With yields in developed markets having nowhere to go but up, credit investors are looking further afield.

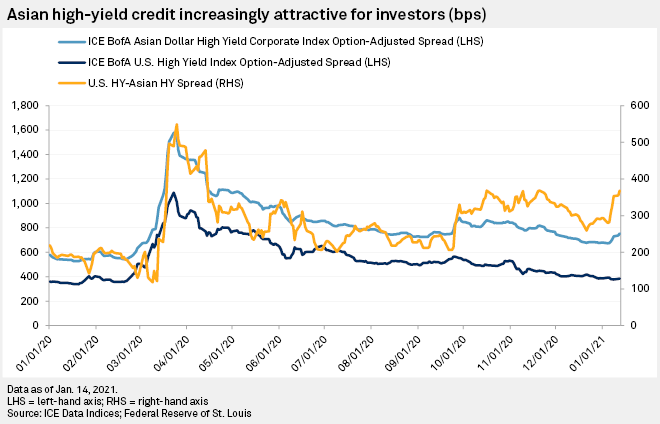

Ultra-loose monetary policy has pushed yields in the U.S., Europe and Japan below levels seen before the coronavirus pandemic, and there may be little juice left in the lemon, even in the sub-investment grade space. However, high-yield investors willing to take a risk on Asia can earn an average of 368 basis points more than they can on equivalent dollar debt in the U.S., close to the most since April, and about 150 bps more than pre-COVID-19.

Asian countries have not only dealt with the pandemic more successfully than most Western nations, but they have also relied less on central bank largesse to support their economies, leaving rates relatively high as growth has picked up.

However, potential investors need to navigate a growing tolerance for defaults from the Chinese government and a swath of Trump-era regulation that has made it harder to invest in the region's largest economy.

"We see continued interest into Asia credit in this coming year, driven by higher growth, better corporate fundamentals, and cheap valuations," Stephen Chang, portfolio manager, Asia at PIMCO said by email. "Asia stands out both in terms of spreads vs. U.S. and Europe as well as versus its own history. Given easy monetary policy globally, liquidity is high and demand for income remains in force."

The ICE BofA Asian Dollar High Yield Corporate Index Option-Adjusted Spread was 753 basis points as of Jan. 12, as opposed to 385 bps for the equivalent U.S. spread. The Asia premium of 368 bps has risen dramatically in recent weeks, having been 259 bps on Dec. 21.

"The Asian economy, in general, is in a better shape so an investor in credit will look for a more benign macro setup and stronger growth fundamentals," Tracy Chen, a portfolio manager at Brandywine Global investment, said in an interview. Chen noted, "it's not just yield, I think the macro setup is attracting investors."

China's economy has rebounded from its first contraction on record in the first quarter of 2020, growing 3.2% and 4.9% YOY in the following two quarters, respectively. Its trade surplus reached a record $78.17 billion in December 2020.

PIMCO forecasts that by the end of 2021, Chinese GDP will be almost 15% above its 2019 level. By contrast, the U.S. will only have just reached parity with the pre-pandemic level.

"Given prospects of a weaker U.S. dollar in 2021 and a 'lower-for-longer' interest rate environment, we expect inflows into emerging market Asia credit to continue," PIMCO strategists wrote in a credit outlook.

Chinese property, Indian banks

The offshore Asian market primarily consists of Chinese property developers, Indian banks, Indonesian industrials and occasionally Filipino banks. The biggest opportunity is in Chinese real estate developers, which Chen notes is a $1 trillion market.

"The lion's share is the Chinese real estate and Chinese banks," Chen said. "The big four banks [Industrial & Commercial Bank of China Ltd., China Construction Bank Corp., Agricultural Bank of China Ltd. and Bank of China Ltd.] have pretty solid balance sheets. The Chinese developers are investment grade, double-BB and single-B rated so you can buy different quality."

Among the higher-rated companies, BBB-rated bonds of property developers Longfor Group Holdings Ltd. and Sino-Ocean Group Holding Ltd. are yielding over 4% while BB-rated bonds are giving yields in the mid- to high single digits.

Even higher yields are available for those willing to go further down the ratings scale.

