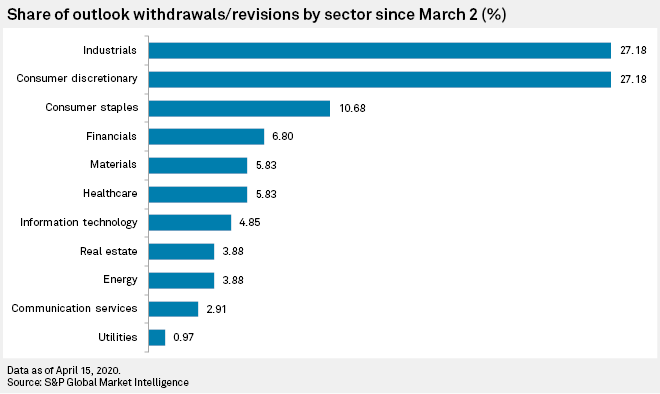

With much of Europe ordered to stay at home, the consumer discretionary and industrial sectors are at the forefront of companies voiding their earnings forecasts because of the COVID-19 outbreak.

S&P Global Market Intelligence tracked 103 Europe Stoxx 600 companies that have withdrawn or negatively revised earnings guidance since the beginning of March, with a marked uptick of disclosures observed since March 23.

The tally is based on earnings guidance announcements in news releases, regulatory filings, financial results and conference speech transcripts by companies in the STOXX Europe 600 index, which covers large, medium and small capped companies, through April 9.

Consumer discretionary brands have been among the hardest hit, with the likes of PUMA SE, Pandora A/S, Hugo Boss AG, Kering SA, AB Electrolux, JD Sports Fashion PLC, EssilorLuxottica Société anonyme, LVMH Moët Hennessy - Louis Vuitton Société Européenne and Rémy Cointreau SA all retracting positive 2020 earnings outlooks.

Manufacturers, including lighting group OSRAM Licht AG, aerospace giant Airbus SE, handling equipment provider KION GROUP AG, and breaking systems manufacturer Knorr-Bremse AG

Dividend suspensions

S&P Global Market Intelligence tracked 86 companies within the STOXX Europe 600 index to have publicly announced that they were suspending dividends.

The industrial sector has thus far contributed the highest number of dividend withdrawals, at 19, including aviation groups Deutsche Lufthansa AG, International Consolidated Airlines Group SA, Airbus SE and Signature Aviation PLC.

Companies that rely on discretionary spending are continuing to suspend shareholder payments to conserve cash, including retailers NEXT PLC and H & M Hennes & Mauritz AB (publ), consumer brands PUMA SE and Hugo Boss AG, and gambling companies Flutter Entertainment PLC and GVC Holdings PLC.

Dividend suspensions by companies in the financial sector have surged since the end of March owing to central bank pressure on deposit-taking banks and insurers.

Following a European Central Bank recommendation on March 27, European banks including Commerzbank AG, ING Groep NV, Bank of Ireland Group PLC, KBC Group NV, Société Générale SA, Banco Santander SA and Intesa Sanpaolo SpA withdrew their dividend proposals.

British banks including HSBC Holdings PLC, Barclays PLC, Royal Bank of Scotland Group PLC and Standard Chartered PLC have also suspended payouts following a request from the Bank of England to preserve capital to support the economy.

Similarly, a Prudential Regulation Authority letter on March 31, which requested that insurance companies remain prudent in their approach to dividends, has thus far prompted the likes of Direct Line Insurance Group PLC, RSA Insurance Group PLC and Hiscox Ltd. to revise their dividend plans.