| Republican presidential candidate Vivek Ramaswamy talking at an Iowa event April 22. The founder of an investment firm with an anti-ESG strategy, Ramaswamy has been pitching his business to red states over the past year. Source: Scott Olson/Getty Images News via Getty Images |

Five weeks into his campaign, Republican presidential hopeful Vivek Ramaswamy testified before South Carolina lawmakers in support of a bill that could benefit the investment firm he co-founded less than a year earlier.

Ramaswamy has made a name for himself in Republican-controlled states as a crusader against what he calls a "cartel" of Wall Street firms seeking to control the US economy with liberal social policies.

"States and other actors across the country need to apply even greater safeguards to make sure that retirees' money is indeed protected, being invested exclusively for the objective of maximizing financial return," Ramaswamy told South Carolina lawmakers in late March as he testified in favor of House Bill 3690, known as the ESG Pension Protection Act.

South Carolina is one of more than 30 states that in 2023 have introduced or enacted legislation prohibiting their state pension funds from considering environmental, social and governance factors when making investment decisions, according to a running tally by the law firm Ropes and Gray.

Waiting in the wings is a growing crop of investment companies that, like Ramaswamy's Strive Asset Management LLC, align with anti-ESG sentiments and the broader conservative activist wave sweeping parts of the US.

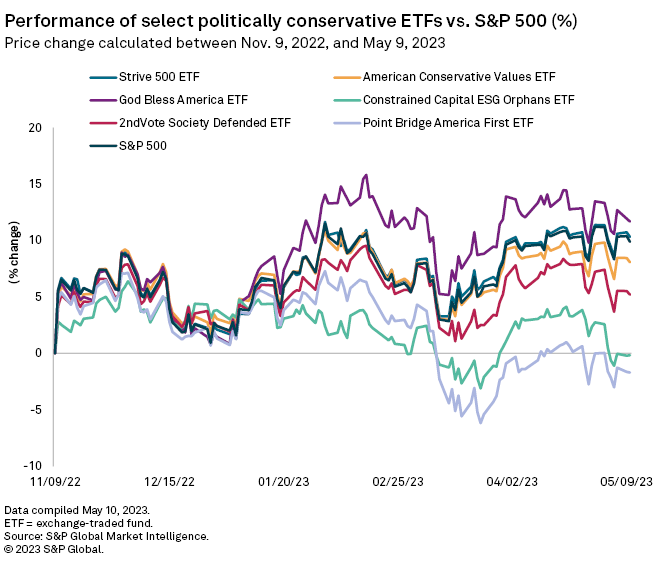

Other firms with targeted exchange-traded funds competing in this market segment include ETF Opportunities Trust - American Conservative Values ETF, Tidal ETF Trust - God Bless America ETF, the Constrained Capital ESG Orphans ETF, 2nd Vote Advisers LLC and Point Bridge Capital's MAGA ETF.

All but one launched since 2020, largely coinciding with the growing backlash against ESG investment criteria. As a group, their performance has been mixed, as shown by the graphic below.

"We try to exclude companies that we think have historically been hostile to conservative values, without sacrificing performance," William Flaig, the founder and CEO of American Conservative Values ETF, said in an interview. "It's not the sneakers or the coffee, it's the corporate culture and how they position their products."

The 34 large companies his firm has explicitly refused to invest in include Nike Inc., Starbucks Corp., Amazon.com Inc. and Walt Disney Co., corporations Flaig said consistently overlook values held by conservative investors. Flaig said Nike was the "straw that broke the camel's back" when the company in 2018 renewed an ad campaign with the National Football League's Colin Kaepernick, who had protested racial injustice by kneeling during the playing of the national anthem. Nike did not respond to a request for comment.

American Conservative Values' largest holding by market value, according to its annual report ending July 31, 2022, was Microsoft Corp.

Clients with 'billions in capital'

Strive, the investment firm Ramaswamy helped found in May 2022, has received more publicity than its peers in the anti-ESG space, and the firm has grown fast. As of April 24, Strive — backed by billionaire investors Bill Ackman and Peter Thiel — had amassed about $686 million of assets under management, according to Anson Frericks, the firm's president.

And Strive is branching out. In November 2022, the company's new advisory services arm clinched a deal to provide ESG consulting services to the Indiana Public Retirement System, according to a partly redacted copy of the contract obtained from the system by S&P Global Commodity Insights via a public records request. Ramaswamy was initially listed as one of the consultants earning $4,000 an hour for ad hoc services, the Indiana Capitol Chronicle reported. He stepped away from Strive's operations when he announced his presidential run in February.