14% yields

Single B-rated companies such as China Evergrande Group — China's second-largest property developer rated B+ by S&P Global Ratings — are offering significant returns for relatively short periods of risk. A $1.5 billion bond with a maturity date of June 28, 2021, is yielding 14.4%, though Chen suggests such a low rating "might be too volatile for investors."

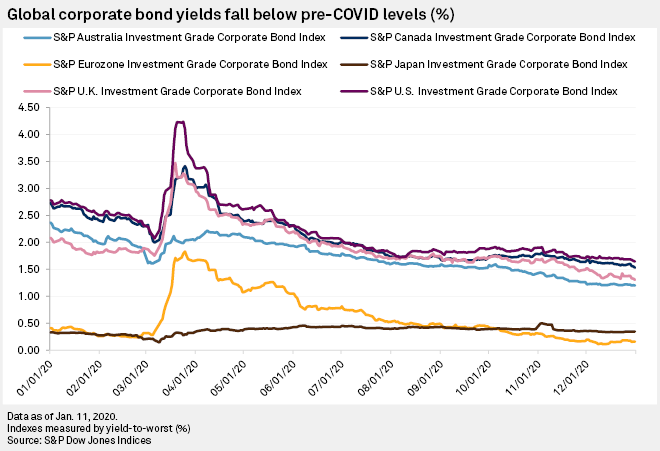

The yield-to-worst for the S&P U.S. investment-grade corporate bond index ended 2020 at just 1.64%. This compared with 2.78% at the start of the year as the Fed slashed rates, ramped up asset purchases and became a backstop of demand for both investment-grade corporate bonds and fallen angels.

The S&P Eurozone Investment Grade Corporate Bond Index yield-to-worst fell to 0.15% by the end of the year, having started at just 0.41%. While in Japan the yield was pretty stable, finishing the year at 0.35% having started at 0.33%.

The more attractive yields in Asia have already started attracting foreign capital. Emerging market securities inflows were about $45.9 billion in December, according to the Institute of International Finance, of which $16.6 billion was debt.

"These results have made the fourth quarter of 2020 the strongest quarter for emerging market inflows since just before the 'taper tantrum,'" Jonathan Fortun, an economist at IIF, wrote in a research note, referencing the market panic in 2013 after the Federal Reserve announced it would begin easing its quantitative easing program. "The main driver for this recovery is the impressive performance of China debt flows, along with the recovery of all other asset classes."

Chinese authorities want to tempt foreign investors into the $15 billion onshore market, home to names such as Alibaba Group Holding Ltd. and Tencent Holdings Ltd., but Chen expects many investors will be scared off by the U.S. government's antipathy to Chinese companies.

Rising defaults

China is expected to see more defaults in 2021, but a bigger concern for investors will be U.S. policy toward China.

The Chinese authorities had been allowing companies to default in recent years as Beijing attempted to defuse the debt bomb that has grown in the nonfinancial corporate sector where debt had swollen to 260% of GDP. Efforts to reduce debt were set aside during the pandemic, but with the economy rebounding, Beijing is returning to its policy to deleverage the corporate sector which is expected to result in more defaults.

Goldman Sachs expects the default rate in the domestic Chinese corporate bond market to rise from two per month in 2020 to three-to-four a month in 2021, similar to levels seen in 2018 and 2019. However, the bank anticipates the default rate on the offshore China high-yield market to drop to 4.3% in 2021 from 4.9% in 2020.

A bigger concern for investors is the dim view the U.S. government may take on a flood of capital into China.

China policy fears

On Nov. 12, 2020, U.S. President Donald Trump signed off on an executive order forbidding U.S. investment in Chinese companies that have connections to the state military. Goldman Sachs estimates that $77.5 billion of China offshore bonds could be out of bounds to U.S. investors.

But with Biden taking over at the White House on Jan. 20, a more predictable administration is expected.

"All eyes will be on the new Biden administration and what issues, especially on the foreign policy front, his appointees will prioritize," said PIMCO's Chang. "It is anticipated that policy actions will be more measured and widely consulted, thereby providing a more stable framework for investors that may ultimately reduce the tail risks that were experienced during the Trump era."