The first half of September was turbulent for U.S. equities, with the S&P 500 slumping from a record high before re-gathering momentum, but corporate bond markets largely maintained their serene progress even amid elevated issuance.

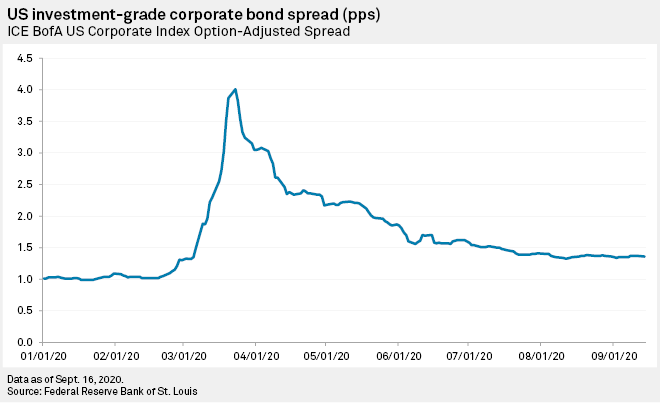

Between Aug. 31 and Sept. 14, the ICE Bank of America investment-grade corporate bond spread against U.S. Treasurys was unchanged at 136 basis points, remaining range-bound between 134 bps and 137 bps throughout.

"The traditional technical ingredients for an outsized move in credit markets appear to be absent," John Normand, cross-asset strategist at JPMorgan, wrote in a research note. "Recent dollar weakness hasn't shaken out many overseas holders of U.S. corporate bonds, suggesting a foreign investor base that is pretty well hedged from a foreign exchange perspective."

That spreads remain flat even as companies continue their surge in bond issuance suggests strong demand for corporate debt. "Many issuers are tapping the market to either raise cash, finance M&A, and refinance outstanding debt via tenders/redemptions. We expect this momentum to continue, with consensus estimates calling for $140 billion in new issuance in September," wrote Eric Ruff, director of the credit trading group at MUFG.

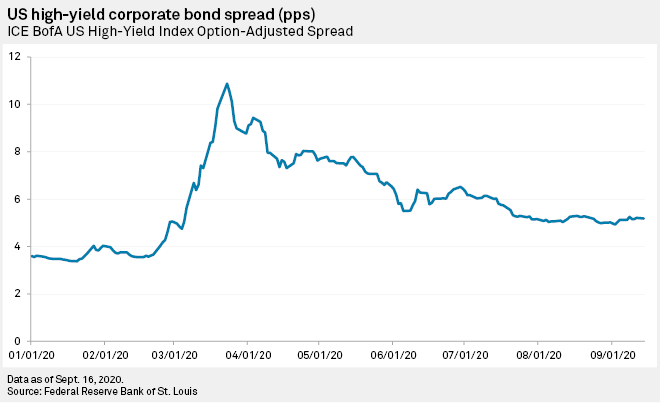

The high-yield corporate bond market was more volatile, with spreads widening from 502 bps on Aug. 31 to a peak of 525 bps at the close of Sept. 8, before dropping back to 518 bps on Sept. 14. However, the spread has reversed 77.9% of the widening experienced during the initial coronavirus market disruption in March, aided by a declining rate of defaults.

Defaults in the U.S. high-yield space were limited to six in August, down from 22 in July and 20 in June, according to Moody's. "This decline leaves us comfortable with our annual U.S. high yield default rate forecast of 10.5% even though the persistence of the default cycle remains uncertain," Lotfi Karoui, chief credit strategist at Goldman Sachs, wrote in a report.

The volatility that saw the S&P 500 fall from an all-time high close of 3,580.84 on Sept. 2 to 3,331.84 on Sept. 8 has eased as U.S. tech stocks rebounded.

The S&P 500 volatility index, or VIX, rose back above 30, a level that on average has preceded average daily movement of 1.3% in the S&P 500, peaking at 33.6 on Sept. 3, but was back down to 25.6 at the close Sept. 15.

The emerging market investment-grade corporate bond space was unaffected by the volatility in equities, with the spread closing Sept. 14 at 342 bps, the same level as on Aug. 31.

The spread has reversed 76.1% of the widening experienced during the peak of the turmoil in financial markets in March.

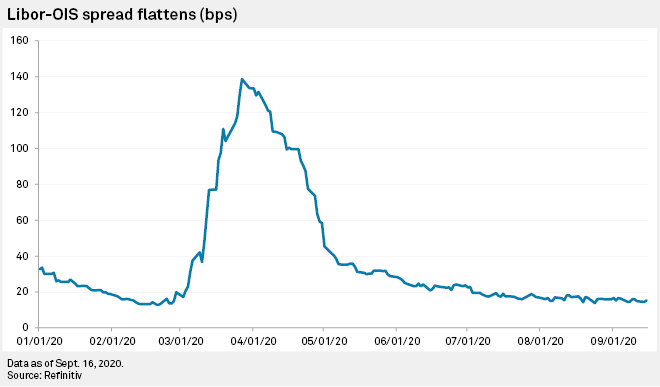

The Libor-OIS spread, a key risk indicator for the U.S. banking sector measuring the difference between the three-month dollar London interbank offered rate and the overnight indexed swap rate, was 15.3 bps as of Sept. 15, up from 14.6 bps on Sept. 8.

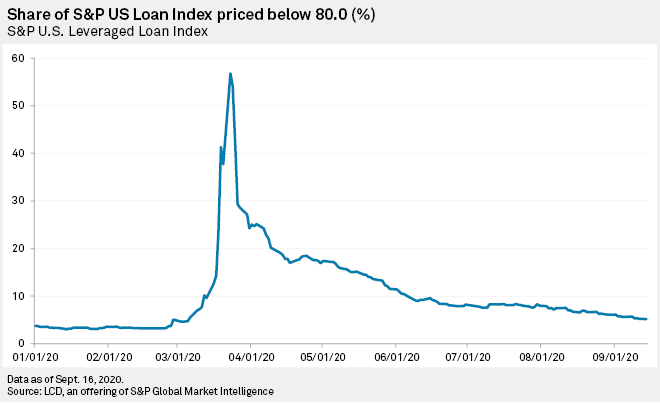

In the leveraged-loan market, the share of issues priced below 80 cents on the dollar, a closely watched indicator suggesting a company is more likely to default, continued to grind lower, declining to 5.2% on Sept. 14 from 5.7% a week earlier.