Frericks said in a recent interview that the company is in talks with more than five other states that, like Indiana, are more interested in getting proxy voting advice than they are in shifting investments. This came after state legislatures also cracked down on perceived bias in companies that have historically helped state pension funds manage their shareholder votes, such as Institutional Shareholder Services (ISS) and Glass Lewis.

Since January, Strive has also been offering its own voting recommendations for institutional shareholders, which clients access on the third-party platform ProxyEdge. Unlike those of ISS and Glass Lewis, Strive's recommendations are void of "environmental, social or political objectives," according to the company's marketing material.

"If they don't buy our [exchange-traded funds], they can access all of our recommendations, so that's a nice line of business as well," Frericks said. "It started this year, and we're already representing clients with billions of dollars of capital with our voting recommendations."

Some states receptive to message

Strive has been the most visible of investment firms with an anti-ESG and conservative agenda, in no small part because of Ramaswamy's energetic networking with states willing to listen to his warnings about the influence of large asset managers such as BlackRock Inc. and leading proxy advisory firms such as ISS and State Street Corp.

"I've traveled the country to meet with state pension funds, treasurers, and corporations. It is staggering how much influence BlackRock & ISS have wielded over these institutions," Ramaswamy said in a Jan. 23 tweet. "They captured the system in red & blue states alike. Time to bring new alternatives to the table."

States proved receptive to Ramaswamy's pitch. In June 2022, for example, Ramaswamy was invited by the Missouri State Employees' Retirement System to speak to the pension plan's board of trustees about ESG for a 45-minute session during an internal educational day. At the same time, Strive has marketed its alternative "non-political" services and material to states.

In September 2022, Ramaswamy appeared with Utah Treasurer Marlo Oaks at a meeting with Republican state legislative leaders where he talked about ESG and its effect on free markets and the democracy.

"We might have an opportunity to solve this through market solutions," Ramaswamy told the lawmakers. "That's why I founded a company called Strive, creating an index fund ... where index funds are just ways that everyday investors can own the market."

South Carolina commissioners also hosted a visit from Ramaswamy in early October 2022. Karen Ingram, a spokesperson for South Carolina Treasurer Curtis Loftis, said in an email that the treasurer appreciated the Strive president's visit, but that it had no bearing on the state's subsequent decision to divest from BlackRock.

Ramaswamy, busy on the presidential campaign trail, could not be reached for comment.

The Enron lesson

Strive's multistate approach coincided with a broader campaign against ESG bankrolled by influential conservative groups that worked in tandem with the investment firm. The movement has scored rapid success in some red states but also experienced setbacks when the proposed policies turned out to be too costly for lawmakers to consider.

"I think the economic realities in the USA have always eventually won the argument," Todd Khozein, co-founder of the impact investment firm SecondMuse, said in an interview. "ESG basically just says, 'There are certain environmental, social and governance risks that need to be considered before you make an investment.' My sense is that anti-ESG is fine until you start losing money because of it."

For example, Khozein said if investors had considered Enron's approach to accounting and tax transparency, a blaring governance risk that led to the collapse of the energy trading company in 2001, they could have saved themselves "a lot of loss."

Ramaswamy remains undeterred. Large Wall Street firms are not just using their own capital to meet certain social and environmental outcomes, he tells state officials. Most importantly, they are using their shareholder might as fiduciaries of state pension funds to push for policies that might not be in the states' or retirees' best interest.

Strive's mission is to "compete with the likes of BlackRock and State Street and Vanguard and others," Ramaswamy told the South Carolina lawmakers via a video link at the March 28 hearing, after which a lawmaker asked the presidential candidate when he planned to visit the state.

It is "no secret that that's actually where you go through on presidential campaign," Ramaswamy responded. "I hope to engage with all of you in the next month."

S&P Global Commodity Insights produces content for distribution on S&P Global Market Intelligence's Capital IQ Pro platform. S&P Global Ratings is a separately managed division of S&P Global and does not contribute to or participate in the creation of ESG Scores generated by S&P Global Market Intelligence or S&P Global Commodity Insights. ESG Scores are statements of opinions and are not statements of fact. S&P Global Sustainable1, which authors and publishes ESG Scores, is part of the S&P Global organization.