Firdaus Ibrahim in a note, singling out the investment bank as the "main culprit."

Pretax losses at the investment bank were CHF1.12 billion, widening year over year from CHF16 million, amid a slowdown in market activity, as well as lower fixed-income sales and trading. Net revenues slid 40% to CHF1.11 billion from the year-ago CHF1.84 billion.

"It is important to remember that our franchise mix, which particularly benefited us in a year like 2021, has been much less supportive in the recent environment given our much more limited exposure to macro and rates, as well as commodities," Gottstein said.

The wealth management business also swung to a pretax loss of CHF96 million from year-ago income of CHF770 million amid lower recurring commissions and fees and transaction- and performance-based revenues.

A turbulent period

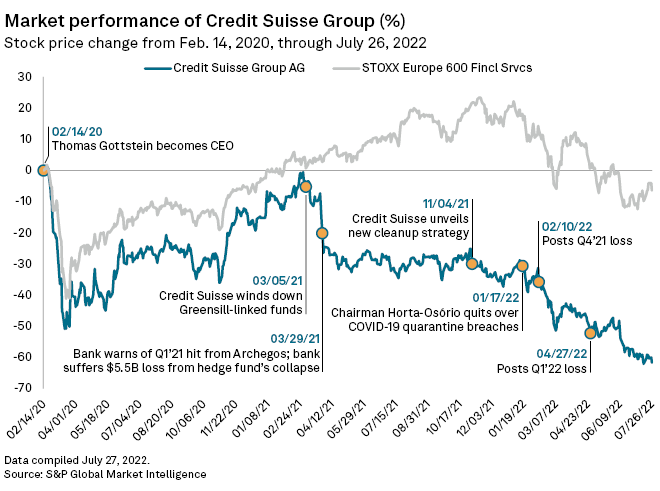

Gottstein took on the role of Credit Suisse's CEO in February 2020, just before the onset of the COVID-19 pandemic. He had to steer the bank through a turbulent period that included fallout from the collapse of hedge fund Archegos Capital and trade finance-focused Greensill Capital (UK) Ltd., to which it was exposed. Credit Suisse shares have lost more than 60% since his appointment.

"[For] personal and health-related considerations … I concluded that now would be the right time to step aside and clear the way for new leadership," Gottstein said in a statement. He will be replaced by Körner, who currently heads the bank's asset management division and has spent time at rival UBS Group AG.

The CEO change will further delay Credit Suisse's turnaround due to a potential new strategy following the strategic review, according to Ibrahim at CFRA, which reiterated its "sell" opinion on the bank's shares.

Credit Suisse's "recent track record of poor management appointments also does not inspire confidence," Ibrahim said.